Introduction

InstaDapp is an asset management platform. Here, you can interact with multiple DeFi platforms in a much easier way as to what you'd get when dealing with each of them individually. Originally, InstaDapp was created as just an interface to activate the functionalities of the underlying platforms. Still, it has subsequently rolled out its own smart contracts that empower you with unique capabilities that the native dapps don't. Read through this review and learn what those capabilities are.

What is InstaDapp?

InstaDapp is an asset management platform in DeFi. Behind the scenes, it connects to some of the most popular DeFi dapps. All of the DeFi projects run on top of the Ethereum blockchain, and they can work together thanks to the composability in this space.

The platform is completely trustless which means that all operations here are performed by the smart contracts, without any engagement of human employees.

In contrast to some other DeFi asset management platforms, you need to create the smart account here. This means that the custody over your assets changes the hands with the tokens being stored in the smart contract. Thus, it might seem that you lose a bit more control as compared to other system management solutions. However, you would need to let go of the same level of control whenever you interact with any DeFi platform out there since the tokens will live on their external smart contracts.

Importantly, InstaDapp is used as a joint interface app to access several DeFi projects together. Thus, whenever you actually use several of them from this dapp, this would mean that you expose yourself to the smart contract risks inherent in all of those solutions, i.e. your risks are being stacked. At the same time, by now most of those dapps have successfully passed rigorous audits and withstood a continuous barrage of hacker attacks.

Now, in September 2020, you can use InstaDapp in order to interact with MakerDAO, Compound, Aave and Curve. At the same time, the Trade Module enables you to easily trade between any ERC20 tokens thanks to the connection to Uniswap behind the scenes. And now let's talk about each of those segments one by one and identify the additional benefits you'll enjoy if you choose to interact with them via InstaDapp and not directly.

How to start using InstaDapp?

Step 1: Connect the wallet

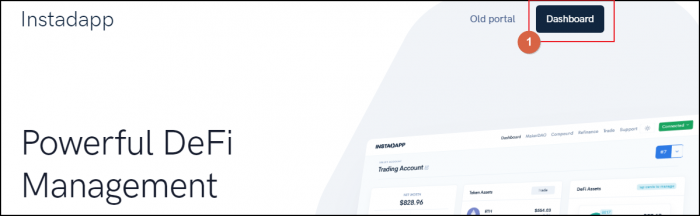

First, go to the protocol's main page and click the "Dashboard" button in the top right corner.

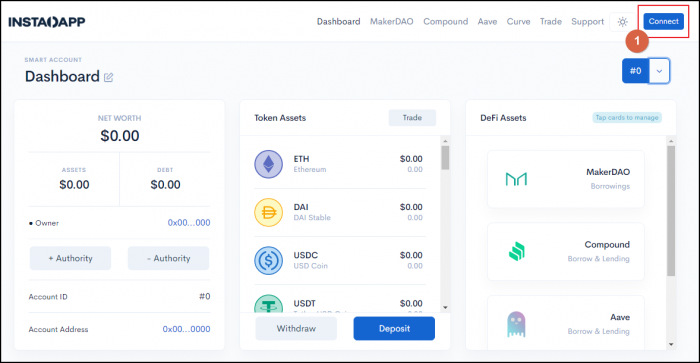

At the next page, you will see the main dashboard page. Go to the top right corner and click the "Connect" button.

The standard module window will open where you'll need to pick among the popular WEB3 wallets. We are going to use MetaMask as an example throughout this review.

After you've completed the connection process, the button will change from "Connect" to "Connected".

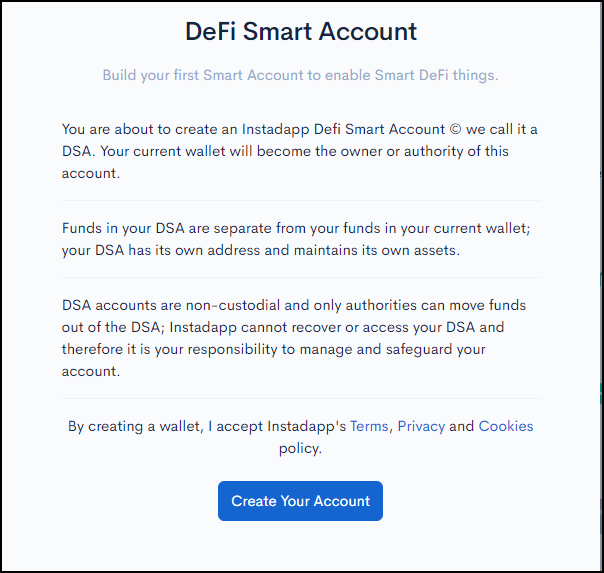

Step 2: Create the smart account

Now you'll need to create the smart account. As we've talked above, InstaDapp requires you to create this smart account and place the tokens you want to work with into it.

There smart contracts are connected to your wallet and their IDs are numbered sequentially based on your history at the platform.

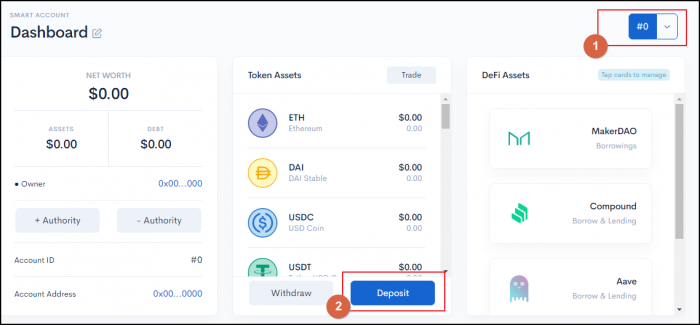

Field 1 at the screenshot shows the current number of the smart account.

And Field 2 shows the button "Deposit". Click it in order to launch the process for creating the smart account.

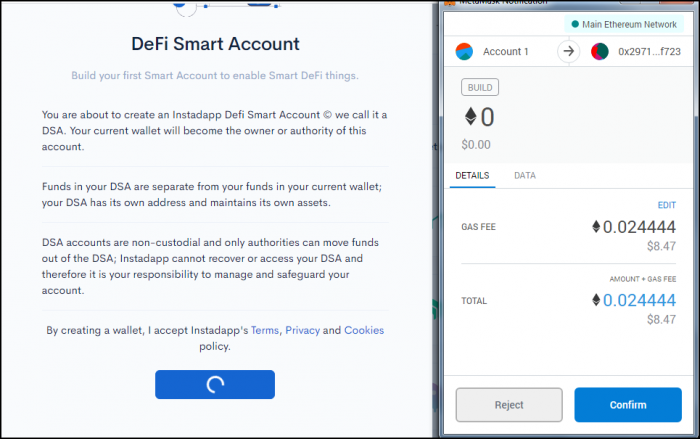

After you've clicked the button, the new window will open with the detailed description on what the smart account is.

Importantly, it states that each smart account is a separate wallet that lives on top of the blockchain network in the form of the smart contract. And it's only your WEB3 wallet that can be used in order to access and the smart account and initiate any actions with regard to the same. Your WEB3 wallet is denoted as the "authority" in relation to the smart account in this case.

The notice says that it's your responsibility to manage and safeguard the wallet. This means that you should prevent any authorised access to your "core" WEB3 wallet as a perpetrator will be able to access your smart account in such a case.

Step 3: Confirm the smart account creation in the wallet

After you've clicked the "Create Your Account" button, the wallet will be opened where you will need to confirm this action.

As you can see from the screenshot above, the gas prices are absolutely crazy at the time of writing! You'll need to spend around 10$ in order to just create the internal account at the protocol. That's why the DeFi niche is staking so much on the introduction of optimistic roll ups and Ethereum 2.0.

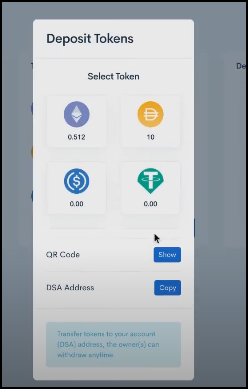

Step 4: Deposit the coins to the platform

And now you can click the "Deposit" button again. This will open the window with all fo the supported tokens and the balances that you have in your wallet.

Click on the coin you want to deposit to the InstaDapp and proceed. The number of supported coins is constantly growing. So before you decide to exchange some of the rare coins into the more used ones, you should just check out whether the coin in question has already been listed at InstaDapp.

And this is how you deposit the coins to the protocol and start using it.

The protocol incentivises users to actively participate in the processes that seek to assure that the peg is maintained. All of the operations are done through the smart contracts, and users buy the second coin MKR which is burned or sold on the open market to generate more money which can be used by the system in order to keep the peg in place.

We've also created the full review on MakerDAO.

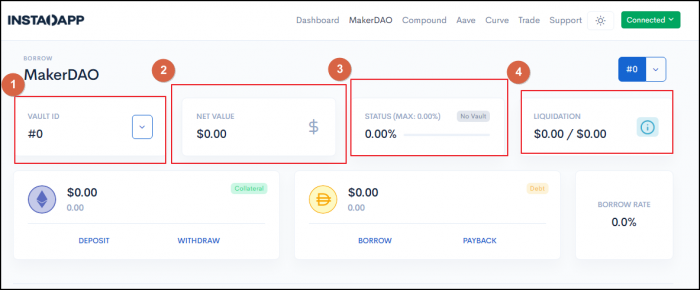

What statistical information can you see at the MakerDAO page at InstaDapp?

At the MakerDAO page, you can see various statistical data needed for your operations.

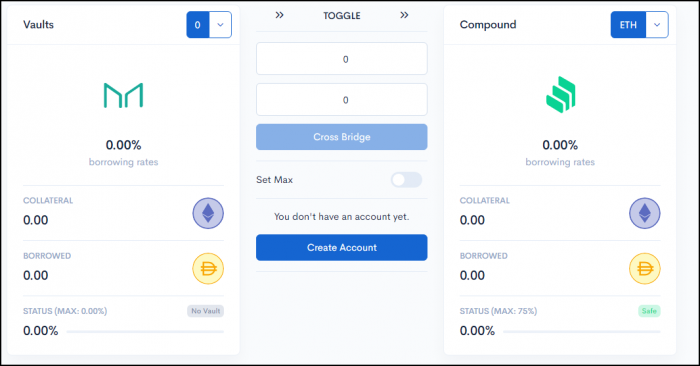

You have to create the "vaults" in order to issue DAI. You place ETH into the vault, and then you can generate DAI for the 66% of the ETH you've "collateralized" in the vault. Field 1 shows the number of the vault which is pretty handy if you want to have a number of vaults running at the same time.

Field 2 shows the net value of the position and Field 3 shows the collateralization ratio.

The most important indicator you have to keep track of is the Liquidation Value. This is the price of the collateral asset that you used. Should it close to the current market price, your position will be under the threat of being liquidated (the liquidation means that a portion of your position will be sold at the discount). Make sure that the liquidation value never gets too dangerously close to the triggering level.

What functions does InstaDapp enable at the MakerDAO page?

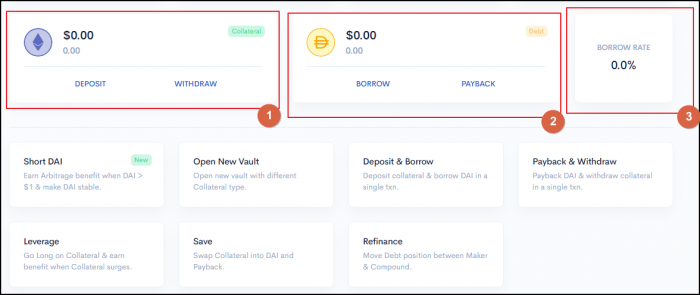

First of all, you can perform the standard actions like the ones that you'd find in the native dapp.

You can deposit and withdraw ETH (Field 1). And you can borrow and repay DAI (Field 2). The borrowing rate, shown in Field 3, means the interest rate you'll have to pay when you borrow DAI. Currently, it stands at 0%.

And below you can see the unique functionalities in InstaDapp.

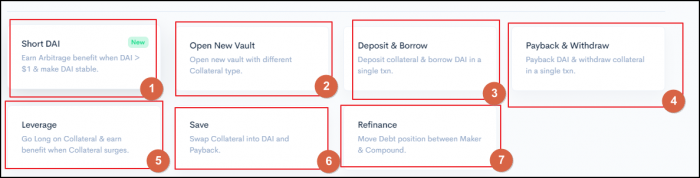

Field 1 shows the function to arbitrage on DAI whenever the stablecoin goes below its peg. It can be extremely beneficial, and your actions are going to help it stay afloat in the long term.

Field 2 has the standard function for creating the Vault. While Fields 3 and 4 deposit the "joined" actions when you deposit ETH and borrow DAI at the same time or you pay back DAI and withdraw ETH. The benefit here is that you'll have to pay the gas fees for only one transaction, instead of the two of them that you'd have to run in the dapp itself.

Field 5 shows the option to create the leveraged position which will include the system generating DAI and then buying some more ETH with those DAI coins.

Field 6 shows the option to close out a portion of the position by exchanging the collateral asset into DAI and paying back a certain portion of the generated amount.

Field 7 shows one of the best functions among the MakerDAO capabilities. It enables you to move the debt you've generated in MakerDAO between MakerDAO and Compound. In certain cases, such transfers might enable you to earn a higher yield while using the coins as a completely passive income source.

Click on the "Refinance" button.

In the new window, you can swap between the two systems with ease. Of coruse, this is much more user-friendly and cheap than interacting with the individual dapps one by one.

How to use Compound in InstaDapp?

Similar to the MakerDAO page, Compound enables you to view the statistical data and activate the functions.

What is Compound Finance, in a nutshell?

It's a lending platform. Anybody can lend their cryptocurrencies and start earning APY, without any AML/KYC in place. At the same time, anybody can collateralize the supported ERC20 tokens and borrows against the collateral. The maximum amount is no more 60% from the collateral input at the platform.

We've done the detailed write-up on Compound Finance here.

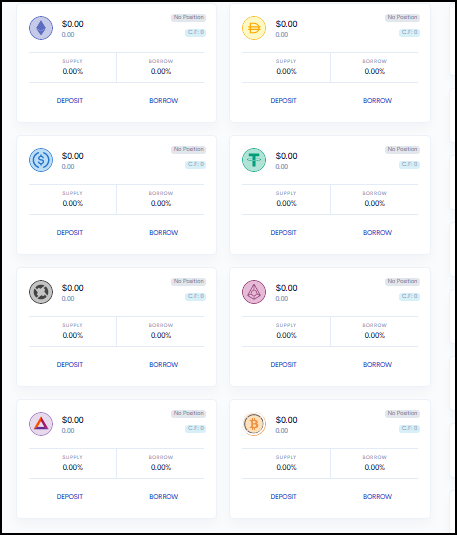

Statistical data for Compound Finance at InstaDapp

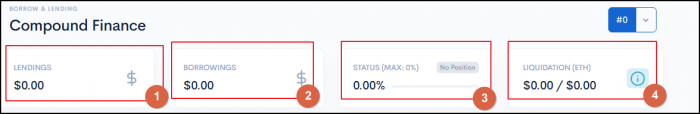

At the top, there's the section with the overall stats.

Field 1 shows the total funds you've lent out, and Field 2 shows the total borrowed funds. You can see the aggregate collateralization ratio in Field 3 and the liquidation level in Field 4.

Below you see the cards for all of the tokens enabled to be used in InstaDapp.

You can review the borrowing ratio for each of the tokens and click either the "Deposit" or "Borrow" buttons for the respective coin.

To the right, there's a series of buttons similar to the ones that you have at the MakerDAO page. The most important one is the button to maximize the GOMP generation.

COMP is being provided to the users for both lending and borrowing at the platform. What this button does is a series of actions when some crypto tokens are lent, and some are borrowed. And then the borrowed ones are lent again, and a new batch of tokens is borrowed. The result of these actions is a higher leveraged position which is capable of increasing your potential APY by 4 times.

How to use Aave in InstaDapp?

Aave is another lending platform which is similar to Compound Finance.

What is Aave in a nutshell?

It's a lending platform with a lot of various functions. Users can borrow funds at the stable or varied rates which offers more flexibility and seeks to solve for more use cases. In comparison, Compound Finance has only two functionalities - lending and borrowing with the use of specific tokens.

Another cool thing with Aave is flash loans which enable developers to borrow an unlimited amount of liquidity without any collateral, provided that they use that liquidity for some cause and then return it back to the platform with the period during which one block is mined on Ethereum (around 15 seconds).

What are the benefits of using Aave at InstaDapp?

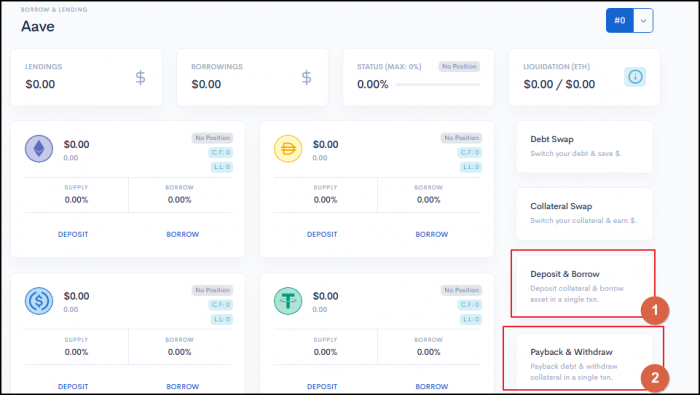

Just as with the previous two platforms, you can review the statistical data at the top of the page.

You can also perform the needed actions with the cards dedicated to each coin the middle of the page.

And you have the functions at the right. Just like with MakerDAO, you can perform the single transaction to deposit and borrow or payback and withdraw your coins.

How to use Curve in InstaDapp?

Curve is a stablecoin exchange. You can contribute to its pools in InstaDapp.

What is Curve, in a nutshell?

Curve is an decentralized exchange and it's run by the AMM (Automated Money Maker). It's used for exchanging stablecoins between each other, and not other coins. The special time of the AMM inside the exchange allows it to cut the slippage even when users need to echange huge of volumes of stablecoins between each other in an effort to squeeze out the profits through the stablecoins arbitrage.

Read the full review on Curve.fi.

What are the benefits of using Curve at InstaDapp

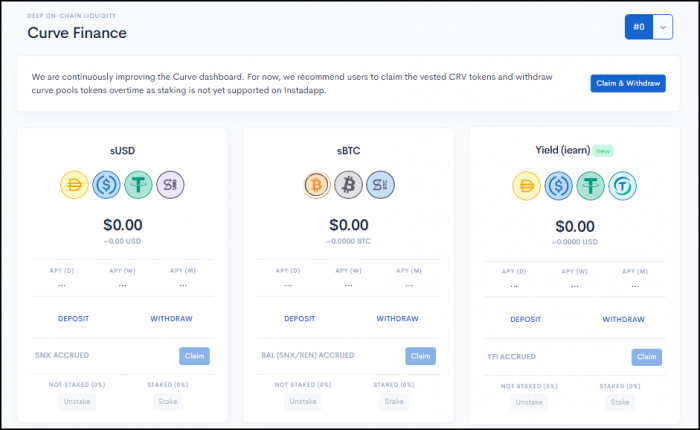

There are 3 pools presented at the Curve page.

It's easy to deposit your funds or withdraw them at any time, without going through the pain of interacting with the Curve.fi. And, importantly, Curve.fi has a very compliant interface. Compare it with the sleek and UX-focused front-end at InstaDapp and you'll get why this asset management app has gotten so popular.

Asset Management Platforms

Many say that DeFi is extremely difficult to find your way around. It's this way because the niche is in its early stages of development, and many projects openly state that they are completely experimental.

It's clear that most of the first-generation dapps will become the back-end with asset management platforms like InstaDapp acting as the front-end for users.

InstaDapp has quickly become one of the most popular platforms thanks to its ability to max out your potential APY from Compound Finance.

The team is experienced and diversified with the developers always ready to answer any questions that you might have in their Discord.

What are alternatives to InstaDapp?

There are a number of similar platforms, and we plan to write them up within the coming weeks. If you are extremely interested in learning about a specific protocol, prod us in email to hurry up.

Zapper is a good tool to have your fingers in many pies at the same time. It also gives you a quick overview on the percentage distribution for your funds across the industry.

Zerion enables a set of standard operations across many well-known DeFi projects. No custody changes hands with the dapp only tracking the balances in your WEB3 wallet.

DeFi Saver has the unique protection against flash crashes. The flash loans functionality from Aave enables users to avoid negative circumstances similar to what happened on Black Thursday.

Conclusion

As you can see, InstaDapp is extremely easy to use. The sleek and minimalistic UI enables users to quickly manage a number of projecsts from the one-stop protocol. InstaDapp requires you to transfer the funds to the smart account. So, yes, there's custody here. But, at the same time, you are transferred to a smart contract without any humans able to tamper with your funds.

We've talked about how you can easily leverage the benefits from MakerDAO, Compound, Aave and Curve. In addition, you can trade any ERC20 tokens between each other thanks to the use of Uniswap behind the curtains. If you have any questions unanswered, proceed to the project's documentation suite where you'll find a good explanation for everything InstaDapp or contact the team directly in their Discord.