Aave is a DeFi lending platform. Here, users can lend and borrow cryptocurrencies in a completely decentralized and trustless manner. There's no AML/KYC process in place which democratizes lending. The project is 8 months old, but it has already garnered a lot of attention in DeFi. We expect that Aave is going to gradually attract lots of external users who will benefit from lower interest rates, easier loan management and approval process. In fact, there's no approval process at all which makes this platform very different from legacy lending facilities out there.

Aave is a DeFi lending platform. Here, users can lend and borrow cryptocurrencies in a completely decentralized and trustless manner. There's no AML/KYC process in place which democratizes lending. The project is 8 months old, but it has already garnered a lot of attention in DeFi. We expect that Aave is going to gradually attract lots of external users who will benefit from lower interest rates, easier loan management and approval process. In fact, there's no approval process at all which makes this platform very different from legacy lending facilities out there.

What is Aave?

Aave is fully decentralised which means that anoby can lend and borrow cryptocurrencies here, without any AML/KYC processes, approval processes or regulatory oversight of any kind!

There are two types of interest rates here: variable and stable. If you want to borrow, but you don't want to be exposed to variable interest rates, then the stable rates are a great option. The stable interest rates are calculated as the average value of the rates for the last 30 days.

It's easy to provide funds or borrow in just a few clicks. All transactions run fully on-chain, without any custody by the platform's team. This means that all the transactions are fully trustless. The only "entity" you have to trust is the Ethereum blockchain. And there’s very little doubt as to its decentralization and resilience at this point.

Aave is very similar to Compound in terms of the basic concepts. But while Compound just delivers a suite of basic lending capabilities, Aave is all about introducing new features. Flash loans, ability to switch between variable and stable rates have turned Aave into one of the key DeFi players. We’ll talk about all of them one by one later in this Aave tutorial.

Aave was created in January 2020. It became the reincarnation of the Ethlend platform that facilitated decentralised P2P lending. LEND is the native token at Aave. It is currently used as the repayment token and LEND tokens are burned whenever repaid. This creates the deflationary mechanics for LEND which sets it up for the long-term growth provided that the platform enjoys the wider adoption.

Stani Kulechov is the leader like Buterian with ETH. You should follow him on Twitter, and you can directly approach him and other folks from Aave on Discord with any questions you have! Great guy, and answers all the questions you have :)

Now that we've covered the basics, let's look into how you can lend and borrow at Aave.

How to lend at Aave?

Step 1: Enter the app

Go to the main page and click the "Enter" button.

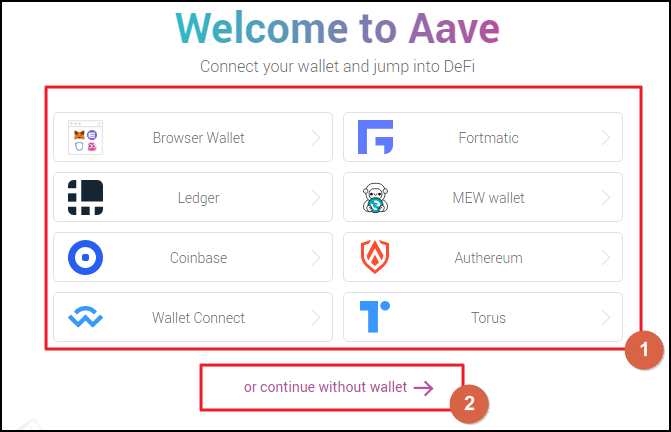

Step 2: Connect the wallet

At the next stage, you should connect the wallet to the lending platform. We use MetaMask in this review. Pick the wallet you use.

And if you just want to look around, click "Continue without wallet" in Field 2.

Step 3: Pick the coin you want to lend

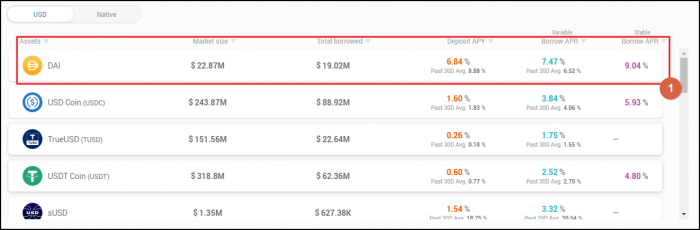

You will be presented with the list of assets that are available for lending and borrowing at Aave.

What tokens can I lend at Aave?

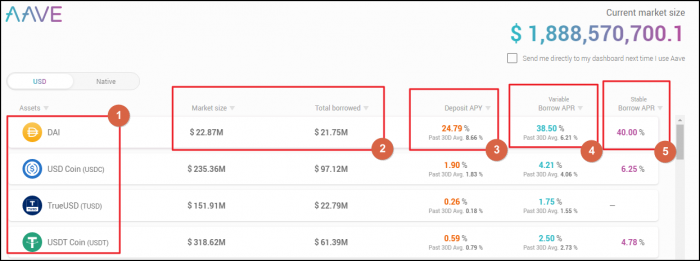

As Field 1 shows, you can lend 19 tokens at Aave: DAI, USDC, TUSD, USDT, sUSD, BUSD, ETH, YFI, BAT, REN, ENJ, KNC, LINK, MANA, MKR, REP, SNX, WBTC, ZRX. It's possible that more tokens will be added subsequently.

Of course, all of the tokens are ERC20 since DeFi projects live on the Ethereum blockchain and win from the composability there.

How to choose a token to lend at Aave?

If you have some excessive liquidity on your hands and you don't want to convert it into fiat, you can lend it at lending platforms like Aave and enjoy some yields from doing so. Meanwhile, you will retain your crypto and thus you will be able to benefit whenever it goes up.

In DeFi, the lending process got a new name "yield farming". The yield farming strategies can require you to use multiple platforms together, performing the "DeFi magic". However, if you don't want to invest time and effort into those sophisticated strategies, you can still lend out your crypto at Aave and start making some money now. Visit our overall list of DeFi Reviews we’ve created for you and learn about other DeFi platforms.In DeFi, you'll always enjoy much higher yield rates than what the banks are ready to offer.

Whenever you try picking a token that you'll lend at Aave, you might just decide to use the yield rates as the main factor in your decision-making. And though this is the most important indicator, there are others to consider too.

Let's talk about them, one by one.

#1 Market size

It's shown in Field 2 in the screenshot above. The larger the market, the more liquidity it has. It's popular with other lenders and borrowers. It’s booming. .

#2 Utilization rate

The utilization rate means the share of the borrowed funds from the provided liquidity. You can calculate this ratio on your own using the data shown at Aave, or you can go to Defiscore and look it up there. Please find below a mini-tutorial for Defiscore.

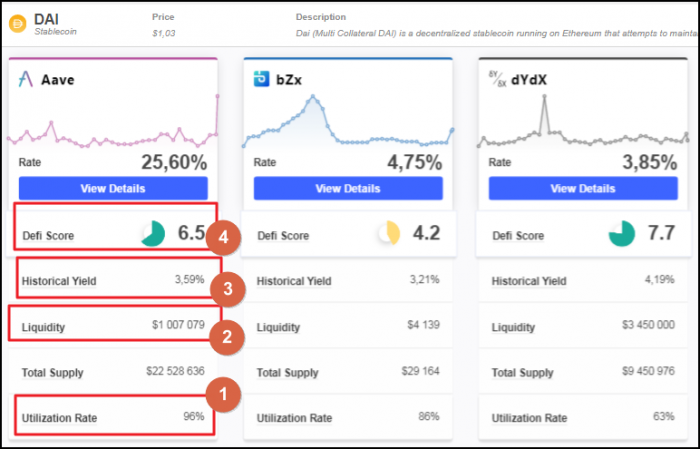

Go to the Defiscore’s main page, click the button "Compare Lending Platforms" at the top, and you'll end up at the comparative page for DAI. At the top, you can pick another collateral asset to review or you can stick with DAI. We’ll stick with DAI.

The utilization rate is shown in Field 1. It's important because the free liquidity is used in order to enable lenders to exit their contracts and withdraw the money from the liquidity pool. If the lending pool has a very high utilization rate, this might result in the inability of lenders to withdraw in case a lot of them rush to the exit door at the same time.

#3 Liquidity

It's shown in Field 2 above. This is the absolute value for the free resources, available for the withdrawals. Again, you can consider this figure and compare it with other platforms when you make decisions about lending your coins at a specific platform.

#4 Historical yield

Show in Field 3. It might seem that markets are completely chaotic, but there are always underlying patterns and market participants behave in line with them. Thus, it's completely OK to expect that the lending yield rates will eventually averagise somewhere around the historical values.

This means that even though you might be seeing exuberantly high yield rates right now, the historic values might help you see the forest and not just the trees.

#5 Defi Score

The Defiscore (Field 4) is an assessment indicator. The Defiscore's team has developed and implemented this programmatic indicator that automatically evaluates various parameters and calculates the quality of the offer from specific platforms.

You can read more about it on the DefiScore scoring page. The DefiScore is used mainly to compare different platforms, and not tokens as such. So, you don't have to use the DefiScore if you wish to stick with Aave and you are just looking for a coin to lend for.

By the way, you can always see most of the above values if you click on each specific asset, but we just wanted to show you how to use Defiscore's website in order to gain quick insights into the DeFi markets. Make sure that you use Defiscore to compare offerings from various platforms.

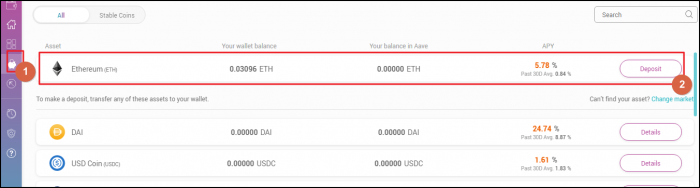

Step 4: Select the coin in the list

First click the piggy bank icon in the left bar, select the coin you want to deposit and click the button "Deposit".

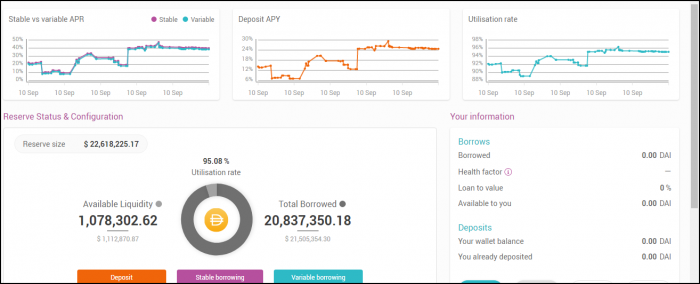

Step 5: Review the lending data

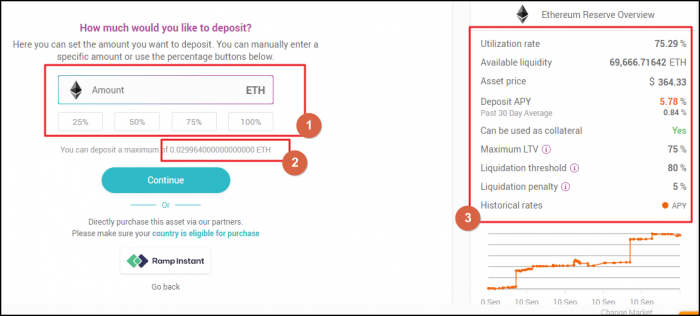

In the next window you will be able to either specify the value of the collateral manually or just pick the 25%, 50%, 75% or 100% of the amount stored in your wallet (Field 1).

Field 2 shows the maximum amount of the collateral you can specify. Remember that you'll need to pay the gas fees whenever you deposit the coins, and thus you should leave a certain amount of ETH in your wallet to cover those fees.

To the right (Field 3), you can review the statistical data about this particular collateral asset.

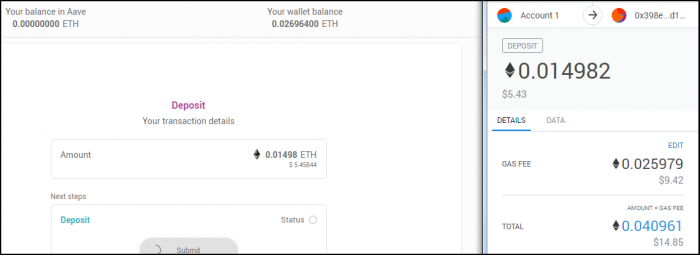

Step 6: Complete the transaction

Click the "Confirm" button. In the next window, click the "Submit" button and confirm the transaction fees in the MetaMask wallet.

Step 7: Review the deposit data

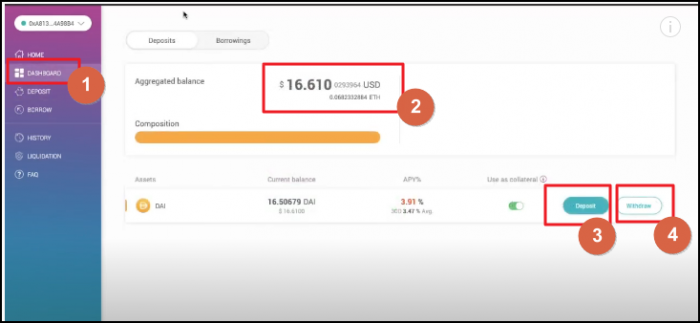

After you've deposited the funds into Aave, they'll show up in your dashboard. First, click on the "dashboard" icon in the left bar.

As we've discussed above in this Aave Tutorial the yield is accrued every second and you can see the changes to your deposit amount occurring in the real time.

Step 8: Withdraw collateral and profits

As shown on the screenshot above, use the "Deposit" button (Field 3) in order to deposit more coins as the collateral.

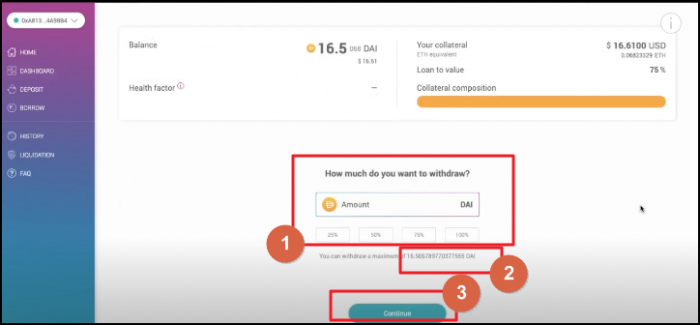

Otherwise, you can withdraw the deposited funds at any time and without any negative consequences. To do that, click the button "Withdraw".

In the next window, specify the amount you wish to withdraw and click the "Continue" button.

You will be taken to the MetaMask window where you'll need to confirm the transaction.

As you can see, Aave makes it pretty easy to deposit and withdraw your lending capital. And now let's look at what you can borrow at Aave.

How to borrow at Aave?

Just like with depositing, you don't need to go through any prior checks or approvals. Just connect your wallet, and you are good to go!

Step 1: Pick the token to borrow

Go to the tokens list and pick the one that you want to borrow. In our example, it'll be DAI.

Step 2: Deposit coins as the collateral

In order to borrow funds, you first need to deposit some coins which will be subsequently used as the collateral for your loan. Thus, all borrowing positions are collateralised.

The process to deposit the coins is the same as described above for lending operations.

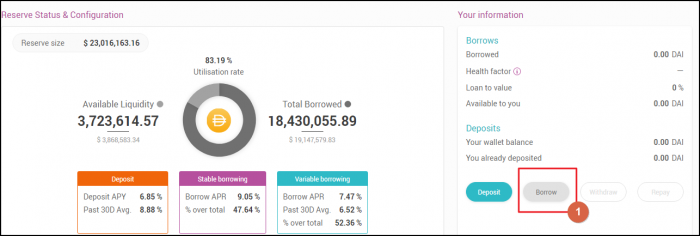

Step 3: Activate the borrowing mode

Go to the DAI's page and click the button "Borrow".

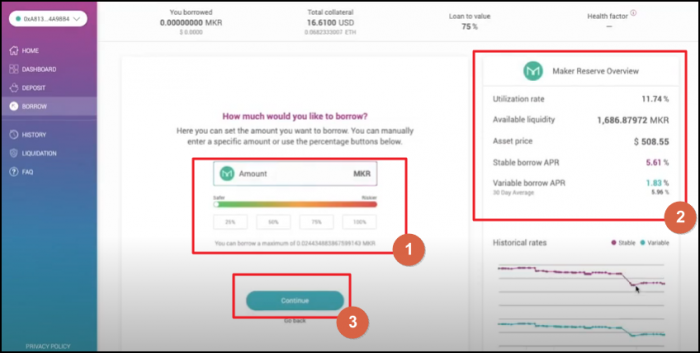

Step 4: Determine the borrowing amount

Now you can decide on how much coins you want to borrow. It's important to make sure that you are protected against possible black swan events and the associated risk of liquidation.

How to minimize the risk of liquidation when borrowing at Aave?

As Field 2 shows above, you can either specify the amount you want to borrow manually or pick one of the percentages. Whenever you decide on the amount that you want to borrow, it's important to prevent the possible liquidation of your borrowing position.

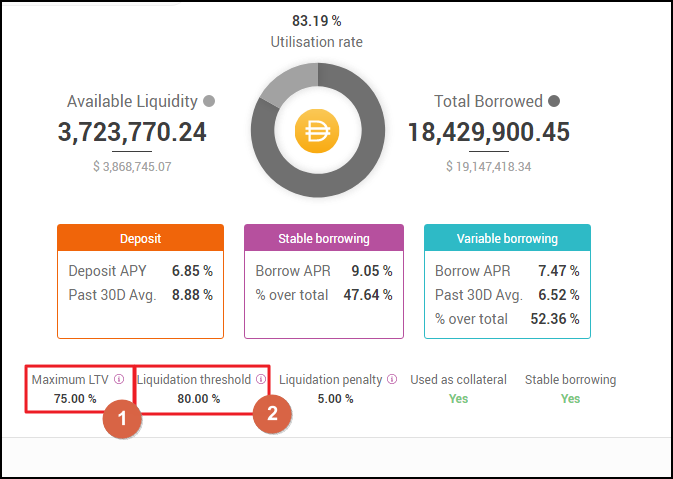

To do that, first review the two stats for the token you want to borrow. These are maximum LTV (Loan to Value ratio) and the Liquidation Threshold. They are shown at the bottom of the token's page.

Thus, as you can see, you should never go below the 75% value. Otherwise, your borrowing position becomes exposed to the real risk of liquidation.

We strongly recommend to keep this risk quite low and never borrow more than 50% of your underlying asset. Of course, a significant reduction in the underlying value may occur only upon the black swan events. And though the possibility of such an event might seem as extremely low, you are always better off by overcollateralization your borrowing position a lot than what the minimum level is.

In case of the liquidation, other actors can buy out your collateral at the discount and immediately sell it on the market. They keep the difference. In addition, you have to pay the liquidation penalty (5-8% for individual tokens).

Click the "Continue" button and move on with the process.

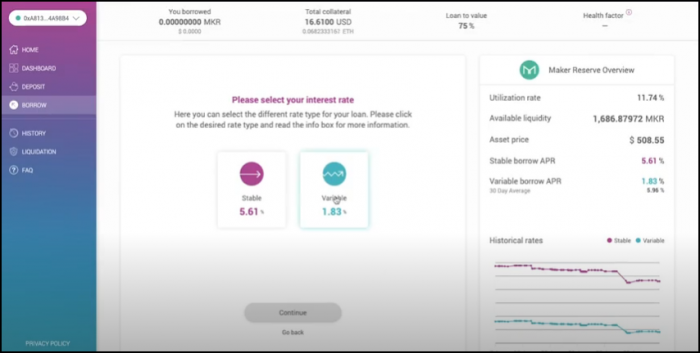

Step 5: Select the rate

Just as with the lending process above, review the borrowing data. Here you will find the variable and stable borrowing rates.

Which is better at Aave: stable or variable rates?

The stable rate is the average value, calculated based on the data for the last thirty days. If you don't want to expose your borrowing position to an extensive risk, the stable rate is the best option to choose.

The variable rate is usually much lower than the stable one. It's the result of the ratio between the demand and supply for the coins currently seen at Aave. It changes a lot and it can both increase and decrease drastically within short periods of time.

Here are where they are shown for each coin.

At Aave, you can easily switch between the two rates whenever you decide to, without any penalties or anything like that. Sophisticated traders check on the variable rates every 12 hours and shift between the two rates based on which rate is lower at the specific time.

By the way, the team with Aave is currently working on the V2 that includes, among other things, the fixed borrowing rates. We'll talk more about V2 below.

Here's the screenshot of the page where you can select the rate you wish to apply.

After you’ve picked the rate, click the "Continue" button.

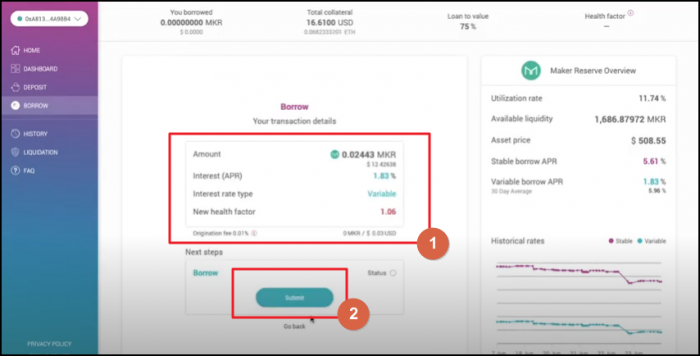

Step 6: Verify and confirm the transaction

Look through the transaction details and make sure that you haven't missed any important piece of information.

Confirm the transaction in the MetaMask wallet.

What is aToken at Aave?

Whenever you deposit some tokens into Aave, your tokens get converted into the native aTokens. For instance, if you've deposited 100 DAI, now you would have 100 aDAI.

The aTokens have a 1:1 ratio to the underlying token. The interest is accrued on them in real time and you can withdraw both the deposited coins and interest at any point in time. The accrued aTokens are exchanged into the underlying coins whenever you withdraw.

This makes it easy to calculate the yield you are seeing, and it's much more convenient than using the native tokens like it's done at some other platforms.

What is a LEND token?

As we’ve said at the start of this Aave Tutorial, LEND is the native token used by Aave.

Today, the LEND tokens are burned and users burn any fees at the platform.

And in the future LEND will be used as a governance token.

What is Flash Loans at Aave?

Flash Loans is a highly innovative solution, and there's been nothing like that in DeFi before! With it, you can borrow any amount of tokens you wish, without any need to provide the collateral. The caveat is that you should repay the full amount within the duration of one block on Ethereum (around 20 seconds). And if you fail to repay the amount, the overall transaction gets cancelled. The platform charges 0.09% for each transaction.

You might think that 20 seconds is just too short of a time period to do anything with that money. But this feature is focused on Ethereum developers who create the smart contracts. These contracts run on various apps within the DeFi ecosystem and leverage various functionalities there.

Thus, they borrow a certain amount of money, channel it to another DeFi dapp, do something there and then repay it by the time the new block is confirmed on the Ethereum blockchain.

Many believe that this technology is what finance will look like in a couple of years. There are various use cases for it, among which are arbitrage, refinancing the loans you take out in other dapps and swapping the collateral you deposit at those other platforms.

Aave vs Compound

There are a lot of similarities between Aave and Compound. Both are the lending platforms with the overcollateralization as the main concept. Both have the utility tokens used for burning through fees and accrual of the yield.

However, there are several differences.

#1 Simplicity for beginners

Compound is much simpler to use since it has just the bare minimum of the features expected from a crypto lending platform. Aave is much more complicated.

#2 Number of features

Aave is more versatile. Aave enables 19 collateral assets, while Compound only 9. Aave offers stable interest rates, while Compound doesn’t.

Aave also offers the Flash Loans, with no such feature at Compound.

#3 Future potential

Compound has effectively completed its development journey and it's now the way it's supposed to be. In comparison, Aave is just starting up and it plans to roll out massive improvements and innovations in their V2.

What will Aave's V2 include?

The V2 was announced in August 2020. And in September 2020 the team was gradually implementing various planks of the V2 implementation plan. To learn more, read this detailed article on the future changes to come.

Here's a brief description for each of the features and the implementation status for Sep 2020.

#1 LEND will be used for decentralised governance

It's planned that LEND will be more widely used for decentralised governance with holders able to have their say on the major changes at the platform.

This will help the team to move forward to creating the full-fledged DAO which is the end-goal for all DeFi projects.

#2 Improvements to borrowing interest rates

The platform will offer the fixed rates that are traditionally offered by the legacy finance institutions. In addition, users will be able to lock in the stable rates for certain periods of time for more protection against high volatility seen at the crypto markets.

#3 Native tokenization of debt and collateral

Whenever you lock in your underlying either as the deposit for lending or as the collateral for borrowing, you can't leverage them anymore. The team is set to continue developing the architectures that will open up those funds for further use.

Debt trading, collateral trading and margin trading will free up the collateral, while credit delegation will pave the way to more active utilization of the deposited funds.

#4 Undercollateralized lending

The credit delegation provides for creation of private agreements between lenders and borrowers. These agreements are to be included in the trust-full manner (opposite to the trust-less nature of defi). Such agreements might become an important component to attract more users from the legacy "ce-fi" (centralized finance).

If you have any questions, reach out to the team in Discord. They are super-helpful and will answer any queries you might have.

The project is completely open-source which enables developers to easily build on top of Aave and integrate its functionalities into their own dapps.

Conclusion

Aave is one of the major lending platforms in DeFi. It offers a number of unique features, such as Flash Loans, ability to switch between variable and stable rates. There are 19 assets available for lending and borrowing. All transactions run fully on-chain which makes this platform completely decentralised and trustless. The team behind the project is amazing, reach out to them in Discord and ask any questions you have. Test out lending at the Aave platform right now. You can use Aave in combination with Uniswap by depositing the Uniswap's LP here and increasing the expected yields in your farming operations.