How it works

MakerDAO is the most popular DeFi project. Its main goal is to create the stablecoin (DAI which is pegged to USD) that operates fully on the blockchain and isn't dependent on "legacy” financial institutions in any way. MKR is the governance token used within the system. MakerDAO has two main purposes: a) deliver a completely decentralized stablecoin, b) enable completely decentralized lending. We'll show how both of these work out below.

In this MakerDAO review, we’ll figure out why the project advanced in the first place and how it helps the DeFi industry to grow.

What is a stablecoin?

A stablecoin is a token that is pegged to another asset (i.e. the token’s value is kept at the same level as the value of the other asset).

Why do you need stablecoins in the first place?

Major cryptocurrencies like BTC and ETH are extremely volatile. This makes it practically impossible to do standard financial operations using them. For instance, you don't want to borrow in BTC. If you borrow $1K in BTC, and then BTC increases 3x, you’ll end up owing $3K.

The only option is to create a stablecoin that is pegged to another asset that is more stable (i.e. less volatile) than BTC. USD is a good candidate.

Why is USD less volatile than BTC?

USD is more stable because it's been around longer. There's much more folks using USD for their transactions.

In 20 years, BTC and ETH will become much more stable. But we need to enable the financial operations within 3 years in order to help the crypto industry to grow now.

Why can't we just use USD?

It's all decentralized here. All the operations are performed on the blockchain. ETH and other crypto are getting popular because they are completely trustless and they live on the blockchain.

If you try doing something like that with USD, it's quite possible that you will be recognized as a money transmitter. In which case, you'll need to ensure compliance with lots and lots and lots of various laws.

USD is controlled by the US. Cryptocurrencies aren't controlled by anybody. They are decentralized. They aren't completely decentralized, but they are much more decentralized than USD.

I guess that it's impossible to "switch off” the crypto at this point. The only way you can do this is by killing the Internet.

OK, so we need the crypto-USD, right? So DAI is this thing, right?

Exactly, DAI is the product of MakerDAO. DAI is a completely decentralized stablecoin that is pegged to 1 USD, i.e. 1 DAI = 1 USD.

It's extremely special. And many folks say that it's one of a kind. Similar to Bitcoin. No such thing has ever been around.

What is so special about it?

In this review on MakerDAO and its stablecoin, DAI, we want to identify the following features that DAI has:

A. Complete decentralization

DAI is completely decentralized (we'll talk about how this works below). There are other stablecoins that are centralized. There are such centralized coins as Tether and UCSD. Centralization is bad. We’ll tell you why below.

B. First-Mover Advantage

There hasn't been such a decentralized stablecoin before. This means that DAI is the Bill Gates of stablecoins. He just started building computers in his garage at the right time. If you build computers today, you'll be competing with Microsoft… Because Bill Gates had the first-mover advantage. You are late to the game.

C. Adoption

Thanks to the first-mover advantage, DAI is seeing lots of adoption which is pushed up with the network effect.

What's up with decentralization?

DAI is fully decentralized which means that the stablecoin lives completely on the blockchain. It's an ERC20 token operating on top of the Ethereum blockchain.

MakerDAO managed to implement the system which eliminates the need to store the collateral backing DAI. Other centralized stablecoins do have the actual storages where the physical (i.e. digital) USD is located. Thus, if there is 1 billion USDT in circulation, this means that there should be 1 billion USD in the bank account somewhere.

Here's how MakerDAO manages to operate in a fully decentralized manner:

1. Free and unrestricted access to the vault system

To issue USDT, the USDT team needs to receive the USD and then mint some USDT. Thus, it's only them who can issue the currency.

With DAI, it's anybody who has ETH that can issue DAI. We explain how to do that in the “ How to use it” Section. All you need to do is go to Oasis app and place some ETH into the vault. In return, you'll receive some DAI. It's that simple!

This turns everyone of us into a smaller central bank. Thus, it can be said that this functionality democratizes the very tasks that are usually performed by the countries' central banks.

2. Decentralized control

Since the system is built completely on top of the blockchain and its operations are governed by smart contracts, there's no single point of control and thus no single point of failure. Even if the government of any specific country outlaws Maker, the system will be able to continue operating without much problem.

And compared to other teams such as USDT, there's no "kill switch" that would destroy the system in seconds just because the team decided to.

3. ETH as collateral, which is already decentralized (kinda) itself

ETH (and some other coins) is used as a collateral. The collateral is something that you need to provide to the “bank" in order to get a loan from the bank. For instance, you can collateralize a loan with the house that you own. If you refuse to repay the loan, the bank might come after your house.

USDT is collateralized with the real-life USD. Those electronic USD have to be stored somewhere, i.e. at a bank account. There's lots of talk that the money is being stored with some Costa Rican banks.

On the surface, there's no problem hidden here. You just store the USD at the bank account and then mint some USDT. However, there's the so-called "counterparty risk". This means that the bank might go bankrupt which will result in the loss of the bank account! Or the US government might decide that USDT is actually counterfeit USD, imprison the management team and ban it. The authorities will simply freeze the bank account, at which point USDT will go down to zero. If you hold just $10, you'll be OK. But if you are a professional trader with $100K in USDT?

And nobody can freeze the ETH coins used as the collateral for DAI. DAI is a crypto-collateralized stablecoin, while Tether is the fiat-collateralized one. As this review of MakerDAO shows, the first type is much better protected against clamp-downs by authorities.

4. Self-regulated system, i.e. there's no need for humans to do anything

The most important thing about DAI is that it's fully programmatic, i.e. it's managed by the code as opposed to humans. This is always good because humans can be bribed, threatened and they can steal. The code can't lie, steal or collude with other codes to do something bad.

However, there's the other side of the medal. If the code was written incorrectly, the system will collapse and nobody will be able to do anything about it. The users will watch how their DAI is being devalued to zero or how the hacker is draining the system of millions (or billions) of dollars in value.

And this happened to some decentralized projects before. The DAO hack is the most infamous of course.

The code behind MakerDAO has been tested on testnets for many months, and the project has been working on the mainnet without any hacks for over 2 years now. The incentives for hackers to attack and siphon off the value are huge, and we know for sure that there's a lot of malicious attacks being done on the MakerDAO every day but none of them has been successful.

Since DAI is collateralized with ETH, you need to make sure that the system will not collapse whenever the price for ETH goes down a lot. So, the below mechanisms are used for that. And should ETH appreciate, it's only going to have a positive effect, so there's no need to protect the system against that.

Here are the protective layers that will help the system withstand any sudden price drops in ETH:

A. Collateralization Ratio

The collateralization ratio is the first protective layer against an ETH nosedive. In order to issue 1 DAI, you need to first vault around 1,5 USD in ETH (this is known as "over-collateralization”) . Thus, you collateralize the higher amount of the collateral and get a loan for a smaller amount. Whenever you place some money into the value, this is called "Collateralized Debt Position" (CDP).

Though you might think that it's weird that you first need to input some value in order to get a loan, it totally makes sense. Since when you borrow money in the real world, the bank has the lien over your assets and income sources.

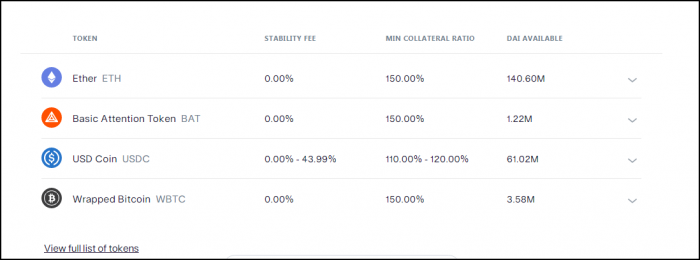

The minimum value for the collateralization ratio is 150%. Whenever ETH goes down in price and this ratio is reduced, your vault will be liquidated and a certain portion of your ETH will be sold in order to ensure that you have the minimum ratio in place.

The liquidation fee is 13% which strongly incentivizes issuers to keep an eye on their collateralization ratio. Many issuers ensure that that ratio is 3-4 times higher than the minimum level just in case.

If you want to get your ETH back, you will need to repay the DAI you've received plus any Stability Fees that your CDP has accrued.

B. DAI Savings Rate and Stability Fee

Whenever you've created DAI, there are two rates that impact your operations.

The first rate is the Stability Fee. You gotta pay this one whatever you do. It can be changed by the decisions made by the meetings of MRK holders but let's say it's 6% per year.

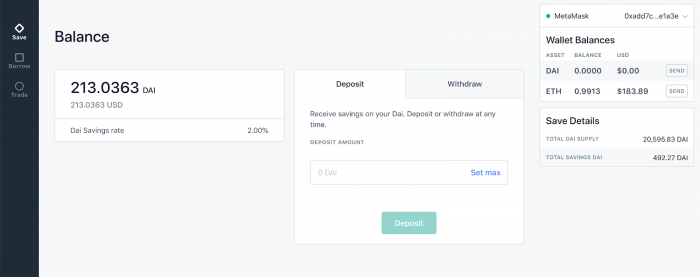

The second rate is the DAI Savings Rate (aka DSR). You can go to the Oasis platform which is the official wallet-platform for Maker where you can "stake" your DAI and receive the DSR. DSR was introduced around the end of 2019 and it used to pay around 6%, but right now it's 0. It's completely similar to what the interest rates are in "legacy banking".

If SF is 6% and DSR is 6%, then you can’t make any money by issuing and saving DAI, but you can safely borrow DAI and use it for margin trading on ETH, i.e. when you first issue DAI and then buy some more ETH with it (we discuss it below in the “Margin Trading” DeFi Strategy).

C. MKR holders as decision-making committee

MKR is the second coin within the MakerDAO system. There's only 1 million of the coins in circulation. It can't be mined. Around half of the cap is owned by the team who gradually channel the coins to the affiliates and other stakeholders. The second half is owned by MKR holders.

The Stability Fee can be paid only in MKR. And whenever you pay it, the respective amount of MKR coins is burned. So, the more DAI is issued, the more MKR will be burned. And since this will reduce supply, the value of MKR will grow. Thus, the MKR holders are incentivized to keep developing and improving the system so that more DAI is borrowed, more MKR is burned and MKR grows in price.

1 MKR coin entitles the holder to 1 vote. It's expected (and it has been proven in practice) that MKR holders will attend the votes and actively support the beneficial initiatives (and they get paid minor rewards for voting). Though it’s possible that major companies might buy out a lot of MKR coins, this might actually benefit the project because the core (or major) owners will want the project to prosper. The problem might arise whenever a competitor buys out coins and pushes through malicious initiative which is a very low-probability scenario.

MKR holders make decisions on Stability Fees and Saving Rate. This changes initiatives for marker actors in terms of supply/demand. Thus, their decisions are capable of impacting the stability of DAI.

For instance, let’s imagine that DAI goes down from its soft peg and costs $0.9. Should the committee decide to increase the Saving Rate, lots of users will stake their DAI coins within hours in order to profit from those rewards (and the rewards will be actually “free money”). Thus, the supply will reduce, and we know that whenever the supply is reduced, the prices go up.

D. Oracles

In order to make decisions on the collateralization ratio, the system needs to receive the information about the prices for the collateral assets. In MakerDAO, this is done with the help of oracles which feed the information from the outside world.

The oracles aggregate the data from many crypto exchanges and feed the data to the system. The 1-hour delay period is used in order to prevent any attack on the oracles by malicious actors. Thus, even if the oracles are trying to feed the fabricated information, the management team will see it and prevent the use of such information.

E. MKR holders as the buyers of last resort

Should the collateral's price go down extremely fast with the CDPs not having enough collateral, the system will automatically "print" and sell MKR on the open markets. In this way, the needed liquidity will be raised and channeled into the CDPs.

This will inevitably result in the price drops for MKR which will negatively impact the MKR holders. That's why we can say that MKR holders act as buyers of last resort.

F. Global Settlement

The last protective mechanism is the Global Settlement. A number of developers retain the keys that will result in the global liquidation of all CDPs. In this case, you will receive the full amount of the underlying asset and the CDP will just get eliminated.

In this way, we can see that those developers can really have the effect on the system. Thus, the system is not 100% decentralized. But the only thing they can do is just initiate the Global Settlement. They can't take your coins, change prices and impact the system in any other way.

How to use MakerDAO (Short Tutorial)

In this MakerDAO review we want to provide general information about interacting with MakerDAO.

MakerDAO includes two coins - DAI and MKR.

You can't mine MKR and the only way to get it is by buying the coin at certain crypto exchanges where it trades.

And DAI is a stablecoin that you issue by collateralizing ETH.

How to use DAI?

You can interact with DAI in the Oasis app which is the official dapp for the MakerDAO ecosystem. There are three ways you can interact with DAI at Oasis app: borrow, trade and save. Let's talk about each of them in brief.

1. Borrow DAI

First, go to the app's main page and click the "Borrow" button shown in the screenshot below.

You can scroll down and see the list of the assets that are accepted as collateral by MakerDAO.

Make sure that you understand what the minimum collateralization ratio is for the specific assets because your CDP will be liquidated in the event that you go below the permitted level.

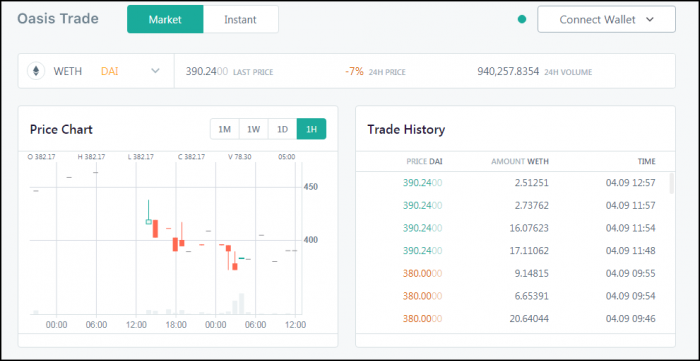

2. Trade DAI

Go to the main page and click the "Trade" button. You will find an easy-to-use exchange where you can trade various coins.

The embedded exchange at Oasis app has a lot of volume and you'll enjoy good prices for cryptos here.

3. Save DAI

You can also lock up some of your DAI at Oasis. This will enable you to receive the Dai Saving Rate (DSR) calculated on the annual basis and accrued to your account in real time.

To start saving, go to the main page and click the "Save" button. Connect your wallet, lock in some DAI and monitor the profits you make in real time.

In addition to using Oasis app, you can actually stack your DAI into DSR at various exchanges. But, in order to simplify your operations, it makes sense to bring all of your excessive liquidity (aka "float capital") and park it into the DSR within the single vault, as opposed to managing multiple vaults at various exchanges.

If you don't want to go through the pain of issuing DAI on your own, you can always go to any major crypto exchange and purchase some DAI from other users. In this way, you'll get your hands on DAI, but you won't have to deal with the nitty-gritty of actually issuing the coin on your own.

Why would you want to issue DAI at Oasis as opposed to simply buying it at an exchange?

If you just want to have some crypto-dollars on your hands, it's much easier to buy DAI at an exchange. There'll be nothing to worry about like rates and ETH price and you'll have no volatility to track.

But if you expect that the underlying asset will rise in price, then you can do the two things simultaneously:

1. retain the underlying asset and wait for it to increase in prices, preferably over the long term

2. obtain the USD-pegged cash that you can use in your activities as you wish.

This means that you can margin trade with the issued DAI.

How to use MKR?

MKR is an ERC20 token. Since you can't mine MKR, you can only purchase it at an exchange.

1 MKR entitles the holder to one vote at the regular meetings. There the decision on rates are made. Thus, if you really want to learn how DeFi operates and get valuable connections in the niche, buying a certain amount of MKR tokens and storing them in a cold wallet can be a great idea.

How to make money (Strategies)

In this Section, we discuss various DeFi Strategies which include MakerDAO (DAI or MKR) as part of the overall process.

#1 Margin trading

We have described the margin trading several times before in this MakerDAO review. This DeFi Strategy includes the following Stages:

1. Borrow DAI at Oasis

2. Use the generated DAI to buy some more ETH (which will result in you engaging in margin trading by actually going long on all of the ETH that you now own)

#2 Borrow and save DAI

This DeFi Strategy includes the following Stages:

1. Borrow DAI at Oasis while you pay a certain amount of Stability Fees (SF)

2. Lock up DAI at Oasis while you pay a certain amount of DAI Saving Rate (DSR)

This Strategy is driven by the arbitrage between the two rates. At the time of writing, both rates were at 0%. Thus, this Strategy would deliver 0% APY.

However, should the two rates change, the investor would be able to benefit from the positive yield while benefiting from the risk-free nature of this investing strategy.

Of course, there are various inherent risks related to the MakerDAO ecosystem. But as compared to other DeFI platforms like Compound and others, there are no lending processes and “utilization rates” here. The interest is being paid from the funds generated from inflows in the form of the Stability Fees.

#3 Issue DAI and insert DAI into other defi projects

This DeFi Strategy includes the following Stages:

1. Issue DAI at Oasis while still retaining ETH as the underlying asset

2. Insert the issued DAI in another defi offering attractive interest rates for yield farming

This is the first stage for most defi strategies where you seek to engage in yield farming and want to use a USD-pegged stablecoin. Of course, you can always use ETH or wBTC, but these assets are much more volatile than the USD-pegged DAI.

#4 Stablecoins arbitrage

Just as crypto arbitrage in general, stablecoins arbitrage is extremely hard to make money on. There are lots of professional traders managed by big hedge funds with all of them going after arbitrage.

#5 Long-term value investing in MKR

As of now, MakerDAO enjoys the first-mover advantage and there are no alternatives to it. That's why it's expected that its governance token, MKR, will continue to grow.

With more and more DeFi projects coming online, all of them will need some sort of stablecoins as the incoming investment vehicle. DAI can become the stablecoin of choice with MKR enjoying sustainable appreciation for years to come. Thus, this can turn into a very strong long-term value investment strategy.

Pros and Cons

MakerDAO is truly one of its kind. It's the main stablecoin in the world of DeFi and it's been praised by many users. However, just like any product, it has certain vulnerabilities.

Pros

Completely decentralized, i.e. all transactions run on the Ethereum blockchain

No connections with the legacy finance institutions, such as banks, regulators, auditors, etc.

No ability by the team to impact the system's operations

Programmatic protective layers that kick in whenever the DAI's price diverges from the soft USD peg

Cons

Possibility of hacking attacks that will destroy the system with hackers stealing all the funds (this is partially prevented by the Global Resolution)

Chance of being banned/restricted by the US government and other governments with the favor given to regulated stablecoins in the form of CBDCs (since DAI doesn't need legacy institutions, it might survive and prosper even with the bans in place)

Possibility of the devaluation since there is no hard peg

Possibility of the drastic fall in the price on ETH (as well as ETH being destroyed or banned by the authorities)

Comparison to Competitors

DAI is not the only stablecoin on the block. It is really the KING in DeFi, but when it comes to "retail Bitcoin investors”, USDC and Pax are leading the way. The reason is the fact that they are regulated, and this makes it easier for retail investors to sleep at night.

DAI

DAI is a completely decentralized stablecoin. MKR is the governing coin in this double-coin system. DAI is the main gateway coin for DeFi apps. It's completely unregulated and there's nothing to regulate here since it has connections with legacy finance. All processes are done by the code. The intricate mechanisms of interest rates and savings rates are utilized to keep the soft peg in check.

Tether (USDT)

USDT is backed with the USD stored in the legacy bank accounts. There are a lot of concerns and gossip about it. It's actually not fully backed by USD, but only for 70%. The rest is filled with precious metals and other valuables. The question "why" is justified.

It was created by the folks very close to the Bitfinex exchange. This is the most popular stablecoin with the highest daily volumes.

People might have stopped caring whether it's backed by the real assets or not. USDT might be used by traders as the "short-term safe haven", i.e. the safe haven for 1-3 days.

We don't think that there's any feeling of loyalty to USDT at this point. Whenever traders find themselves on exchanges with other stablecoin enables, they pick others. Like BUSD, for instance.

USD Coin (USDC)

Fully regulated, USDC was created by Coinbase and Circle. It has a number of major supporters from Wall Street, including Goldman Sachs, Silvergate and US Bancorp. This is the stablecoin that Wall Street wants you to use in crypto.

To own USDC, you need to go through the full AML/KYC process.

USDC is preferred by the "retail investors" and establishment finance. All transactions are transparent and regulated. DAI is transparent but can be used completely anonymously. DAI is not regulated at all which makes it easy to use it in the world of DeFi.

Paxos Standard (PAX)

It was the first major alternative to USDT. PAX is completely regulated, but it's an ERC-20 token, which makes it the direct competitor for DAI.

PAX is for institutions who need accountability, taxability and transparency. DAI is for everybody who believes in anonymity and freedom of financial choice, i.e the libertarian principles on which the crypto universe is being built. PAX is not an alternative to DAI in terms of the gateway to DeFi.

Thus, upon consideration, it's clear that DAI doesn't really have any strong competitors when viewed as a gateway to DeFi.

Team and Community

MakerDAO is an extremely popular project with lots of support in the crypto-industry.

Community

MakerDAO has a strong community on Reddit and in their internal chat.

The community that has coalesced around the project is always ready to answer any questions from newcomers. This sets it apart from many other projects where you have lots of people who write messages but don't actually understand what the project is all about. With MakerDAO, it's totally different.

The MKR community has bought into the project financially, i.e. they own MKR coins. And these coins are expected to grow with more adoption of DAI. That's why there is a clear alignment of the goals between ordinary investors and the overall project. This might not always be the case with DeFi projects where greed and chase of ultra-profits come first.

Team

MakerDAO was founded by Rune Christensen (his Twitter) and many other talented programmers. They took around 2 years to test out all the kinks and potential problems.

As of now, the project is being managed by the "weekly meetings" where MKR coin holders vote on the major decisions on how the project will continue to develop.

The team still retains around 50% of MKR coins in circulation but it's an "open secret" and the team says that the funds will be gradually released for the use by affiliates and various other supporting campaigns. It’s clear that MKR holders aren’t being driven into the bag-holding event.

Conclusion

MakerDAO is probably the most popular DeFi project. As this MakerDAO review shows, It's a gateway to other defi apps. Though you can't make profits on borrowing and saving DAI due to the zero rates, currently offered by the platform, it's extremely widely used to access other initiatives. The biggest benefit that DAI brings is completely decentralization and composability within the defi niche since it's an ERC20 token. You can learn more about the project at their site and the Whitepaper. We expect to see the continued growth in the number of DAI in circulation which will have a positive effect on MKR prices. Use the project’s blog to dig deeper and maybe even become part of the MKR community.