Balancer is an innovative DEX that enables users to provide liquidity with ease. It's totally trust-less and on-chain. Anybody can exchange ERC20 tokens here. Investors provide liquidity and simultaneously enjoy the two income streams - proportional fees distributions and allocations of BAL tokens. The multitude of pools helps users find the best ones taking into account their specific conditions. In contrast to Uniswap, LPs can deposit in either all of the pool's tokens or only one of them.

What is Balancer Finance?

Balancer is a DEX, and it's a liquidity mining pool, and it's an index management platform too. This DeFi project came out with a pretty novel solution to the age-old use cases found in exchanging assets and creating index funds. And it turned the approaches to these use cases on their head. Let's see how it was done.

Balancer is a DEX

The protocol enables anyone to access it in order to exchange the supported ERC20 tokens. Here you can see the great effect from composability of the DeFi projects. Of course, it's all because they live together on top of the Ethereum blockchain network. And we are seeing the democratization of finance being done in full force - anybody with a MetaMask wallet can connect to the platform and exchange the listed ERC20 tokens.

The fees vary by pool, and we are going to talk about the pools below. The fees are much much lower than what you'll get at any of the CEX out there like Binance or Coinbase.

The transactions are performed fully on chain which means that you don't need to trust any party with your coins.

Balancer is a liquidity mining pool

Just like with other liquidity mining opportunities, you can port any tokens that you have sitting idle in your wallet. They'll get added to the liquidity pool and enable you to start earning from minute one.

Just like Uniswap and Curve.fi, which are the other two big DEXes in DeFi, this is the DEX with the AMM (automated money maker) inside. This means that the liquidity pool will act as the second party to anybody who wants to exchange some tokens to another one, provided that both tokens are included into a pool.

And whenever you become a member of the liquidity pool, you'll be able to receive the rewards, generated out of the fees that users pay for the exchange transactions here. As opposed to the legacy exchanges and CEX endeavors in our beloved crypto space, the protocol takes just a small cut out of the fees with the bulk of the commissions going directly to folks like you and me - liquidity providers.

Balancer is an index management platform

Balance Finance is also an assets management platform where you can create the index funds in the form of the pools. And this is the core innovation hidden inside Balancer. Let's first look at how legacy index funds work and then what innovation Balancer brings to the table.

How do legacy index funds operate?

The legacy index funds are managed by fund managers. For instance, the investor asks the fund manager to create the custom-made index fund that would include Apple, Amazon and Facebook stocks. All 3 in equal shares, i.e. 33%. In this way, the investor seeks to diversify their risks while also looking to win from the upside within this market segment.

The fund manager would need to rebalance the index fund on the regular basis. Say, quarterly or annually. The fund manager must assure that the index fund continues to have the 33% shares of the 3 stocks. But, since the stocks might grow or fall in price, the actual share distributions will fluctuate without the rebalancing being done on the regular basis.

Now, the fund manager in the legacy index fund would need to manually (or programmatically) sell some of the stocks and buy some other stocks in order to maintain the original weightings. Whenever they do that, they would charge the additional fee payable by the investors into the index fund.

This is how it's always been with the legacy index funds. And everybody has been sure that it's basically the only way to rebalance your index fund. But then Balancer turned the whole situation on its head.

What innovations does Balancer Finance bring to index fund management?

With Balancer Finance, anyone can create the index fund either for their own use or for their customers. Thus, you don't have to hire a professional index fund manager anymore. And you don't have to be one in order to find customers if you seek to become a provider of financial services.

The index funds are called here as "pools". The creator can add from 2 up to 8 assets into the pool. When they do this, they have to specify the shares for each of the assets inside the pool. For instance, a pool can be created with 50% in wETH and 50% in DAI.

Now, in the situation with the legacy index fund, the manager would need to rebalance these two weightings manually. But with Balancer, the protocol uses the blockchain and the AMM (automated market maker) which enable the pool to automatically rebalance itself.

In order to do that, the special type of the AMM is used - the n-diagram AMM. It might be a bit hard to understand. But, in a nutshell, it uses the liquidity in all of the assets in order to continuously maintain the originally specified shares within the pool.

And, amazingly, in contrast to the legacy index funds, Balancer Finance allows the liquidity providers to make money since they receive the distributions formed by the commissions that are paid by the pool users. Anybody can invest in the pool/index fund and be sure that the weightings are going to remain the same on a continuous basis, without any additional hassle in the form of fees, communications or decision-making of any kind.

Now that we've done the review of the theory behind Balancer Finance, let's go through the practical tutorial on how you can actually start using the protocol today.

How to become a liquidity provider at Balancer Finance?

As we've said above, Balance Finance is completely on-chain. This means that whenever you port any of your tokens inside the ecosystem, they are managed by the smart contracts and not "meatbags". Thus, there's no risk of collusion, theft or any other malfeasance.

Now, let's go through the step-by-step tutorial for liquidity provision here.

Step 1: Open the protocol for liquidity provision

Go to the site's main page and click the "Pool Management" button in the top right corner.

Step 2: Choose the pool type

You can see the 3 pool types identified in the top left corner.

Let's talk about each of them one by one so that you understand the differences and learn how to choose the pool that suits you best.

What are shared pools at Balancer Finance?

The shared pools were created by somebody else. All you need to do is to send some tokens to it.

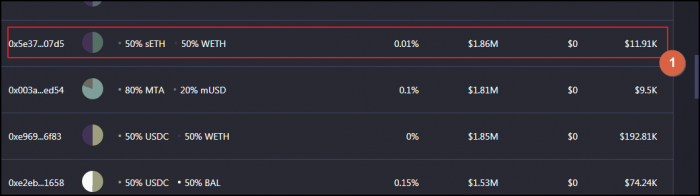

Here's an example of a shared pool.

Importantly, nobody can make any changes to the pool's settings. Neither you, nor the team, nor the creator can tweak anything. This means that there's 0% risk that anybody would be able to syphon off your tokens or change the weightings without your consent.

There are lots of various shared pools at Balancer Finance and we'll review how to choose one later in this Balancer tutorial.

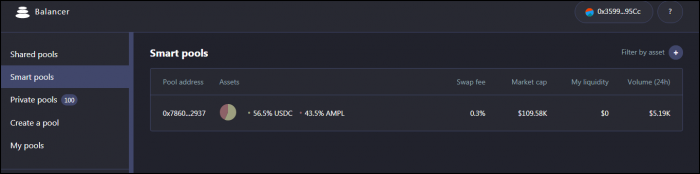

What are smart pools at Balancer Finance?

The second type of pools is the smart pools. These index funds are more flexible, i.e. you can set up various additional features here. Such as value caps, mechanics to pause trading upon specific circumstances, etc.

The smart pools are just starting to gain attention at Balancer, and there hasn't been much traction for them yet.

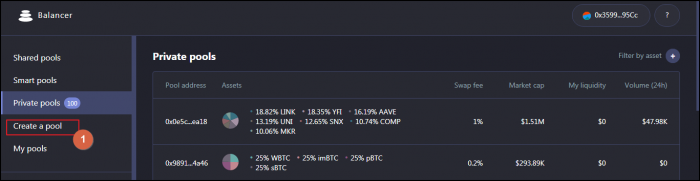

What are private pools at Balancer Finance?

The third type is the private pools. These are the pools that a fund manager created for his own use, and these enable managers to add some changes down the road.

If you want to create your own private pool, click the "Create a pool" button and proceed further.

Here's a detailed guide on how you can set the private pools at Balancer Finance from our friends at Bankless. Importantly, only the creator’s wallet can be used in order to interact with the private pool.

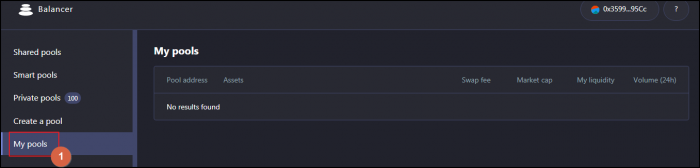

You can see all of your private pools by clicking the "My Pools" button in the menu.

Thus, if you just want to add liquidity and don't wish to go deep into the reeds, you should join the shared pool. Plus, since you are going to make money from the fees paid by traders, it makes sense to join a popular pool. Thus, this is a strong disincentive against creating your own index fund instead.

Step 3: Choose the specific shared pool at Balancer Finance

Now that we know that you need to pick a shared pool, let's talk about how exactly you should select one of them. And there are hundreds of pools available at Balancer Finance.

To decide on the type, you first need to determine what your goals are.

Liquidity providers at Balancer Finance, just as with other liquidity mining protocols, might be after one of the four things - exposure to a specific coin, higher safety level in terms of the impermanent loss, exposure to a specific basket of coins, or profitability. You can't have the four of these "tacos-ed" into the same pool, so you need to decide on what matters most to you and what trade-offs you are prepared to take.

Option 1. By exposure to a specific coin

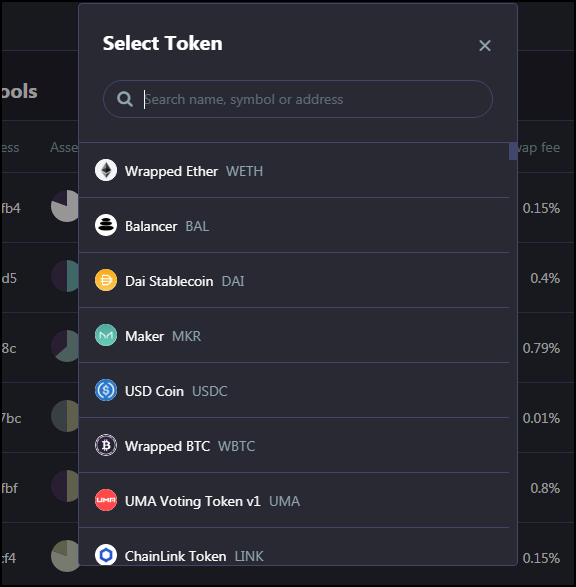

In the top right corner, click the "Filter by asset" button.

In the opened window, type the ticker into the search bar or scroll to find the one that you need.

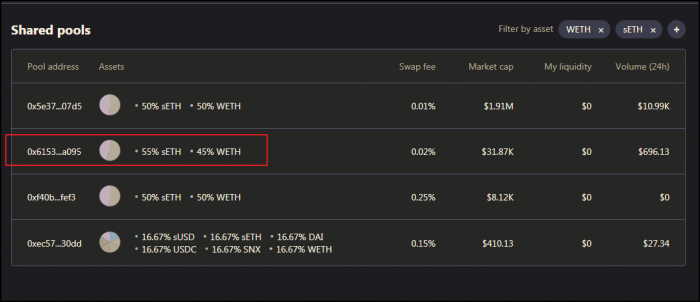

Let's say that we want to filter in only those pools that have WETH in them. Now we can see the listing of all the pools with WETH inside of them.

In this option, you just want to look through the WETH pools. And this is how you do that.

Option 2. By safety level in terms of impermanent loss

If we continue with the previous examples, there are two groupings here - the pools with other flavors of ERC20 ETH avatars and the pools with just some other tokens. The difference between the two groups is the riskiness level stemming from the impermanent loss.

The impermanent loss occurs whenever a liquidity provider adds liquidity to a pool that contains two assets: a stable asset and an asset that is much more volatile than the first one. For instance, the pool with DAI and WETH, broken into the two 50% shares. Whenever the price for ETH goes up or down at an external venue, such as Binance or Coinbase, the arbitrageurs will be attracted to equalize the asset prices as seen at Balancer and that other venue.

This will result in the changes to ratios of the coins inside the index fund. Thus, the liquidity provider might be short of the coins in the appreciating asset. And should the liquidity provider decide to withdraw the funds, he or she will convert the impermanent loss into the permanent loss. If they wait for the price to go back to the original mark, their impermanent loss will be eliminated.

Of course, it's extremely hard to predict the chaotic prices in crypto, and thus waiting isn't an option.

Thus, you need to take into account the possibility that you'll suffer from the impermanent loss when contributing liquity to any specific pool.

How to counteract the impermanent loss?

First, take into account the BAL distributions. Since Balancer Finance offers liquidity providers two streams of income - distributions of fees and distributions of BAL tokens, the cumulative effect of these incentives might negate a significant portion of the potential impermanent loss.

Second, go for Balancer pools that contain various flavors of the same asset, like wETH and sETH. Just like at Curve.fi, you'll see your impermanent loss go down significantly.

Third, you can look for pools where the asset you want to hold occupies the significantly higher share of the pool. Something like 98/2. In this case, the effects of holding and providing liquidity in that asset will be very close to each other.

The big problem with this approach is that Balancer will not distribute a lot of BALs to you for participating in such a pool.

Option 3. By exposure to a specific basket of coins

If you want to have exposure to several assets, it makes sense to port those tokens to the protocol and hold them there in the liquidity pool.

To find all the pools that include the assets you want to get exposed to, just specify them one by one in the selector tool.

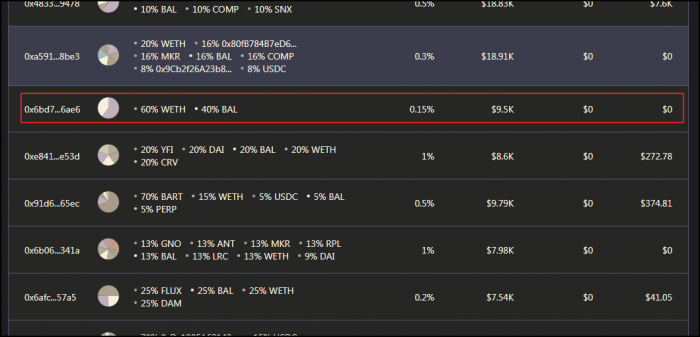

In this example, we want to see all of the pools that include both WETH and BAL.

Option 4. By profitability

Like at other liquidity protocols, your profitability rate is composed by the proportionate share of the fees and the distributions of the governance token BAL.

Compare various options in terms of the potential swap fees which you will be paid.

And the amounts of the BAL distributions are determined based on the amount of fees. The lower the fees, the more BAL tokens providers stand to receive. In this, the protocol seeks to incentivize actors to offer the possible lowest fees to traders.

Step 3: Add liquidity

In contrast to its major competitor Uniswap, Balancer Finance enables providers to offer liquidity both in all of the tokens within the pool or just in any specific one.

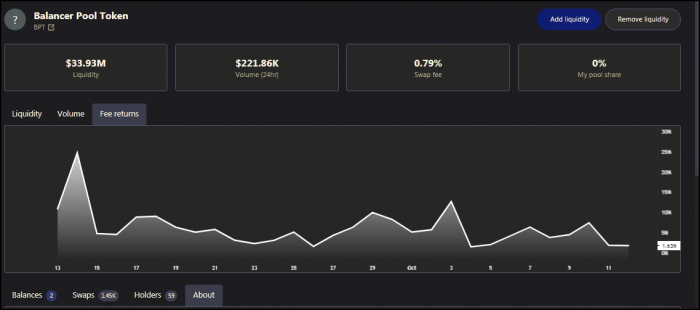

Click on the pool you want to contribute to and review the stats.

You can see whether the pools enjoy sustainable trading volumes or whether they are "spikey" and unstable. It makes sense to provide liquidity for a lengthy period of time so that you can accumulate significant profits, without chasing the higher rates all over the place.

You can add liquidity either at the platform itself or using an assets management dapp like Zapper.fi. If you pick the second option, you'll save on the fees that you pay since Zapper will combine several transactions and charge you fees only once.

Now that you know how to add liquidity at Balancer Finance, you can deposit some of your coins and see them generate lucrative interest on the long-term basis.

How to exchange coins at Balancer Finance?

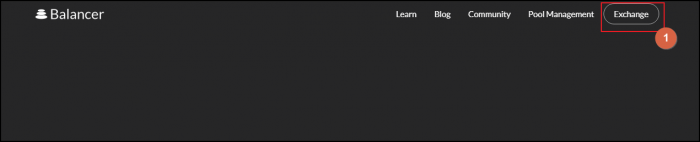

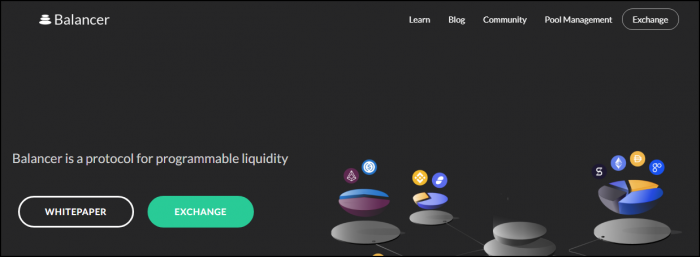

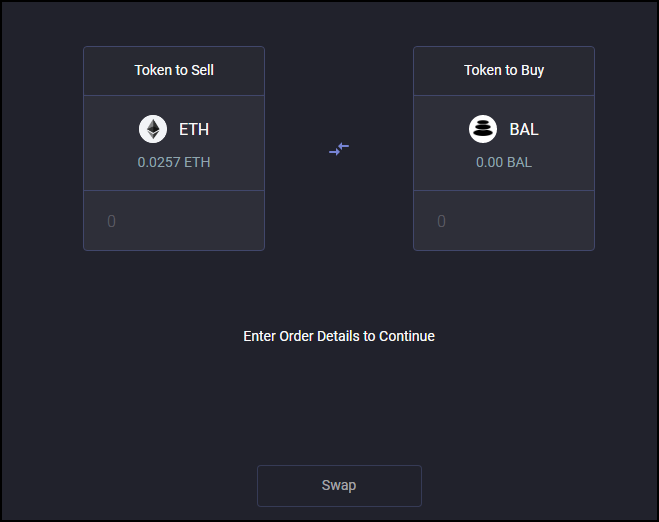

Go to the site's main page and click the "Exchange" button in the top right corner.

Just like at Uniswap, you'll see an extremely clean and easy-to-use interface.

Pick the tokens you want to trade and exchange them at once. Without any KYC, fully on-chain and with minimum exchange fees.

Conclusion

As this review shows, Balancer Finance is extremely easy to use for exchanging ERC20 tokens. And if you seek to provide liquidity, you can pick from the multitude of the pools here. The protocol distributes its governance token BAL on the regular basis so that the liquidity providers are sufficiently incentivized to continue offering liquidity pools for trades. As this tutorial shows, LPs can contribute their tokens with ease and expediency. If you want to learn more about the underlying technology, make sure that you review the Balancer's Resources Pack and the Whitepaper.