Yearn.finance is a yield maximizer. The bot inside acts to shuffle your investments between different lending platforms, liquidity mining platforms and rewards systems. As a result, you win from the highest possible yields, currently obtainable in DeFi. All this is done while the protocol also seeks to mitigate the risk by avoiding new and untested solutions. At the same time, Andre Kronje openly says that all of the solutions are experimental and might include bugs. DYOR and use yearn.finance at your own risk. Yearn might become the DeFi's Bitcoin.

What is Yearn Finance?

The yearn.finance project helps users maximize their profits. To use it, you need to input some tokens into its smart contract first. The smart contracts constantly monitors the yield values among lending DeFi platforms (Aave, Compound, DyDx and others). Whenever it sees a higher rate at a specific platform, it shifts funds there. In this way, you are seeing much higher rates than what you would have seen if you had stuck with just one specific platform. In addition, since yearn.finance shuffles millions of USD in single transactions, the gas fees are much lower as compared to the ratio from your own funds.

Team behind Yearn.finance

The protocol was originally developed by Andre Cronje. After dropping out of the law college, he went through the 3-year coding curriculum in just 6 months. He's been actively working in fintech, insurance and other industries.

Several years ago he became fascinated with the blockchain and cryptocurrencies. In particular, he discerned the immense potential of DeFi protocols enabling users to enjoy huge APYs with investing stablecoins.

The yearn.finance protocol was launched in early 2020. In the middle of summer, the governance token YFI was introduced.

There's a high level of decentralization in this project which is always good in DeFi. The protocol is slowly turning into the fully-fledged DAO.

Andrew Cronje always says that the YFI token has the 0 value, and that all of the solutions are experimental. He also says "I always test in prod" which means that the smart contracts don't go through rigorous audits prior to the implementation which exposes users to higher risk as compared to other systems which do smart contract audits first.

The whole of DeFi is highly experimental and opens us up to high risk. And much so is yearn.finance. You should never invest any funds on which your livelihood depends. If you have some funds to play with, yearn.finance offers great opportunities for yield farming.

There's a certain understanding shared by Andre Cronje and others that DeFi protocols are becoming too complex to interact with. Yearn.finance, as we'll see in this review, features a super-easy UI. However, behind the scene the "DeFi magic" takes place. Below we'll make sure that we'll explain to you the major business processes performed by the platform.

How does Yearn Finance work?

Yearn.finance can be extremely hard to understand for newcomers. There are so many moving parts here. In addition, the YIPs (Yearn Improvement Proposals) are constantly pushing through new changes. Thus, in just a couple of months a lot might change. DeFi is currently undergoing the "big-bang" moment and it's growing fast with new revolutionary solutions popping up all over the place.

6 Modules inside Yearn Finance

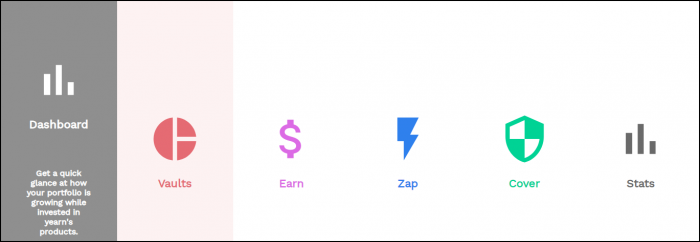

Go to the site's main page and you'll see the 6 modules available within the ecosystem.

These are Dashboard, Vaults, Earn, Zap, Cover, Stats.

Let's start with the oldest one, Earn.

What is Earn module at Yearn.finance?

The yearn protocol is at the core of yearn.finance.

This module is used to maximize your by shuffling the pooled investments across various DeFi lendings platforms. The protocol uses some of the most popular lending protocols such as Aave, Compound, DyDx and others.

Here's the detailed step-by-step description of the underlying process.

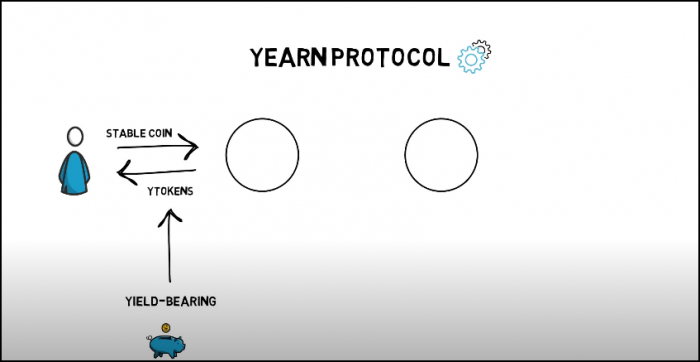

#1 User inputs stablecoins and receives yTokens

The user would need to first get their hands on some stablecoins. Say, DAI. Read this review to learn how to obtain DAI.

Then the user inputs the stablecoins into yearn.finance. In return, they will be provided with yTokens. These are the so-called "yield optimized tokens". They are used as receipts or certificates of deposit for the funds contributed to the protocol.

Should the protocol deliver any yields to the contributor, the contributor will receive a higher number of yTokens. They will exchange these tokens into the "base asset" and withdraw that asset from the platform.

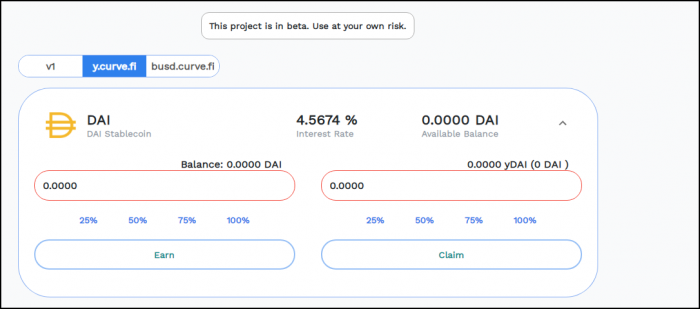

Go to the yearn UI where you can contribute and claim your profits.

#2 Yearn protocol maximizes the potential yield

When the first version of the protocol was launched, it was used to simply shift the pool between various lending platforms. However, with time, this became infeasible since the pool got much bigger and any such reallocations would inevitably cause the negative changes to the yield offered.

That's why, in its current version, the Yearn protocol first calculates potential impact of its actions and reallocates the coins between the allowed platforms accordingly.

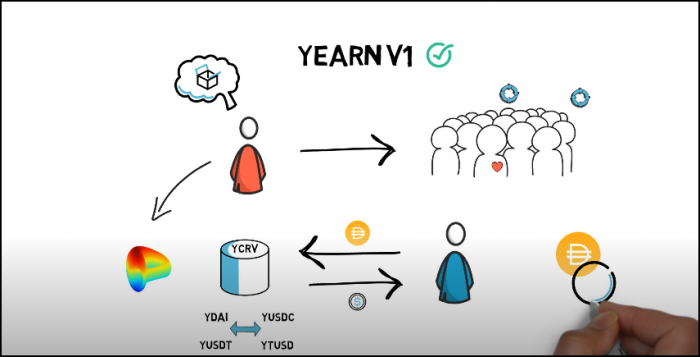

#3 Depositing to yCRV pool

DeFi are all about composability. They are lego pieces and developers like Andre Kronje are building amazing financial structures with them.

At some point, the Yearn protocol started closely collaborating with the Curve platform. The yCRV pool was created.

This pool contains four tokens - yDAI, yUSDC, yUSDT and yTUSD. These are the "wrapped" tokens for the “base” tokens - DAI, USDC, USDT, TUSD. It might seem that these are derivatives, but they aren't derivatives. These are just tokens of tokens which simplify the interaction with specific platforms.

As we've discussed above, the yTokens deliver the yields, as opposed to the base stablecoins which are just that - stablecoins.

Sometimes, users might want to swap some stablecoins for others. They can do that at the Curve platform which is specifically designed to facilitate trading between stablecoins. And now users are able to actually exchange the wrapped versions, without unwrapping them into the underlyings. The liquidity providers at Curve receive the pro-rata cut of the 0.040% fees chargeable from all transactions performed here.

#4 Receiving yCRV from Curve and staking it at Yearn.finance

Now, whenever you contribute any coins to the yCRV pool (the deposits may be either in base stablecoins or their wrapped y-versions), you receive the yCRV tokens.

You can use these tokens at the Curve platform and place them into the gauges at Curve. We've created a detailed review on all the processes at Curve.fi.

If you do that, then you will enjoy the three streams of profits: a) yields from the yTokens, b) fees from yCRV pool, c) additional rewards from staking yCRV tokens into gauges at Curve.

As you can see, it's not that hectic and pretty logical. Just don't feel overwhelmed with the fact that you are reading information about Curve.fi, while you came to learn about yearn.finance. This is how it is in DeFi in 2020 - there's a lot of lego-ing going on around here.

And now let's take a look at the Vaults.

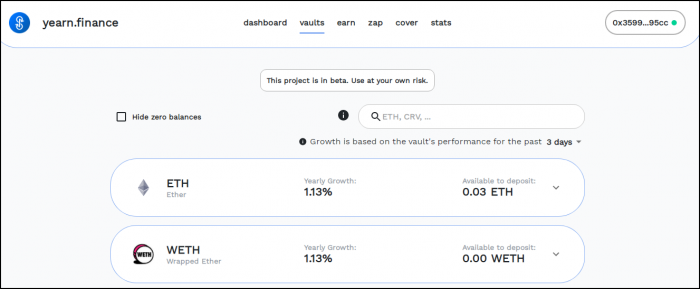

What is Vaults module at Yearn.finance?

While the Earn Module only serves as a tool to automatically identify the highest yields from the lending platforms and rebalance the investments accordingly, the Vaults Module goes deeper. Inside each of the Vault sits a custom-developed investment strategy that might include a large number of steps.

How do Vaults work at Yearn.finance?

The decisions on creation of new Vaults are made based on YIPs with the voting being performed in line with the governance rules. See the Section on Governance below.

Each Vault is being managed by the so-called "Controller" who makes the decisions as per the specified algorithms.

In order to contribute to the Vault, you need to deposit the corresponding base asset. For the ETH Vault, you need to deposit ETH.

The Vaults are expected to deliver yields. Whenever the yield is realised, it is used to purchase more of the underlying asset. That's why the Vaults are called "the continuous buy-and-hold strategies" since there's nothing the investors need to do until they decide to withdraw their funds.

What fees do you need to pay?

Though there are different setups for specific vaults, almost all of which charge 0.5% in withdrawal fee.

At the same time, it should be noted that many of them include purchasing DAI from MakerDAO for ETH. This creates the CDP and thus you are exposed to the liquidation risk whenever your CDP is less than 150% collateralized. (Read the meaty review of MakerDAO.)

Vaults might expose you to much more risk since they involve your funds across many platforms and might leverage less tested approaches for yield farming and liquidity mining.

Yearn.finance also offers a tool that might help you mitigate the risk you take on. There are two types of vaults - standard vaults and delegated vaults. The standard ones are for stable assets (stablecoins and flavors of wrapped BTC or ETH).

And the delegated ones are used for volatile assets. There's only one delegated vault operational now - for aLINK. Whenever you place some aLINKs inside, they get swapped to a stablecoin internally. And whenever you withdraw, the stablecoins are first swapped back into the aLINKs.

What is yUSD?

yUSD is a token you receive after placing the assets into the yCRV Vault. This is the most popular vault on the platform.

As you start to see, DeFi is getting extremely complex and intertwined. Even professional developers are having trouble understanding the way the dapps operate and collaborate together.

yUSD might gradually turn into the DeFi's "reserve currency". Within it, there are layers of operations that seek to deliver the highest yields, rewards and efforts to mitigate risk. But, on the surface, it's just a token with the RoI.

This might be a perfect element for the wider adoption for less technical users out there.

What layers does yUSD have?

The tokens includes the following layers:

1. Money-market operations

The yTokens are used to programmatically shift between lending platforms in an effort to obtain the highest available yields from the DeFi lending platforms.

2. Y Curve pool

The yCRV pool brings the fees for the liquidity provision at Curve.fi. In addition, the liquidity providers are rewarded with CRV tokens.

3. CRV-yCRV circulation

The newly generated CRV tokens are used to purchase more yCRV tokens which results in growing the asset base.

What is Cover module at Yearn.finance?

This module allows you to insure your activities by pooling the funds with other Insureds.

The Module includes 3 components: Insurer Pool, Insured Pool and Claim Governance.

The insurers deposit the funds to the Insurer Pool, while the insurees contribute the tokens to the Insured Pool. The insurees pay out the 0.1% at the deposit date and then 0.1% on the weekly basis. These fees are paid to the insurers as the reward.

In the event of the insured event, the vote is taken by the Insurers on whether to satisfy the claim or not. The 33% quorum is required for the affirmative decision.

It is expected that the Insurers will act diligently when considering the claims. Otherwise, the Cover Module will lose legitimacy in the eyes of any future potential insurees.

Other Modules at Yearn.finance

In order to keep this review short, we are going to say just a few words about of the other modules:

Dashboard brings together all the data about any of your investing strategies.

Zap helps you minimize your gas costs by using the Zapper's capabilities.

Stats shows the statistics.

What is YFI token?

YFI token is a governance token at yearn.finance. It's not used for any utility purposes at all (i.e. you can't receive it whenever you use the service).

There are only 30,000 YFI tokens in existence. And 100% of them are in circulation (except for 56 tokens burned by somebody in the early days). The protocol doesn’t provide for creating more tokens, but this might be changed based on the resolution by the stakeholders.

All the YFI tokens were distributed among the liquidity providers at Curve and Balance who were engaged in using the yPools in the middle of the summer 2020. This distribution was seen as extremely fair and decentralised since the founder Andre Kronje, the developers or VCs didn't claw back any portions of the token supply. Today, this project is seen as one of the best examples for decentralised platforms.

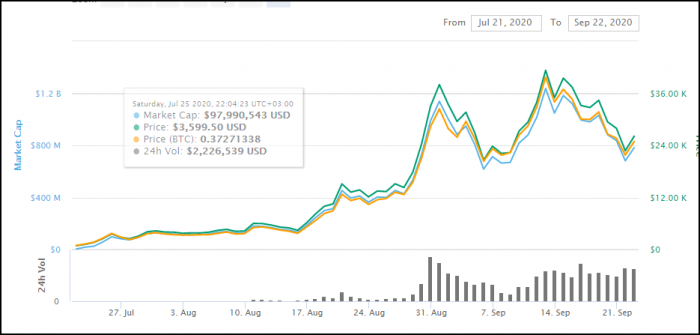

Why has YFI grown so much?

Even though Andre Kronje openly said that the token has the zero value, the community might think differently.

The protocol provides for the distribution of the profits, generated through the system's operations. As of now (September 2020), yearn.finance is only taking the first steps in its development journey. Since the project is seen as extremely decentralised and driven by the loyal and qualified developers acting as active stakeholders, it's possible that the protocol will be augmented with many other new features in the future.

That’s why the price has been parabolic ever since the launch of the token.

The profits from operations are sent to the Treasury Vault. Upon the accrual of $500,000 therein, the funds are used to pay developers, operational expenses and community grants.

Just like Bitcoin within the wider crypto industry, Yearn might become the first dapp that has stumbled into this kind of architectural solution. Thus, it is destined to win from the first-move advantage - not because it's better than other similar protocols, but because there's never been anything like it before. The first-move advantage always enables the strong network effect and a loyal user base. And yearn.finance enjoys a truly formidable stakeholders base with many developers actively participating in devising and implementing the YIPs.

How do you vote with YFI?

Anybody who has 1 full YFI token can participate in the voting process. This is done by staking the tokens in the stacking module. Following the vote, the user may not be able to withdraw the tokens for 72 hours. The votes are made on the YIP (Yearn Improvement Proposals) which can be tabled by anybody in the community.

As a minor reward, the voters will receive certain fees for their participation in the collective decision-making process.

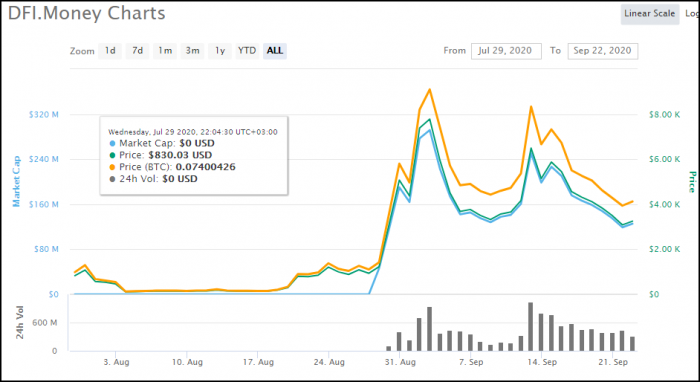

What is a YFII token?

At the end of summer 2020, the community rejected the proposal to increase the supply of YFI tokens which would have occurred in the form similar to the stock split.

A certain group of stakeholders didn't like the outcome of the vote and decided to create the protocol's fork. It became known as YFII, and it has been subsequently rebranded to DFI.Money.

The YFII has been seeing certain ups and downs, in line with the YFI’s dynamics. Thus, it's not a completely worthless coin.

Importantly, YFII has nothing to do with yearn.finance.

There have been many other forks from the original yearn.finance platforms. Some of them are clearly fraudulent, and some, like YFII, are trying to push a divergent USP to the users.

Conclusion

Yearn.finance is a profit maximizer. The yearn.finance protocol shifts the investment pools between different lending platforms, seeking to maximize your yield. While the Vaults Module creates the custom-made investing strategies which are voted in existence by the loyal community. All of this is highly experimental and thus exposes users to extremely high risks (smart contract, theft and collusion, etc.). Yearn.finance seeks to leverage the composability as the driver for the concerted use of multiple apps in order to simplify DeFi and act as the gateway to other - more complex (backend) dapps. That's why some call it “Defi's Bitcoin”. Learn more in the yearn.finance's official resources pack.