Synthetix enables users to create the synthetic assets for any underlying. Anybody can do this. All operations are performed on chain with the use of smart contracts. No slippage for trading on the embedded DEX, and the fixed 0.3% fee for both market makers and takers. Users can use the inverted crypto tokens to short them, indexes (e.g. DeFi and CeFI), stocks, commodities and forex currencies. All of this sets up Synthetix to try and claim a piece of the huge piece in derivatives. Let's learn why.

What is Synthetix?

Let's talk about the basics. Synthetix is a DeFi platform where you can create the synthetical tokens. These tokens will be pegged in their value to the base assets.

For example, there is USD. It's a base asset. If you create sUSD (i.e. synthetic USD) and peg it to the price of USD, then sUSD will always have the price of $1.

Why do you need all of this?

Synthetix is a project that operates fully on top of the Ethereum blockchain. The synthetic assets (Synths) are ERC20 tokens. This means that you can generate the synths at Synthetix and then use them at any DeFi project you want to. This is the power of composability in DeFi.

Obviously, you can't do that with USD.

In addition, Synthetix plans to gradually roll out synthetic avatars for currencies, stocks, indexes and more. This will facilitate trade in those assets since it's extremely difficult to access those markets at this time. And it's frankly impossible for poor third-world countries.

We can imagine that anybody can easily buy a smaller fraction of Tesla and Apple, enjoying the rapid growth of such stocks. This will clearly help people around the world grow their wealth.

Is this platform a game-changer?

Each and every project in Defi has immense potential since all of them are exploring the new scope of activities. And Synthetix reviewed here is not an exception. Previously, there've never been the enablements that allow tokenizing real-world assets and safely transact online.

At the same time, there are 3 big problems here. First, regulators might decide that Synethix (and many other DeFi projects) are nothing else but brokers. This will introduce the stringent requirements toward Synthetix. Second, while you can transact in synths, you can't really control the life of the underlying base asset. Third, since synths are traded on the open market (i.e. they have the soft peg to the base asset), these avatars might debase from the underlying in their prices which can be extremely problematic.

Synthetix has already tackled the third problem. The platform is sufficiently decentralised and hard to shut down, i.e. it has implemented a certain level of decentralisation and censorship resistance. And, as of now, the industry isn't ready to start tackling the first two problems. But the solutions might come in the future.

Synthetics enjoy the first-mover advantages and can really become a big player in the DeFi niche for years to come.

How does Synthetix work?

Synthetix is growing fast and implementing new functionalities on the continuous basis. So, if you see that we've missed something, email us and will add up the needed information. Below we provide the detailed information about each business process at the platform so that you can form a good understanding about how Synthesis works, without being a professional smart contract developer.

There are several processes here: creating the synths, trading synths, governance. Let's look into each of them one by one. While we do that, we'll discuss the mechanisms inside the system whenever they are applied.

How to create synths at Synthetix?

Here's a detailed walk-through on how you "mint" synths.

Step 1: Buy SNX

SNX is an ERC20 token and it's the internal stablecoin on Synthetix. It's similar to MKR at MakerDAO.

Where can I buy SNX?

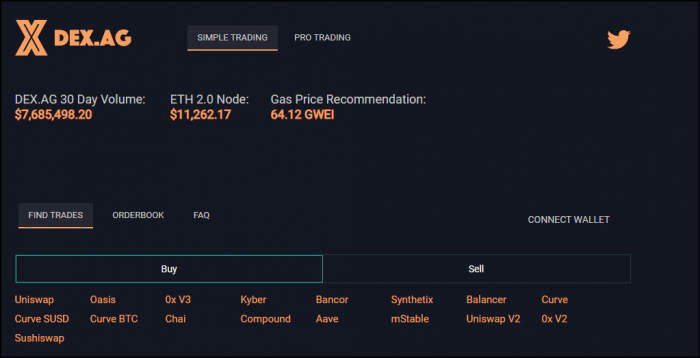

The biggest place where you can buy the token is Uniswap. It looks like it has the biggest volumes among all other platforms.

And if you want to use another decentralised exchange, consider Kyber.

SNX isn't widely popular at centralised exchange since the team doesn't want to invest in paying exorbitant listing fees. Kucoin and Poloniex are two of the more conventional venues where you can buy it.

You need to buy SNX and store it in your web3 wallet. Say, MetaMask.

Step 2: Mint synths at Mintr

Sub-step 1. Go to Mintr which is the most popular app to interact with Synthetix. There you'll need to connect your wallet with the allowed wallets shown at the right.

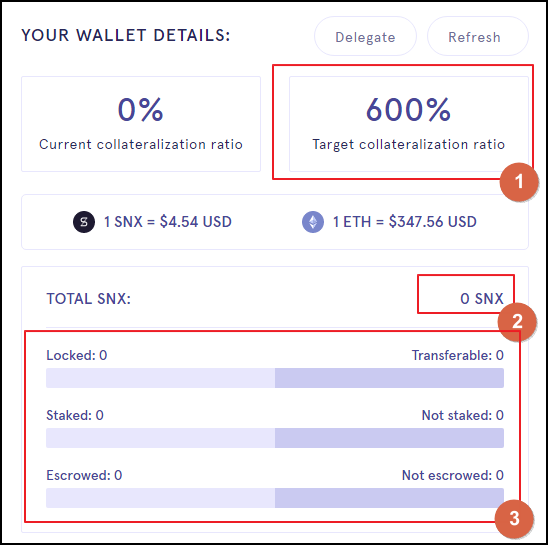

Sub-step 2. Review the data shown in the left module where the stats live.

What is the collateralization ratio at Synthetix?

This is the ratio for the collateral you need to place inside the system when you want to mint synths. The most widely used collateral at Synthetix is SNX. But there are certain developments seeking to enable the use of ETH for these purposes.

The current "c-ration" is 600%. Several months ago it was 800% then it went down to 650%. Collateralization is at the core of Synthetix and many other platforms in DeFi.

This means that if you want to min 100 sUSD (synthetic USD), you will need to input the SNX for the value of $600 USD.

The collateralization is a necessary instrument which is currently used by many DeFi projects. It enables platforms to hedge against huge falls in prices for the collateral assets they allow.

SNX is currently priced around $4, and it has seen a lot of growth within the last months due to the boom and hype surrounding DeFi. There's no guarantee that it won't go down to 1$ due for some reasons.

To the left of Field 1, you will see your current ratio.

Field 2 shows the locked, staked and escrowed SNX tokens. This is the cue for talking about staking them coins.

Sub-step 3. Stake SNX coins

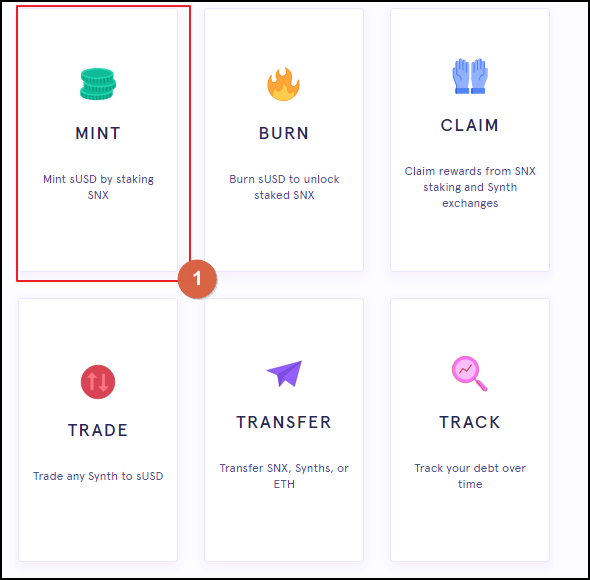

In the right section, you will see 6 Options you can use.

Click the "Mint" option.

The new page will open.

In Field 1, you need to specify the number of SNX coins you want to stake in order to generate a specific amount of synths.

In Field 1, you need to specify the number of SNX coins you want to stake in order to generate a specific amount of synths.

Field 2 allows you to max out all the SNX coins from your wallet which can be a big time-saver whenever you just need to use all of them.

Field 3 tells how many SNX coins you are already stake at the time when you initiated the process.

You can review the c-ratio in Field 4. You need to make sure that the c-ratio never goes below the stipulated minimum level. If it does, you won't receive the rewards as the staker and upon the huge reductions in the c-ratio, a portion of your position might be liquidated.

And Field 5 shows the gas prices which are absolutely crazy with the current gas prices crises on Ethereum.

How to claim rewards at Synthetix?

After you've generated some synths, your SNX coins get staked automatically. Thus, there's nothing else needed to be done in this regard.

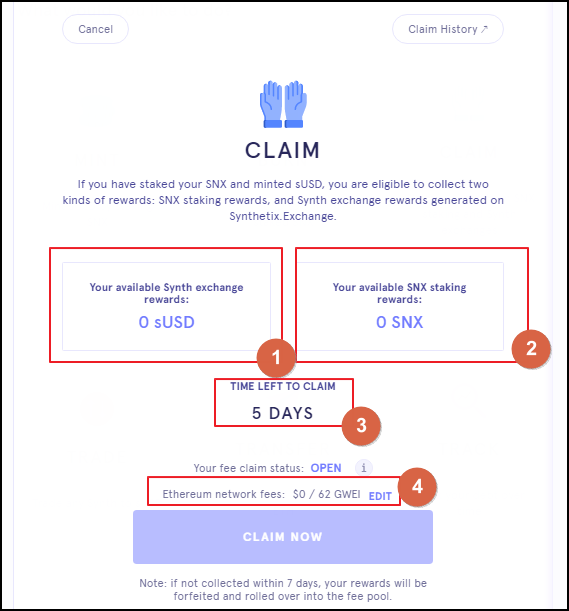

In order to incentivise staking at Synthetix, users receive the two types of rewards. In order to track your rewards, click the "Claim" tab in the right module.

What is the fee-based reward at Synthetix?

The first reward is formed by the fees, traders are charged at the Synthetix exchange. It stands at 0.3% for both marker makers and takers.

These rewards are shown in Field 1 on the screenshot above.

Notably, the 0.3% is much higher than what other exchanges offer with fees around 0.05% - 0.25%. This is the price we have to pay in order to be able to trade synthetic assets.

What is the inflation-based reward at Synthetix?

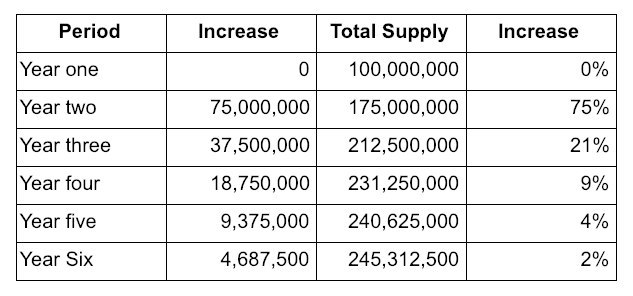

The second reward is made up by the newly issued supply of SNX tokens.

Prior to March 2020, the platform had the deflationary tokenomics model in place. This meant that SNX tokens were burned whenever a user carried out any transactions with synths on the platform.

Thus, the holders were incentivised to stake and hold their coins since the constantly reducing circulating amount of tokens would be expected to trigger the price increase.

Apparently, this was not enough to incentivise users. That's why the team decided to implement the inflationary monetary policy.

As per it, the supply will be inflated by 2.5% on the weekly basis with the newly issued coins being distributed among the stakers based on the pro-rata distribution model.

This model will be in place till September 2023. Below is the numeral data on the newly issued amounts.

Starting from September 2023, the system will have the inflationary model at 2.5% on the annual basis.

Importantly, you need to withdraw your rewards every 7 days. The number of days left for you to withdraw is specified at the bottom of the window. If you don't take out the coins, they will be added to the fee pool.

How to burn synths?

Synths are burned whenever you trade them on the exchange. We'll talk about that process in the next section. And they are also burned whenever you need to do something with your position as a liquidity provider.

As you remember, the current collateralization ratio is 600%.

Whenever the c-ratio goes below, you won't be able to receive the rewards anymore. Thus, you will need to do one of the following actions:

#1. Add up more SNX coins in order to reach the the require c-ratio level

In order to do this you'll just need to add up more SNX to your position. After you've done that, your minting position will become collateralized correctly once more.

#2. Burn some synths

The second option is for you to burn some synths which will increase the c-ratio.

You can either burn the exact amount of synths that will take you to the lowest permitted c-ratio level. Or you can act preemptively and burn some more to stay on the safe side.

How to trade synths at Synthetix

And now let's talk about how we can trade synths. You don't have to stake SNX. You can just exchange synths in the allowed pairs.

Importantly, the Synthetix DEX is different from other platforms since there is no order book or AMM here. Instead, the system provides a practically infinite liquidity pool with SNX tokens burned whenever the two sides perform the trade.

The DEX is completely custody-free and there's no KYC/AMC process. All you need is a WEB3 wallet with some ETH or sUSD in it.

Step 1. Connect the wallet

Go to the exchange's main page and click the "Connect Wallet" button located in the top right corner

In the opened window, you'll need to go through the standard wallet connection process.

Step 2. Review the Markets and find the needed pair

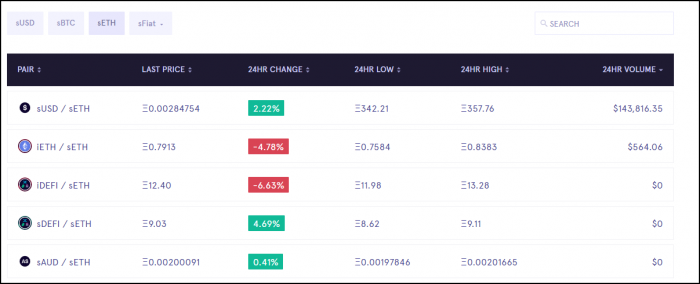

If you already have some sUSD, you can click on the "Markets" button in the top menu.

You will be shown all the existing pairs at the platform. Here, you'll need to choose the one that you want to trade.

Step 3. Buy some sUSD or sETH

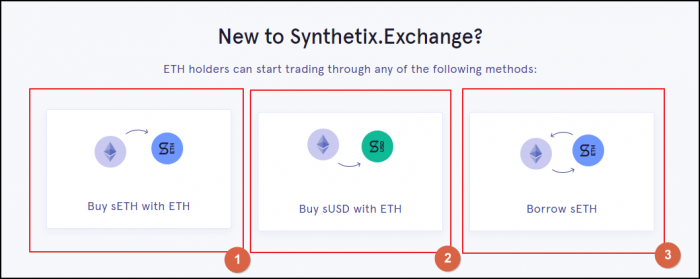

If you don't have the sUSD yet, you can buy the sUSD which is the internal stablecoin and Synthetix. It's similar to how DAO and USDT function within the Ethereum-wide ecosystem.

In addition to sUSD, another stablecoin has advanced. It's sETH. It's a stablecoin collateralized with ETH.

When deciding on whether you want to interact with sUSD or sETH, you need to decide as to whether you believe that ETH will appreciate within the long term. If you do believe that there's good potential for price growth, then it makes sense to use ETH as the collateral for sETH. Otherwise, if you believe that SNX has higher potential, then you can first exchange ETH for SNX and then use the obtained SNX coins in order to produce some sUSD.

There are 3 options that you can use in order to buy sUSD. These options are shown at the bottom of the main page.

The first two options will take you to the DEX.AG platform where you can easily convert your SNX and ETH into sUSD and sETH.

The third option takes you to the Loans Section at the Synthetix DEX.

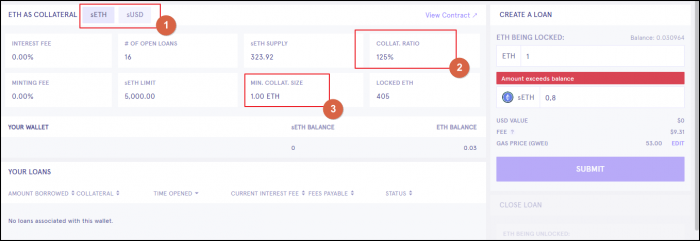

You can actually borrow both sUSD and sETH there, as Field 1 shows.

Field 2 tells us the minimum c-ratio for the loan. Make sure that you closely track this value because it goes below there is a risk of being liquidated.

Field 3 shows the minimum amount of the collateral you can use in order to create the position.

Step 4. Trade one synth for another

Whenever you trade, the SNX coins underlying the synths are getting burned. This means that you don't have to worry about slippage at all, and all your transactions will get executed right at the price you specified.

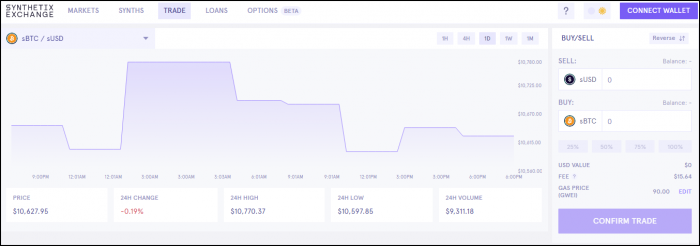

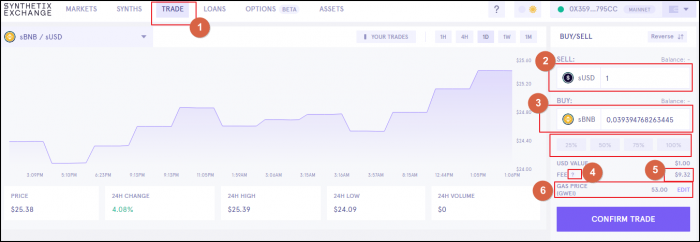

Click on the "Trade" button shown in the top bar (Field 1).

You can take a look at the chart to the left.

In this example, we want to trade sUSD for SBNB. First, specify the amount of sUSD you want to sell in Field 2. Field 3 will show you the number of sBNB coins you'll receive.

Click on the question mark in Field 4 in order to see the actual fees you'll be charged within the platform and by the Ethereum network. And, of course, as of the time of writing, in September 2020, we are seeing insanely high gas prices.

The actual gas value is shown in Field 5, and you can play with gas amounts in Field 6.

What synthetic assets can you trade at Synthetix?

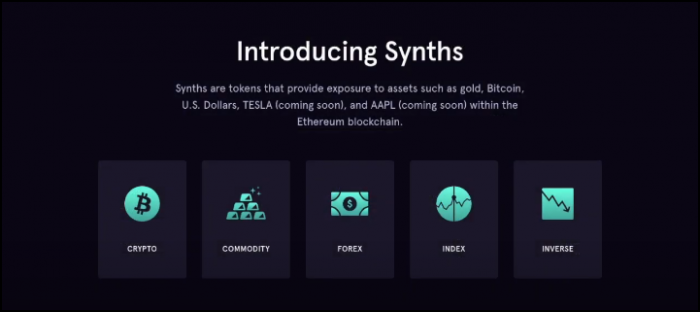

There are four groups of synths at the platform: crypto, commodity, forex, index and inverse

Crypto is self-evident.

In commodities, you can trade gold and service. And this is amazing because the platform is clearly bridging the gap between the crypto industry and rest of the economy. Long-term investors might actually find it much easier to buy the synthetic gold on this platform as opposed to dealing with the high-friction processes in the real world.

Forex offers USD and EUR.

In Index, we have the DeFi and CeFi segments angling you to buy into the overall segments of the decentralized and centralised finance systems emerging on top of the blockchain systems.

Inverse gives you an easy change to short any crypto you wish to. These assets are indicated by the letter "i" at the beginning of the name.

What makes Synthetix so unique?

Of course, there are a number of competitors on the market and new projects are popping up all the time. But Synthiex has a strong team behind it and a number of unique features.

1. There's a distributed pool of highly motivated liquidity providers who have already flocked to the platform which significantly reduces the liquidity crises for the years to come.

2. P2P "magic" without any order book or AMM takes all of the friction out of trading.

3. You can trade between each and every synth you want to. With the team set to deploy lots of the assets from the real world of finance, this can become huge and bring liquidity to completely illiquidity pairs IRL.

Future of Synthetix

The platform is clearly winning from the first-mover advantage, and it has become the most popular synthetic assets creator on the market.

The derivatives market IRL totals trillions of dollars. If the system manages to siphon off just 1-10%, it'll grow into a huge endeavor.

And, importantly, whenever the users start migrating from the real-world platforms to Synthetix, this will kick off the network effect and result in more and more people following the others.

We might really be seeing the advancement of the emergent tech solutions that will lead the way for decades to come.

Conclusion

Synthetix is a unique platform where you can easily issue the synthetic assets for some of the popular underlyings. Today, there are about 30 base assets allowed within the ecosystem, but the team is set to increase their number in the future. Being the utility token and actually needed within the business processes here, SNX is expected to appreciate it with more and more people starting to use the platform.

We like that you can trade synthetic gold and silver. Trading these assets can result in tons of friction for micro-traders around the world (i.e. third-world countries). 1$ here and 1$ there is not much. But when you count the billions of unbanked folks, these numbers are expected to snowball. That's the reason for SNX appreciation, and that's the reason which might catapult it to the moon.

Liquidity providers can earn lucrative rewards by staking and minting, enjoying the two streams of goodies in the form of fee distributions and inflation allocations. Thus, this platform is worth exploring right now. Learn more about the project in Synthetix official resources section.