DeFi stands for "Decentralized Finance". It's a new wave of decentralized applications based on top of the blockchain networks. All DeFi apps seek to provide some financial services (lend, borrow, invest, exchange, leverage, insure, create derivatives). The space takes its first steps to recreate the "legacy" financial system. The DeFi wave launched in early 2020 but it got into the full swing in summer 2020.

There are a lot of great DeFi dapps such as Uniswap, Aave, Curve.fi and more. At the same time, there are a lot of clones, fakes and other scammy dapps out there. That's why it's so important to do your own research before you invest any money into a particular ecosystem.

All operations here are done using cryptocurrencies. No fiat is used. There's currently no regulation or oversight by anybody! Most founders openly say that these projects are completely experimental. We expect to see through regulation to come to this space within the next 3-5 years.

And now let's dig into specific concepts that are at the core of the DeFi world. Feel free to skip around or read the full guide from A to Z.

#1 DeFi and Ethereum

At the start, there was only one cryptocurrency - Bitcoin. It is based on the blockchain. The blockchain is a distributed ledger that contains all the transactions ever performed within the network. This means that nobody controls your transaction and nobody can ban/stop the Bitcoin blockchain.

Subsequently, the new forms of the cryptocurrencies advanced. Among them was Ethereum. Ethereum enables developers to code any operations that the users might want to perform. In comparison, Bitcoin is used primarily to transact, i.e. make payments. And Ethereum can be used for any type of financial operations you might want to perform.

With the DeFi kicking off in early 2020, Ethereum became the major network for DeFi projects to build on top of. Subsequently, other platforms started to take notice of the new wave. Now, in September 2020, Binance and Tron are starting to compete with Ethereum (with Ethereum suffering from extremely high gas prices). Ethereum clearly continues to hold the leadership position in the niche. In particular, many DeFi projects leverage the composability within this network.

#2 High gas prices and Ethereum 2.0

Today, in September 2020, we are seeing extremely high gas prices. Of course, we should consider these fees in relation to the transaction amount. Thus, if you transact in $10K, then any fees for 50$ will be OK.

However, the DeFi industry was seeking to become the finance for anybody with any crypto in the wallet. It is expected that optimistic rollups and sharding in Ethereum 2.0 will enable Ethereum to go back to insignificant gas prices. Whenever this is done, we are bound to see a continuation of the boom that we witnessed during the 2020 summer.

The spike in gas prices created the opening for other blockchain networks to vie for the hearts and minds of "defiers". These are mainly Binance and Tron at this time.

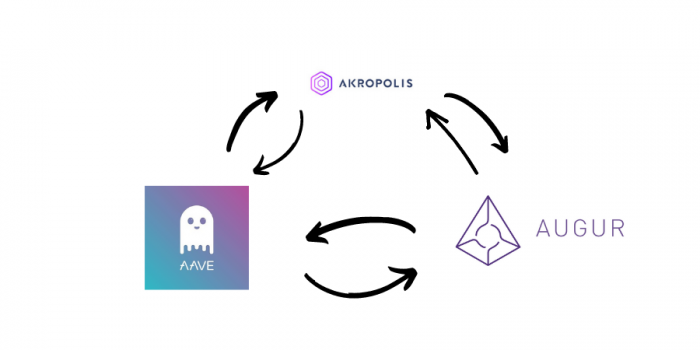

The biggest thing about the DeFi project is its composability within the Ethereum network. If cross-chain composability is enabled, then we might see the collaboration between the likes of Ethereum, Binane and Tron. But, as of now, composability is mainly limited to the bound of the Ethereum network.

#3 Composability of DeFi projects

All DeFi projects use ERC20 tokens which run on top of the Ethereum network. This means that you can generate some tokens from one DeFi and input those tokens into another platform.

It does seem like slots at some points. And the expected yields are huge too.

But there are huge risks as well. The main risk is associated with the fact that these systems are operated by smart contracts. Should any smart contract be hacked, the attacks might siphon off the value from the system with the users not being able to do anything about that.

Whenever you use several DeFi platforms together, the smart contract risks are getting "stacked" on top of each other. This can have devastating effects on a problem exposed at any link of the chain.

And to make money in DeFi, you increasingly need to use dapps jointly, leveraging your position several times.

#4 How to make money in DeFi projects

DeFi projects are trying to recreate the legacy financial system. Thus, you can expect to see the same business models as you'd expect from traditional outlets.

The majority of DeFi users have been around the crypto industry for some time. They started investing a couple of years ago. And by now they have amassed a certain amount of Bitcoins and other coins. Yeap, there are a lot of folks who are making money by hodling!

These are crypto-enthusiasts who expect their favored coins to appreciate with time. Bitcoin and Ethereum are expected to continue growing. Meanwhile, lots of coins that became big names during the previous boom are kinda in the limbo. They aren't doing much. They might be "zombie coins'' with no definite future for them in the cards.

However, both BTC/ETC and other big-name coins have loyal communities around them. Those investors don't want to sell the coins for USD. They are really hodling them for decades to come.

DeFi opens up new opportunities to continue holding the underlying asset while investing it too. It's done through the process of collateralization.

Collateralization means that you first furnish the coin to the platform and lock it up there. Then you can withdraw a certain number of the native tokens that equals a certain percentage from the collateralized coins.

Now you can use these natives tokens in order to invest them on the platform or elsewhere within the ERC20 universe thanks to the composability of these "money lego" systems.

Just like in legacy finance, platforms offer only certain services since specialization always wins over offering many various services. We are seeing categories arise with internal competition within each of them.

You can lend your money to other crypto users. Or you can provide liquidity to exchanges such as Curve.fi which is called "liquidity mining". And of course, you can exchange ERC20 tokens between each in an effort to trade them based on technical and fundamental analysis. Do this at Uniswap where you can exchange any two ERC20 tokens provided that there's the liquidity pool for that pair. Invest money at Compound Finance, trying to do the yield farming

Whenever you've identified the DeFi money-money strategy that you want to use, you can leverage aggregating apps like InstaDapp so simplify and power up your ops.

And now let's identify specific categories of DeFi projects and talk about how we can make money there.

#5 DeFi Type 1: MakerDAO - Gateway DeFi Project

What is it? It's a platform used to generate the stablecoin called DAI (pegged to $1). It has too native coins - MKR and DAI, where MKR is the governance token and DAI is the stablecoin. MakerDAO is seen as the "Bitcoin of DeFI" since many users prefer to collateralize their ETH tokens and generate DAI. Then they input DAI into various DeFI projects.

How to make money? Currently not possible to make money here directly, but it's used as the gateway system. Use its stablecoin in other DeFi.

Meet DeFi projects: MakerDAO

#6 DeFi Type 2: Stablecoins

What is it? In addition to DAI, there are other USD-pegged stablecoins living on top of the Ethereum network (like USDT). In addition, some stablecoins are pegged to other assets like BTC or ETH.

How to make money? You can try to arbitrage stablecoins against each other, though it's very hard to make money this way by this time. Another way is holding your reserves in either a specific stablecoin or a number of those for diversification reasons. You can then deploy stablecoins on one of the other platforms where they can earn the yields.

Meet DeFi projects: USDT, USDC, BUSD

#7 DeFi Type 3: Lending Platforms

What is it? Just like with any bank, you deposit your crypto. You will start getting the APY (Annual Percentage Yield). On the other side of the deal, the borrowers will borrow the crypto in order to trade it or invest elsewhere. All DeFi projects are built on top of the smart contracts - there are no humans inside and you don't have to trust the system you interact with. The only thing you have to trust is smart contracts. The code can't lie or cheat, which is good. But, at the same time, the code can have big bugs that'll expose you to big losses.

How to make money? It's a completely passive income source. All you need is port some crypto into the platform and check up on it every n months. Naturally, there are certain risks here, but this is a hands-off investing model. It's the opposite of trading crypto or doing some work on your own. Your quest to find the highest yields at the lending platforms is called "yield farming"

Meet DeFi projects: Aave, Compound

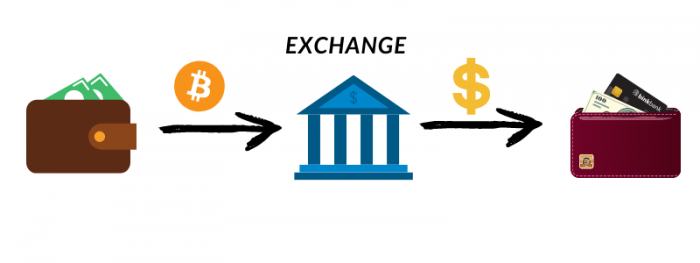

#8 DeFi Type 4: Exchanges

What is it? All exchanges inside the DeFi space are DEXes. It's the rule of the land here. All projects roll out with some level of centralization and start their journey toward the complete decentralization. You can't be a DeFi project without trying to go decentralized. Thus, there are no KYC/AML processes here, and all DeFi projects use the WEB3 wallets to connect. This means that you don't even have to register or create anything here - all you'll have to do is connect your wallet like MetaMask.

How to make money? You provide the liquidity to these exchanges. All of them run without any order book in place because they use AMM. The AMM is a smart contract that uses the idly sitting liquidity and places it as the other side for the deal. Then, the arbitrageurs run around equalising the prices between the respective AMM DEX and a reference platform, like Binance, which has the orderbook. This is called "liquidity mining". It's also passive as with the lending platforms.

Meet DeFi projects: Uniswap, Curve.fi

#9 DeFi Type 5: Asset management platforms

What is it? These projects help you manage your investments into DeFi and maximize your potential yields. They don't do anything but simply furnish your tokens between other platforms. It's important to use these solutions to improve your RoI, as opposed to sticking with specific "underlying DeFi" and being a DIY guy.

How to make money? Port money to Yearn and improve your chances to profit from yield farming. Yearn shuffles funds between the lending DeFis depending on which one offers the highest APY at that particular moment. Another choice is InstaDapp which leverages your position at Compound Finance and brings the 4x increase to your APY.

Meet DeFi projects: Yearn.Finance, InstaDapp

#10 Defi Type 6: Derivatives platforms

What is it? Just like in traditional finance, you can create synthetic assets and leveraged positions. As with other DeFi protocols, there's no need for KYC/AML and all connections are performed without any registration. Users input the underlyings and generate derivative instruments which function depending on the price changes for the base asset.

How to make money? Use Synthetix to get the reserve positions and hedge against any falls in the market prices. Or you can buy into the indexes (for instance, DeFi and CeFi crypto indexes) in order to win from the overall market growth without the excessive dependence on any one specific player. DyDx enables you to enter the leveraged position for up to 4x to your underlying Ethereum holdings.

Meet DeFi projects: Synthetix, DyDx

#11 Stablecoins in DeFi

The stablecoins advanced a number of years ago with USDT being the first biggest coin in this category. However, there've always been significant concerns with regard to the original stablecoins' exposure to censorship and regulation.

MakerDAO created the first crypto-collateralized stablecoin which is not dependent on any outside influence factors and which regulates itself. DAI became the cornerstone to the DeFi industry and it's currently used as the gateway asset.

Other stablecoins operate here as well (USDC, USDT, BUSD and others). The traders prefer to diversify their stablecoin holdings by diversifying among several tokens and protecting themselves against the failure of any specific protocol.

#12 Collateralization in DeFi

Many DeFi can be seen as the "second-layer" protocols in the sense that users first need to obtain the cryptocurrency and then input those coins into the DeFi ecosystems. The most popular cryptocurrency is ETH.

In many cases, you are supposed to collateralize your ETH holdings. This means that you input a certain amount (say $100 in ETH) and that you receive a number of the native tokens which you can use either at this platform or elsewhere within the DeFi ecosystem. The collateralization ratio stipulates how much value you can withdraw with regard to the collateral assets. If it's 60%, this means that you may not withdraw more than 60% from the base asset.

Thus, collateralization is conceptually similar to the leveraged position traditionally used in forex markets. It's trust that its use increases the risk, but there's also an upside for the profits that you might see.

Collateralization is used across many platforms, such as MakerDAO, Compound Finance, Aave any many more.

#13 Arbitrage in DeFi

Whenever you engage in arbitrage, you sell and buy the same asset at the two different exchanges at different prices. The differences arise due to the natural pressure of supply and demand on the prices for the asset at a particular exchange.

Previously, DeFi DEXes offered extensive opportunities to earn profits through arbitrage, but currently, all of those differences are being quickly eaten up by either automated bots or exchanges themselves.

Curve.fi is the DEX which seeks to facilitate trading between stablecoins. It seeks to raise huge liquidity pools and engage in the stablecoins arbitrage.

#14 Yield farming in DeFi

Yield farming denotes activities that seek to maximize the potential yield through the joint use of various DeFi protocols. Users lend and borrow crypto at the same protocol (as is the case with Compound Finance) or use Yearn and Curve.fi together in order to earn more native tokens through the investing and staking processes.

#15 Decentralization in DeFi

Though all cryptocurrencies try to increase the level of decentralization within their protocols, not all of them are actually sufficiently decentralized.

For instance, USDT might be exposed to significant regulatory risk, and, in comparison, MakerDAO offers a completely decentralized and crypto-collateralized coin.

The decentralization enables us to avoid any KYC/AML processes, registration and similar points of friction that habitually preclude actors from leveraging the traditional financial instruments. Nobody can take hold of your money, impose any requirements or request some information. You are the sole owner of your funds, even when you invest those in DeFi protocol.

The trustless and no-custody nature of transactions is enabled thanks to the use of smart contracts which are impervious to human meddling.

#16 AMM in DeFi

All decentralized exchanges function without the order book in place. This means that they need to create the liquidity pools which would act as the counterparty for the deals opened by the users.

The nature of interactions between the liquidity pools and users is determined by the smart contracts responsible for this. These are called AMM (Automated Money Maker).

There are different types of AMMs with certain pros and cons. Some of them focused on enabling exchanges for any crossings between any two ERC20 tokens (like Uniswap). Others seek to deliver the lowest possible slippage while enabling exchanges only about the limited number of stablecoins (like Curve.fi).

Irrespective of the type of the AMM used by the protocol, all of them source the comparative data from the "reference exchanges (like Binance).

#17 Liquidity mining in DeFi

Just like yield farming, liquidity meaning enables users to earn huge profits via using a number of DeFi protocols together. Liquidity provision is the cornerstone for decentralized exchange operations with the use of AMM (see above). And in order to incentivize the active liquidity provision, protocols offer lucrative rewards (e.g. distributions of $COMP tokens by Compound Finance).

Conclusion

DeFi protocols have advanced at the start of 2020 and started to boom in summer 2020. The platforms win from composability enabled by the fact that all of them operate on top of the Ethereum network. Users engaged in yield farming and liquidity mining, seeking to obtain extremely high APY. Though most of the platforms are experimental and highly risky, these undergo stringent audits and successfully defend against a large number of hacks on a daily basis. It's clear that DeFi is capable of ushering a more equitable and democratized financial reality for the users irrespective of their capital amount or place of residence.