Read out a detailed review on Curve.fi with the tutorials into all the major processes here. Curve.fi offers amazing opportunities to trade stablecoins and wrapped-Bitcoin coins. And it needs a lot of liquidity to do that. That's why liquidity providers can easily join liquidity pools and start earning profits completely passively. You can first create DAI with some ETH as the collateral and then pass DAI into Curve.fi and start doing liquidity provision. This is a great strategy for those of us who believe that ETH is destined to go up. As of now, there are 9 pools, and the Y pool is the most profitable and famous one. Let's learn Curve.fi together!

Read out a detailed review on Curve.fi with the tutorials into all the major processes here. Curve.fi offers amazing opportunities to trade stablecoins and wrapped-Bitcoin coins. And it needs a lot of liquidity to do that. That's why liquidity providers can easily join liquidity pools and start earning profits completely passively. You can first create DAI with some ETH as the collateral and then pass DAI into Curve.fi and start doing liquidity provision. This is a great strategy for those of us who believe that ETH is destined to go up. As of now, there are 9 pools, and the Y pool is the most profitable and famous one. Let's learn Curve.fi together!

What is Curve.fi?

Curve.fi is a decentralised exchange. It's mainly focused on enabling users to trade stablecoins between each other.

What are stablecoins: quick refresher

Stablecoins are coins that are pegged (i.e. tied) to another asset. For instance, they can be tied to the price for USD, gold or silver.

Whenever you have several stablecoins that are pegged to the same asset, their value should be equal. For instance, DAI, USDT, USDC, TUSD are all tied to the value of USD, and they should always be equal to 1USD. And thus they should have the equal value between each other.

However, in real life, their values can diverge from the peg. This happens because of the pressure exerted by the sellers and buyers operating on the open market. For instance, DAI is a very popular stablecoin in DeFi. If there's a lot of people selling it at any specific moment (for whatever reasons), the DAI's value will go down. It's expected to be 1.00000000000 USD, but it might go down to 0.99 USD.

It's not such a big dip. It's just for 1 cent.

But any crypto trader can easily buy DAI for 99 cents, wait till its price finds its way back to the 1.00 mark and ten sell it. If you do this at scale (say, if you buy 1 million USD), you can earn significant profits. With 1 million, the profit will be 10K.

Such traders are called "arbitrageurs". They engage in "arbitrage". There are different kinds of arbitrage in crypto-markets, and stablecoin arbitrage is quite popular.

Many stablecoin arbitrageurs focus their efforts specifically on stablecoins. Plus, there's a lot of people who buy stablecoins as the "safe haven" whenever the market moves against them.

The big problem for trading stablecoins against each other is slippage.

What is slippage and why is it bad for you?

Slippage is an undesired price move which is caused by your actions. If you want to buy BTC for $10 million, this might hike the price up which is not good for you.

All standard DEXes like Uniswap and others do a bang-up job of enabling no-custody, decentralised trades at low fees. They use the automated money maker to facilitate trading. And, specifically, most of them use the CPMM (Constant Product Money Maker).

Curve.fi uses another formula - the Hybrid Money Maker (HMM). It allows you to significantly reduce slippage whenever you trade assets that feature only minor fluctuations against each other, but which you want to trade in humongous volumes.

Humongous trading volumes ask for humongous volumes of liquidity provided at the DEX.

Why is the scale of liquidity provision so important at Curve.fi?

Ordinary DEXes like Uniswap are expected to provide a certain volume of liquidity for a certain pair. Nobody knows what the liquidity is for each pair out there. You just test it out as it goes. And if there isn't sufficient liquidity, you'll be hit with huge slippage and might not want to trade at all.

Curve.fi knows that their volumes are ALWAYS going to be huge. Because anyone who wants to make money on stablecoins arbitrage needs to trade in high volumes.

That's why Curve.fi offers better incentives for people to provide liquidity at their exchange. Uniswap does that too, but they aren't anywhere close to the benefits liquidity providers enjoy at Curve.fi.

Below we have the detailed tutorials for trading and providing liquidity at the platform. We try to share with you as many details as we can. If we missed something, please email us.

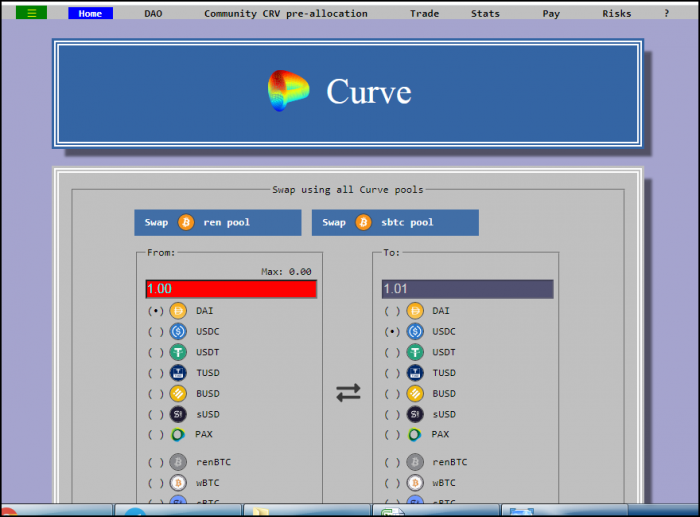

How to trade at Curve.fi: Tutorial

Let's take a look at how you can trade stablecoins at Curve.fi.

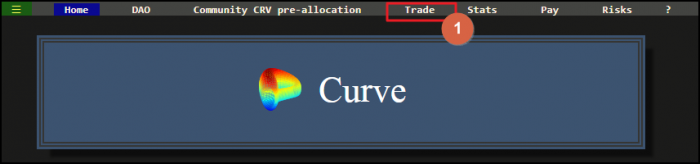

Step 1: Open the Trade Menu

Go to the dapp's main page and then click the "Trade" button in the top menu.

Step 2: Pick the pair and review the charts

On the Trade Page, you'll need to pick the stablecoins pair that you want to trade. The respective menu is shown in Field 1 on the screenshot.

After you've picked the pair, you can review the candles chart (Field 2) and analyse the volumes data (Field 3).

You can pick the period which you scope in Field 4 to review the details within a specific period of time.

Step 3: Consider the pricing data

While you can see the pricing on the charts too, the charting tools are better suited to analysing the dynamic changes within a specific period of time. And the menu below the charts (Field 1 on the screenshot below) is more convenient to review the actual pricing figures.

What stablecoins/wrapped coins can you trade at Curve.fi?

Curve.fi trades 7 stablecoins: DAI, USDC, USDT, TUSD, BUSD, sUSD, PAX.

4 wrapped BTC coins are available: renBTC, wBTC, sBTC, HBTC.

Use the toggle in Field 2 in order to change the direction of the trade. The values you see already include the fees charged by Curve.fi (0.040%).

Field 3 identifies the pool through which your transaction will be routed.

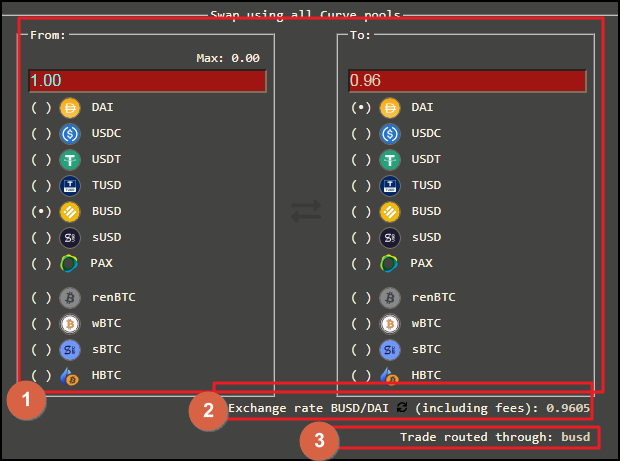

Step 4: Toggle the infinite approval

You can decide whether you want to provide the infinite approval for all the future transactions or not. Do that in Field 1 shown in the screenshot below.

If you decide to provide the infinite approval, this is going to simplify your interactions with Curve.fi protocol. However, you will face an additional risk - should Curve.fi get hacked, the attacker will be able to drain all of your funds since all the transactions will be pre-approved.

Thus, even though you might find it a bit inconvenient, it makes perfect sense to avoid providing the infinite approval and protect yourself against such a risk.

Step 5: Adjust the advanced options

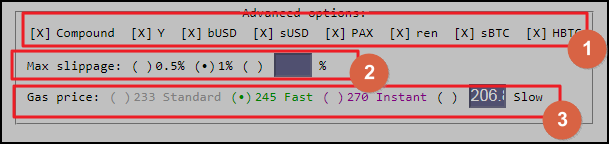

At the next step, you can adjust the advanced options for your trading transaction.

In Field 1, you can check the pools you want to engage into or you can de-check some of them to avoid using those ones.

In Field 2, you manage the maximum slippage value that you'll be OK with. This might be a very useful value in certain cases but you should be extremely careful with using it if you just start out. For the majority of transactions, the maximum slippage for 1% is sufficiently high.

Should the transaction exceed the stipulated maximum level for slippage, it just won't go through.

Field 3 allows you to specify the gas fee level so that your transaction is processed faster with a higher fee in place.

All you need to do now is click the "Sell" button. This will initiate the trading transaction at Curve.fi.

How to provide liquidity at Curve.fi: Tutorial

Liquidity provision can become a highly lucrative income source that is completely passive. This means that there's nothing you need to do here as compared to more active endeavors like short-term trading or investing in new high-potential coins. Whenever you provide liquidity at Curve.fi, all you need to do is transfer your funds into a liquidity pool and stake your CRV. Though it's not hard at all, there are some important nuances which we are going to talk about below.

Step 1: Choose the liquidity pool

Curve.fi enables cheap and fast exchanges between the Ethereum-based stablecoins and BTC-on-Ethereum coins. This is achieved thanks to the massive liquidity pools present at the platform.

A liquidity pool is a smart contract that aggregates the funds from all investors who have contributed to it. It is used to facilitate trades in specific coins.

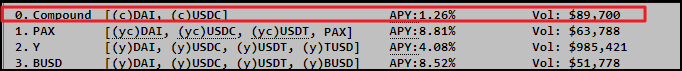

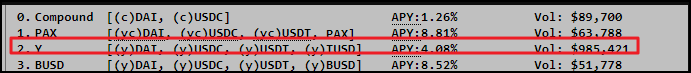

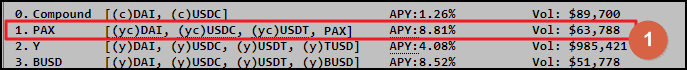

There are 9 liquidity pools at Curve.fi: Compound, PAX, Y, bUSD, sBTC, renBTC, hBTC, 3pool.

All pools enable you to enjoy the distributions of CRV tokens which you can stake at the platform. We are going to talk about this below.

In order to become a liquidity provider, you need to have some coins from the list of the coins used by the pool. But you don't need to have all of the participating coins.

Go to the site's main page and then click on the menu symbol at the top (Field 1 below).

You will see the dropdown menu with all the pools available at Curve.fi.

Now you can click the "Deposit" button in the top menu and review the details for each individual pool.

It makes sense to break down the pools into several groups and review them one by one.

Group 1: Lending Pools (Compound, PAX, Y and bUSD)

There are various streams of income that liquidity providers enjoy at Curve.fi.

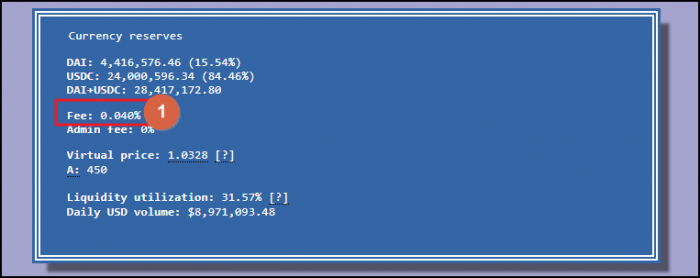

The first one is the interest, generated from the exchange fees. Whenever anybody trades one coin for another, they are charged the fixed fee at 0.040%. These fees are distributed among all the pool providers pro rata their shares of the overall pool.

For instance, if you pick Compound in the menu and go to the "Deposit" page, you'll see the fee amount at the bottom of the page. It's shown in the screenshot below.

All pools have the same fees at 0.040%.

The fees form the core of the APY enjoyed by the liquidity providers. But the lending pools offer another benefit - all the idle capital sitting around the Curve.fi's pools is invested at DeFi lending platforms which serve to generate the second stream of income from lending.

Different lending pools invest funds into specific lending platforms.

Compound Pool at Curve.fi: quick tutorial

For example, the Compound pool contributes only to the Compound protocol.

You can contribute to the Compound pool only with DAI and USDC. Thus, the pool automatically creates the two cTokens: cDAI and cUSDC. These are native tokens living inside the Compound.

The pool has two coins: DAI and USDC.

Naturally, the most important factor is the APY whenever you are choosing a liquidity pool at Curve.fi. But, at the same time, you should understand that various pools have different member coins inside. So, whenever you deposit to any pool, your contribution is immediately split into the coins as per the distribution percentage currently seen. This results in your exposure to all the member coins. Thus, if you don't want to expose yourself to any specific stablecoin (e.g. USDT), you shouldn’t pick a pool that contains it, among other coins.

Y Pool at Curve.fi: quick tutorial

And the Y pool invests into the iEarn protocol. Thus, the pool has the yTokens.

It's important to note that it's not always that Compound offers attractive yields. In comparison, iEarn is the yield aggregator and it quickly rebalances the balances inside so that you can enjoy the highest yields available in DeFi at that particular time.

The Y pool includes DAI, USDC, USDT and TUSD.

PAX Pool at Curve.fi: quick tutorial

This pool lends on both Compound and iEarn protocols. It includes DAI, USDC, USDT and PAX.

Thus, the only difference between the Y pool and the PAX pool is the fact that the second pool has the PAX tokens.

This means that whenever you want to get more exposure to PAX, you could contribute to this pool.

bUSD Pool at Curve.fi: quick tutorial

And this pool is the mirror version of the PAX and Y pools. The only difference is that it has BUSD instead of TUSD as its member coins.

It's well known that the Y pool offers the highest yields as compared to other lending pools.

It's well known that the Y pool offers the highest yields as compared to other lending pools.

And it's important to remember that higher yields always come with higher risks. Whenever you invest your funds into a pool at Curve.fi, you expose yourself to the risks associated with the smart contracts operating at Curve.fi. And whenever Curve.fi lends out the idle funds to other lending platforms, this essentially means that your risks related to smart contracts are "stacked".

Curve.fi has been around for just over 1 year. Its smart contracts have gone through rigorous audits, and it has attracted millions of dollars in liquidity. Thus, it's certain that many hackers have tried to attack the system but failed. At the same time, there's always a risk that the smart contracts might be attacked and funds drawn to anonymous Ethereum wallets.

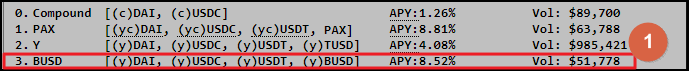

Group 2: sUSD

You can review the data for this pool at its Deposit Page. Though this pool doesn't engage in lending your funds, it still offers pretty attractive yields. This is made possible thanks to the incentives from Synthetix.

To earn those incentives, you need to stake your CRV coins at the protocol. We'll talk about this process below.

To earn those incentives, you need to stake your CRV coins at the protocol. We'll talk about this process below.

It's important to note that all Synthetix assets are synthetic in nature as opposed to other tokens which are Ethereum-based avatars with 1:1 backing. Synthetix doesn't claim to have the backing in place. This means that whenever you interact with such protocols, you open yourself to other risks which are not present with fully backed stablecoins. But, of course, this is more nuanced than this, and it’s not so black and white. For instance, DAI is not actually fully backed but overcollateralised with ETH.

Group 3: Bitcoin-on-Ethereum pools

The third group of pools is those that enable trading between the Bitcoin-on-Ethereum coins. These coins are pegged to the value of BTC just as Groups 1 and 2 contain the USD-pegged tokens.

It's a new trend and these coins are just gathering steam. These pools might not offer extremely high yields, but it might change in the future.

renBTC pool at Curve.fi: quick tutorial

The renBTC includes the two tokens - renBTC and wBTC. These are fully backed, and they are pegged to BTC.

renBTC was rolled out just a couple of months ago. It's decentralised.

In comparison, wBTC has been around for a longer time. But it's much more centralised. And, of course, everybody is looking for decentralisation in DeFi.

sBTC pool on Curve.fi: quick tutorial

The second pool is sBTC. Just like renBTC, it includes renBTC and wBTC. But it also has sBTC. sBTC is a synthetic token, generated by Synthetix.

This pool is highly incentivised with rewards being provided by REN, SNX and BAL. That's why it enjoys much higher yields as compared to the previous pool. Bitcoin-on-Ethereum pools might become very popular in the months to come so make sure that you are keeping an eye on them.

Group 4: other pools

In addition to the above pools, Curve.fi has rolled out other options such as hBTC and 3pool.

These are the variations for the above specified groups, and they focus specific groups of traders who want to expose themselves for certain coins they can't find elsewhere.

We hope that now you understand the difference between the pools now. And you can make an informed decision as to the choice of the pool. Of course, the offered RoI is the main factor in everybody’s decision-making, and the Y pool seems to be the best performer overall among all the pools available at Curve.fi.

Step 2: Deposit funds into a liquidity pool at Curve.fi

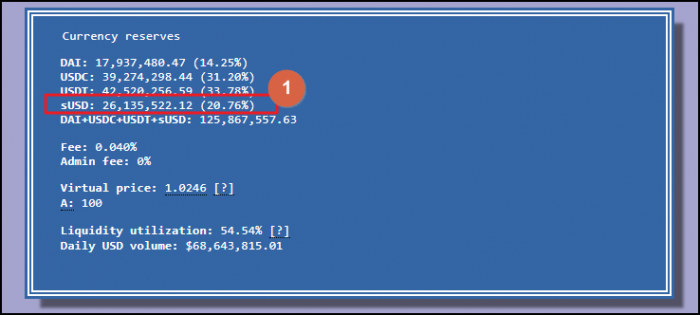

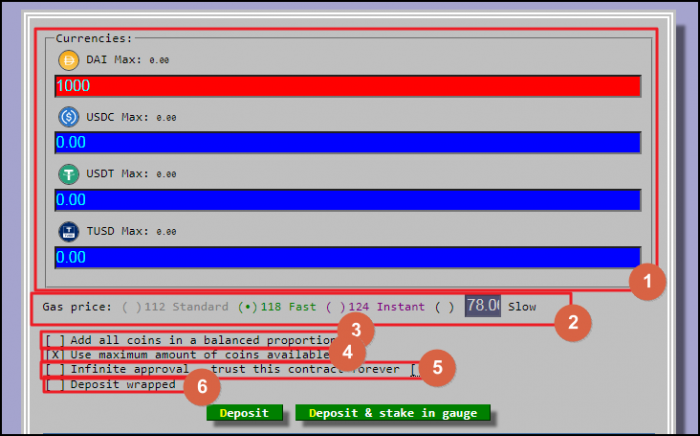

Let's say that you've decided to contribute to the Y pool. Here's how you can do this.

#1. Adjust the amount of coins you want to invest

Go to the Deposit page for the Y pool and connect your wallet.

You can either specify the exact amounts of the coins in the table at top. Do this in Field 1 in the screenshot below.

And if you don't want to deal with this manually, you can use the checkbox to furnish the maximum amounts of the respective coins available in your wallet. Use the checkbox in Field 4 to activate this function.

And if you don't want to deal with this manually, you can use the checkbox to furnish the maximum amounts of the respective coins available in your wallet. Use the checkbox in Field 4 to activate this function.

Make sure that you understand that each coin will be transferred via an individual transaction, and thus you’ll need to pay the gas fees for each of those transactions.

It's also possible to add the coins in the balanced proportion. Set this up in Field 3.

Does it matter which coin I deposit with at Curve.fi?

You can deposit to the pool with any coin that is specified as a member token for this pool. After you've contributed to the pool, your investment is broken down as per the percentage shared of the coins (these are shown below on this page).

Importantly, you will receive the bonus whenever you contribute with the coin that has a higher-than-peg price. For instance, if you decide to invest with DAI, you'll enjoy a certain bonus which is shown below.

Then, you need to decide on whether you want to provide infinite approval or not. We advise against doing this.

What is "deposit wrapped" at Curve.fi?

Use this function whenever you already have the wrapped tokens on your hands. For instance, you want to contribute to the Y pool and you already have yDAI tokens in your wallet. To port these tokens into the pool, check the "deposit wrapped" toggle in Field 6 above.

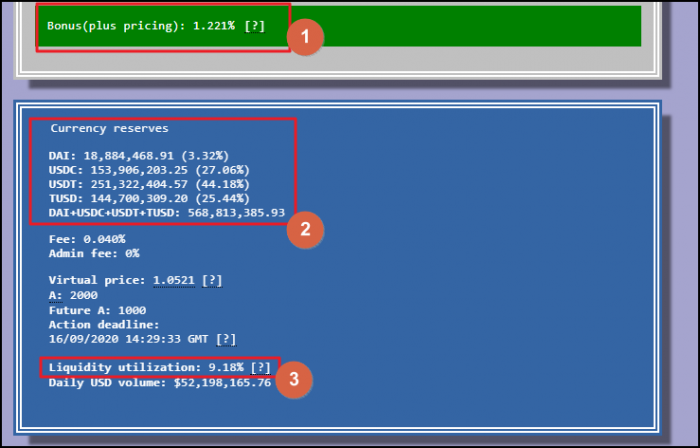

#2. Review stats for the pool

Before you make the final decision, you can review the statistics about the operation of the respective pool.

In Field 1, you can see the specific value for the deposit bonus you will receive for the coin you plan to contribute.

Field 2 shows the percentages distribution.

Field 3 identifies the utilization rate. It's important to note that a higher utilization rate might prevent traders from withdrawing the funds if a black swan event occurs. So, beware of the pools with the utilization rate that’s too high.

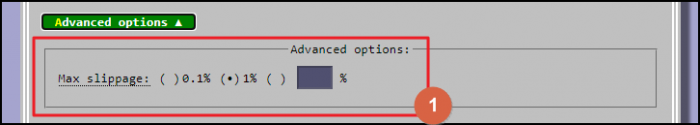

#3. Adjust the slippage rate

To make sure that your deal goes through, you can adjust the slippage value.

However, make sure that you understand the actual consequences of setting up the slippage level manually. And if you don't, it makes sense to leave it as is. The 1% level is the most popular level to use.

How to stake your CRV tokens at Curve.fi: tutorial

Whenever you provide liquidity at Curve.fi, you start receiving the internal utility tokens CRV. You can either sell these tokens on the market as soon as you receive them. Or you can hold them with the expectation of the price appreciation to come in the future. If you decide to hold them, you can stake them at the platform. When staking, you will "mine" additional CRV tokens which will accrue to your wallet as soon as they are mined.

CRV is the native utility and governance token at Curve.fi. It is used by holders to vote on the proposals regarding the changes to the protocol. Thus, Curve.fi is gradually moving toward higher decentralisation in their efforts to become the fully-fledged DAO.

Step 1. Deposit the coins in a liquidity pool

For example, you have deposited a certain amount of the tokens into the Y pool at Curve.fi.

You can read the detailed tutorial on how to deposit the coins above.

Step 2. Lock your LP tokens in the gauge

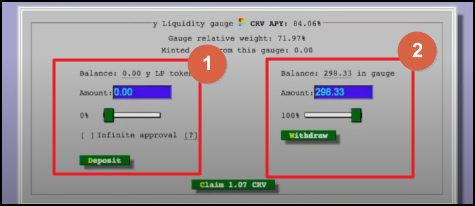

Now, you need to go to the page with the "gauges". Since we've invested into the Y liquidity pool, you need to find the respective section below.

If you have added some coins into the pool and haven't staked them yet, you'll see these "stackable" LP tokens in Field 1. Click the "Deposit" button to stake them.

And whenever you already have some stacked coins, you'll see them in Field 2. You can withdraw them at any time.

Whenever you stake the LP tokens at Curve.fi, you will keep receiving these tokens as a reward for your efforts to provide liquidity at the platform.

Step 3. Claim the generated coins

You can claim the generated CRV tokens at any point in time. You can either trade them for other currencies or hold them expecting the price to grow.

How to "vote lock" CRV tokens?

Curve.fi is continuing to develop new features, and the "vote locking" process is one of them.

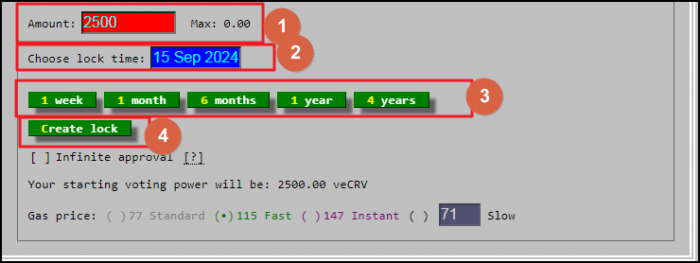

Go to the locker page. Here, you can "vote lock" the CRV tokens and generate the veRB tokens that are going to be used for the voting purposes.

Specify the amount of the CRV tokens you have that you want to lock into the locker In Field 1. The more tokens you lock up, the higher your voting power is going to be.

Field 2 shows the final date for the completion of the locking period. You can't unlock your coins before the end of this period. The longer you stake, the more veCRV you receive. The 4-year period is the longest and delivers the 1:1 ratio in veCRV for each CRV token. The other periods are based on this period as a benchmark.

Choose one of the permitted lock-in periods in Field 3.

Click the "Create the Lock" button to complete the period.

After you've locked some CRV tokens, check whether it's possible for you to apply the boost. Learn more about applying the boost in this article.

Conclusion

Curve.fi has been growing fast since it offers lower fees and slippage for users that trade between various Ethereum-based stablecoins and wrapped Bitcoin coins. You can start providing liquidity here and earn the passive income. You won't have to take any specific actions and the system will keep generating the CRV tokens for you. You can either lock these coins up and then boost them in order to receive more coins. Otherwise, you can exchange them immediately on the open market and obtain some other crypto. Learn more about the project in their Resources Section.