Compound Finance offers extremely high yields for lenders. In this Compound Finance tutorial, we'll show that it's very easy to use. You don't have to prepare in any way - there's no KYC process or verifications in place. In fact, you don't have to register at all! We'll also share the 2 methods used by defiers in order to maximize their yields. We also show you how the platform differs from its main competitors - MakerDAO and Aave. Compound Finance is a great tool that will make your crypto holdings work for you, instead of idly sitting in your wallet.

What is Compound Finance?

It's a DeFi lending platform that enables any user to lend and borrow cryptocurrencies. There is no AML/KYC process in place at the Compound Finance site which is expected to democratize the lending industry as we know it. It's in stark contrast with legacy finance where banks need to comply with various regulations while users need to present the documents and undergo credit checks.

In its current format, Compound Finance enables borrowers to take out loans that are less than the collateral they've placed at the site. Thought this is different from the legacy lenders who don't require any collateral in the form of the actual assets, escrowed with them, this is not that different since the legacy lenders are informed as to the borrower's assets, such as a car, house or savings, which they can impose the lien on.

We expect that Compound Finance will become a pioneer in the emerging lending ecosystem, and various intermediaries will arise who will borrow from the platform and lend to retail borrowers at the next stage.

Importantly, the system functions fully on-chain with the smart contacts efficiently operating on top of the Ethereum blockchain.

There's been so much hype about Compound Finance and users making huge PAY here. Though the interest rates you can enjoy here have subsidies, they are much higher than what you can expect to get from the legacy banks.

Let's see how both lending and borrowing processes work at Compound Finance.

How to lend at Compound Finance?

As we've said above, there is no registration or AML/KYC processes since the dapp is fully decentralized. All you need to do is connect your WEB3 wallet and you can start lending your coins.

Why does it make sense to lend at Compound Finance?

If you have some crypto that you are holding long-term and expect it to significantly appreciate within a few years, you have the un-utilized capital on your hands.

You could, potentially, exchange your coins (e.g. ETH) into USD and then invest those USD in stocks, launch a business or buy a piece of real estate. Should you do that, your capital would be put to work. But you won't be able to benefit from the upside in those crypto tokens.

Compound Finance and other similar lending platforms solve this use case. You can furnish your crypto tokens to those ecosystems and lend them out to other users. This will result in a certain APY. At the same time, since all operations run on the blockchain, this platform is completely trustless, which means that you don't have to trust anybody, but only just a piece of code.

And now let's take a step-by-step walkthrough for the lending process here.

Step 1: Decide on the token which you want to lend

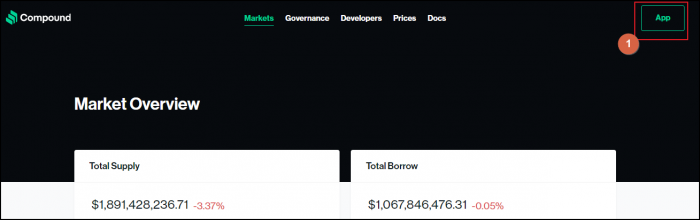

Go to the dapp's main page and click the "Markets" button in the top menu.

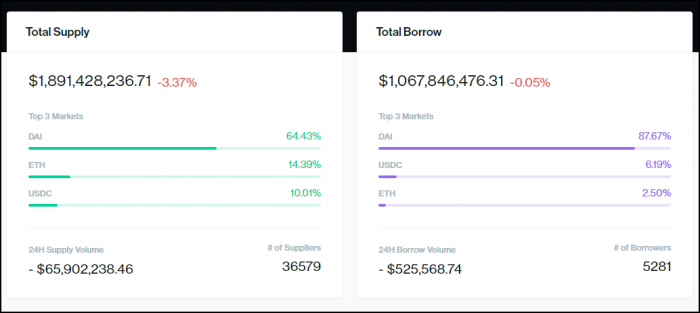

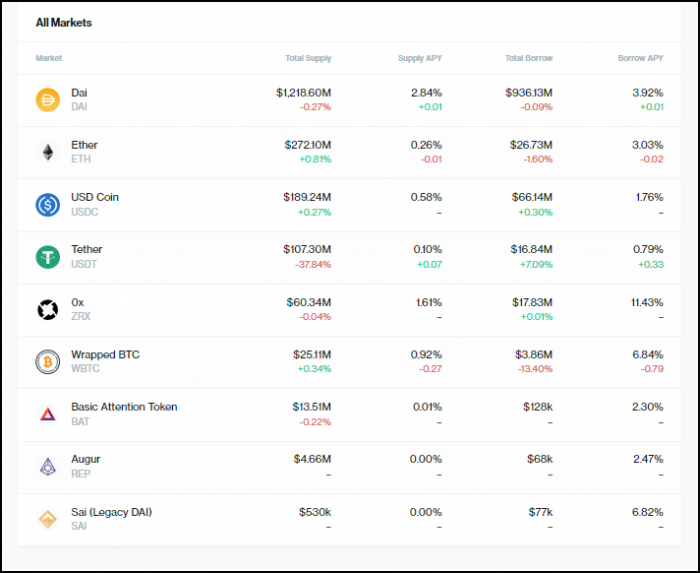

At the top of the page, you can see the quick overview of the stars within the system.

You can observe the most popular assets for lending and borrowing, as well as the APY and APR values related to each of those.

Below you can see the information about each specific coin and the APY you'll enjoy if you decide to lend any of those at Compound.finance.

Quite logically, you need to pick the one that offers the highest APY because this is what here for - to maximize the profits you can generate with your long-term holding that would be sitting idle in your wallet otherwise.

How is APY determined at Compound Finance?

All of the commercial banks in any country on the globe are bound to take into account the interest rates set forth by their central banks. And, in a way, all the countries look up to the Federal Reserve System (US Central Bank) when deciding on their local interest rates.

Some countries have a higher inflation rate than others. Thus, the higher inflation rate makes the Central Bank allow higher interest rates. Because, otherwise, the deposits would actually lose money while storing them in an investment account.

And Compound Finance is different. Just like other DeFi projects, it's the smart contracts and algorithms that determine the interest rates payable to the lenders and chargeable from borrowers. Though those algorithms might become pretty complex and we don't expect you to read the actual code underlying the system, it's fair to say that they base their valuations on the supply and demand currently observed at the market.

Compound Finance takes out the cut from the margin between the borrowing and lending rates.

This money is used to pay out the reward to lenders.

Step 2: Connect the wallet

Go to the top right corner and click the App button.

At the next page, you will see the "Connect Wallet" button in the top right corner.

Now you need to perform the standard process to connect your wallet. We'll use MetaMask in this Compound Finance tutorial.

Step 3: Buy the lending tokens

In order to lend out the tokens at Compound Finance, you need first to buy them elsewhere. Uniswap is probably the most popular DEX where you can easily purchase any ERC20 tokens with no AML/KYC processes and enjoying the lower slippage.

And when you find yourself in possession of some stablecoins but you actually want to lend another one, Curve.fi is the best place to trade stablecoins between each other.

Step 4: Supply the tokens for lending

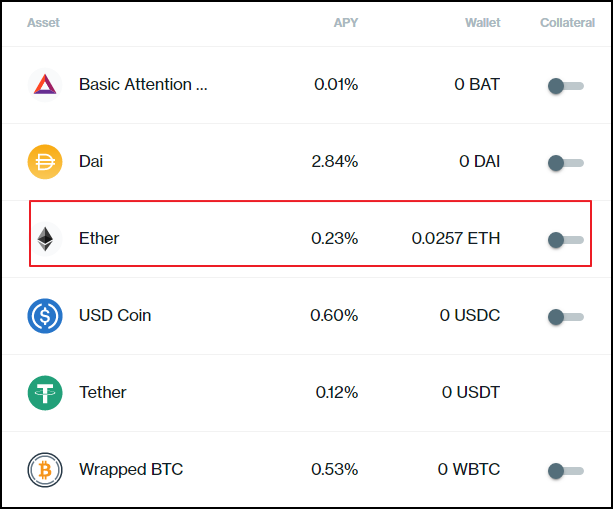

Now that you've obtained the tokens you want to lend out, you will be able to see the full balance of these tokens in your wallet.

Click on the token in order to open the next window.

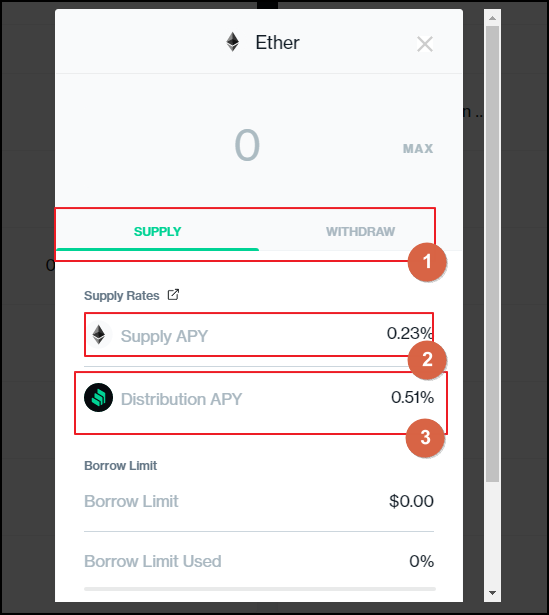

Field 1 shows the two options for you to enter the sections to supply or withdraw.

The supply APY is shown in Field 2, and the distribution APY is identified in Field 3.

What is Distribution APY in Compound Finance (How to get tokens by lending here)?

Compound Finance incentives both lenders and borrowers by distributing the native $COMP tokens to them.

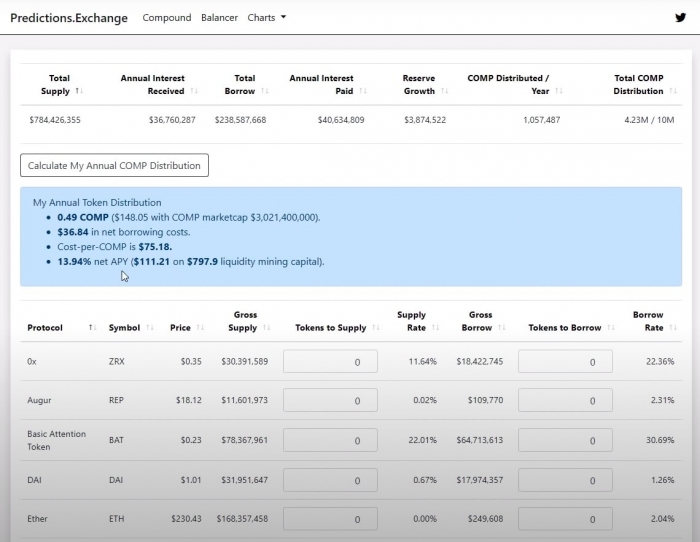

The total supply of $COMP tokens is 10 million units with 40% of that amount reserved for the incentivizing distributions. You can find out about the distributed volumes at the User Distribution Page. You can also see the other stats for the distributions on the platform.

Importantly, the system distributes the allocations based on the current APY/APR rates. Thus, the specific shares each asset gets depends on today's rates in place. The amount is further split into the 50% shares that are furnished to lenders and borrowers.

What if $COMP used for?

$COMP is a governance token and it's used to cast votes on the improvement proposals. These proposals deal mainly with the value for interest rates applicable to e lending and borrowing operations.

Whenever a holder uses the tokens to cast the vote, they also receive a smaller fee.

It's expected that COMP will continuously grow in price as the platform finds itself growing in popularity.

How to borrow at Compound Finance?

Borrowing here is pretty easy too. There are no credit checks or scores to be submitted. However, you do need to provide the collateral and you can't borrow more than 60% of your collateral.

Such borrowing ecosystems are called overcollateralized.

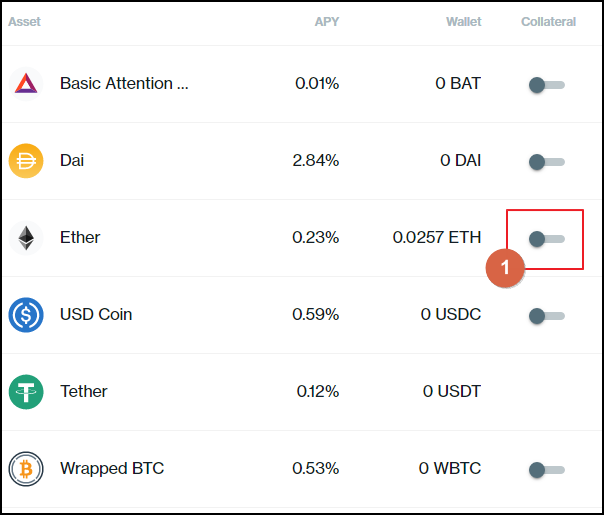

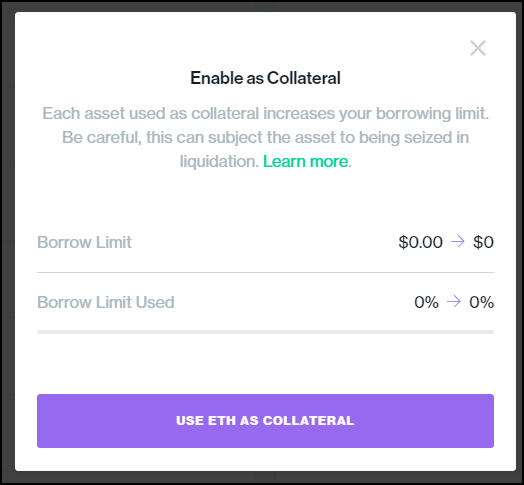

Step 1. Enable the coin as collateral

Click on the slider located at right within the coin's section.

This will open the window with the borrowing limits.

Review the information and follow up with the process to confirm the transaction in your wallet.

Important notice on the liquidation clause

Keep in mind that Compound Finance has implemented the mechanics in order to prevent the collapse of the borrowing system.

The liquidation clause states that whenever the borrowed amount exceeds the collateral you placed with the platform, your borrowings are to be liquidated. This means that any other user will be able to obtain your collateral assets at the discount. If the discount rate amounts to 7%, this means that they will get those coins at the price that is 7% lower than the open market valuation.

They will need to sell your baseline assets and close out your position.

Thus, it's important to always keep track of the collateralization level you have for your borrowings. And it's always safe to ensure that your operations are over collateralized by a large margin which would prevent your account in case of a drastic change in the asset's price.

Just like for lending, you will receive the tokens for your borrowing operations. You can see how many tokens you've generated at the Vote Page.

Thus, you are essentially being paid to borrow. This is how people reach mind-bogglingly high APY at Compound Finance. Let's learn more about this.

How to yield a farm at Compound Finance?

As we've clarified above, users receive the incentive tokens both for their lending and borrowing operations. That's why it makes sense to lend and borrow at the same time. This is the state of DeFi that we are seeing at this time. The business models will normalize with time, but as of now, users can make use of those huge incentives Compound Finance doles out.

Method 1. Yield farm by simultaneously lending and borrowing and Compound Finance

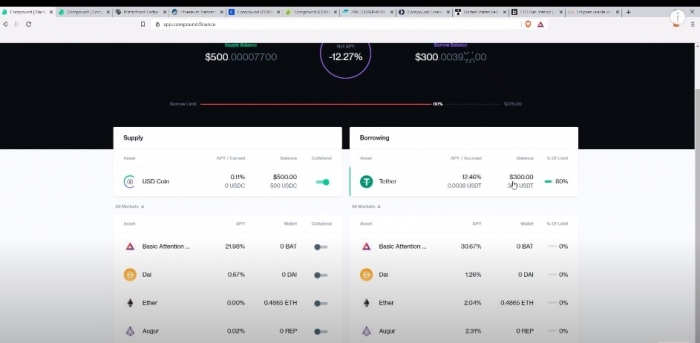

Let's say that we've lent 500$ in USDC and then borrowed 300$ in USDT.

Taking into account the current interest rates for lending and borrowing operations, we will see the net interest rate at -12%.

But then we can take into account the $COMP distributions we'll receive. The best tool to determine those values is the prediction.markets app.

And since the distribution rate would be around 14%, this means that the effective annual rate is around 2%.

Method 2. Use InstaDapp to leverage your position

Another method is to use an external dapp, such as InstaDapp, which will allow you to maximize your profits at Compound Finance via the leveraged position.

What the dapp does is folding your leveraged operations on top of each other which increases the amount of funds you play with. And, thus, the $COMP distributions are increased too.

Here's the sequence of actions that InstaDapp will do this case:

1. Deposit USDC

2. Borrow USDT

3. Convert the borrowed USDT into USDC

4. Deposit USDC

5. Borrow USDT

As you can see, the same sequence is being done in rounds enabling users to leverage their positions up to 4 times!

Future of Compound Finance

This is one of the rare DeFi dapps which seems to be completed. When it was launched, the team saw the project as an experiment without a clearly specified roadmap.

But as far as we can understand from the Medium article published by CEO Robert Leshner, there were 3 goals set forth for the project. Facilitate support for multiple assets, enable each asset to have its specific collateral factor and turn the project into a DAO.

And within several months the team managed to deliver on each of these 3 goals. Compound Finance is currently being run by the decentralized community and it did indeed transform into the DAO.

It might seem that this is how this dapp will continue operating for the years to come, but nothing is set in stone. The community might collectively decide to implement novel functions, add numerous other assets and adjust the collateralization factor and reserve factor (i.e. a smaller portion of the funds that is taken from the collateral in order to create the "financial cushion" to mitigate any negative effects of big prices changes for the collateralized asset).

Compound Finance versus Competitors

Though Compound Finance is a pioneering dapp, there are some competitors in this space.

Compound Finance vs MakerDAO

While both Compound Finance and MakerDAO enable users to collateralise their assets and obtain borrowing, MakerDAO is primarily focused on facilitating the operations of the stablecoin, DAI. In comparison, Compound Finance seeks to deliver high yield rates and thus create the network effect within the DeFi niche.

MakerDAO currently has the 0% saving rate which means that if you borrow DAI, you'll pay the 0% percent. This allows users to do just that - borrow DAI at the 0% interest rate and immediately lend out the coins at Compound Finance. While they do this, they enjoy huge interest rates and can yield farm (using one of the 2 methods we described above.

Thus, as you can see, the two dapps make up a part of the "money lego" which is possible thanks to the composability of the DeFi dapps built on top of the Ethereum blockchain.

Compound Finance vs Aave

Both of these are lending protocols that utilize the collateralization mechanism.

Aave is a much more complex system with various additional options such as flash loans and fixed and stable rates. All of these functionalities are aimed at the professional developers so that they can incorporate them into their dapps and subsequently ship to end-users.

In comparison, Compound is just what it advertises to be - the platform to lend and borrow in cryptocurrencies. The UI here is much more simple as compared to the Aave's UI.

And, of course, the biggest difference between Compound and Aave is the fact that Compound offers the incentive distributions of $COMP tokens and Save doesn't have any similar program in place.

Conclusion

Compound Finance is very easy to use. You can lend and borrow without any KYC/AML process in place. The interest rates are determined based on the ratio of supply and demand for the specific coin you interact with. There's no middleman or regulator who might freeze your accounts and impose new requirements on you. As you can see from this Compound Finance review, all of the operations can be performed by anybody with basic computer literacy. That's why we believe that Compound.finance will continue drawing many users both from inside and outside of the crypto space for years to come. Read up on the project's documents to learn more. By the way, you can use Curve.fi to get the right kind of the stablecoin you need for the operation at Compound.