Nexus Mutual is an insurance dapp within the DeFi universe. It doesn't have a lot of competition, and many DeFi netizens are all about x's and not insurance. But Nexus Mutual has been growing steadily with more grounded developers and early adopters using the service to insure against one of the major risks in DeFi projects - smart contract bugs.

At this time, October 2020, this is the main use case for the platform, but in its Whitepaper the team has envisaged the gradual expansion into many traditional insurance niches. In this tutorial we tell you how to use Nexus Mutual to cover against the smart contract risk, and how the project can grow in the future. The future potential underpins the expectations for appreciation of its native token, NXM.

What is Nexus Mutual?

In essence, it's an insurance protocol. However, for legal reasons, the team can't call themselves as such. Instead, the word "mutual" is used.

There is a huge potential for the protocol to occupy the mainstays of legacy insurance providers.

Currently, the system is focused on delivering the coverage against just one type of the risk. It's the risk of bugs in smart contracts.

Why do I need the cover from bugs in smart contracts?

Amazingly, DeFi projects have been successful in decentralizing and automating most of the processes that ordinarily take a lot of effort and fees in traditional markets. And, here, you don't need to interact with any intermediaries, go through AML/KYC processes or trust your money to anybody at all.

One of the only major risks remaining within the ecosystem is the risk that somebody might identify certain bugs in the smart contracts and utilize those bugs to syphon the funds to their own wallets.

And though such occurrences are rare, they have happened before. In particular, the infamous DAO attack was such a big problem that it resulted in the Ethereum community deciding to fork off into a new chain.

Thus, if you interact with any DeFi platforms (and you are expected to play "money lego" driven by composability in this space), you can easily insure yourself against any bugs that might be found in the smart contracts. Whenever a bug has been found, the perpetrators will try and embezzle the funds. Thus, you'll stand the risk of losing your investments.

If you decide to obtain the cover from Nexus Mutual, you'd need to pay the premiums. And in case of the attack, the system will pay out the amount that fully covers your losses.

Importantly, Nexus Mutual is quite decentralized at this time and it'll be moving toward even more decentralization in the future. Decentralization is important since it ensures that there won't be any "fat cats" making decisions with regard to your wealth, like what we are seeing in big bangs. But there does need to be somebody who can decide on whether your insurance claim is valid or not.

Who decides on validity of insurance claims in Nexus Mutual?

As the project's whitepaper states on Page 5, the team had two options - either source the decisions from oracles or engage the community into the decision-making process.

There are a number of big problems with oracles including the possibility that they might be tampered with and the fact that the internal smart contract would need to be fed with data and make super-complex decisions all on its own.

Thus, they were left with the decision making-driven by the stakeholders. Of course, should they have chosen to make all the decisions by some sort of the internal committee as you’d see in legacy finance, this would not have flown well with the decentralized community. Thus, it was decided to engage the community into the decision-making process.

Anybody who wants to get the insurance coverage here has to become a member of the mutual. This is how it used to be centuries ago in insurance, when merchants were insuring the overall shipping endeavors on their own without any "big brother" in the form of insurance companies. But the current traditional architecture always embeds the big corp at the center monitoring the insurance and profiting from the utilization of the contributed funds.

After you've become a member, you can start providing the insurance to other users that are named "insureds".

Whenever an insured furnishes a claim, the overall community can decide on whether the claim is valid or not. The insurers are motivated to make valid decisions. If they refuse to recognise the valid claims, this will disincentivize any future insureds from buying insurance policies here and the platform will crumble.

What is the Advisory Board in Nexus Mutual?

At the same time, the system prevents the abuse by insureds who might decide to attack the protocol with fake claims. This is where the central oversight body comes into play. Yes, as compared to many other projects that have gotten very decentralized, Nexus Mutual still does have the central body. It's called the Advisory Board, and it takes measures in extraordinary events. For instance, it might burn the tokens used by the malicious users.

Meanwhile, the Advisory Board can't dispose of the users' funds at their own will, i.e. they can't withdraw your funds to their wallets.

Now that we've covered the theoretical basics as to how Nexus Mutual functions, let's get practical and see how it works in the real life.

How to register at Nexus Mutual?

Before you can start using the service, you need to go through the KYC/AML and register here.

The dapp is actually owned by the legal entity which functions in accordance with the UK laws and regulations. And thus it has to require its members to go through the full registration process.

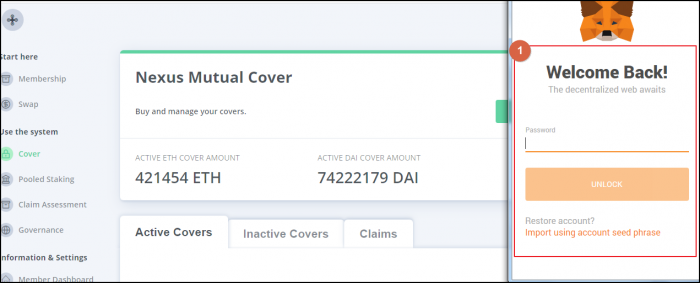

Step 1: Open the wallet

Go to the site's main page and click the "Get a quote" button.

Then the dapp will request that you open your MetaMask wallet.

In many of our other reviews, we say "connect" your wallet. But in Nexus Mutual, there are actually two different operations - "open" and "connect" your MetaMask wallet. We’ll talk about the “connection” below.

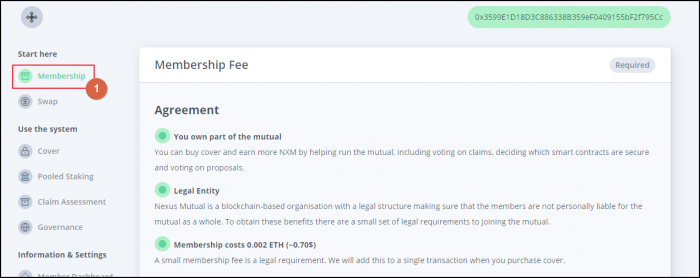

Step 2: Familiarize with the Membership Terms and Conditions

As we've said above, you need to become a member of this mutual in order to perform any operations in the dapp.

First, you'll need to click the "Membership" button and open the tab.

Here you are going to see 3 important pieces of information that you need to familiarize with before you proceed with registration.

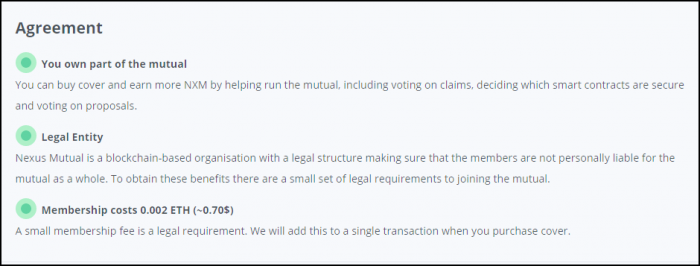

The first one is the legal agreement.

The most important point here is that you aren't liable for any obligations assumed by the mutual. However, you might be asked to pay $1 if the company runs out of money.

And you'll need to pay the registration commission which is around $1. This is a formality.

The second section is the list of prohibited countries.

As the comments state, it's not possible to accept users from these territories. So, if you are a citizen of one of them, you won't be able to participate. But the team is focused on including as many of these countries as they can in the near future.

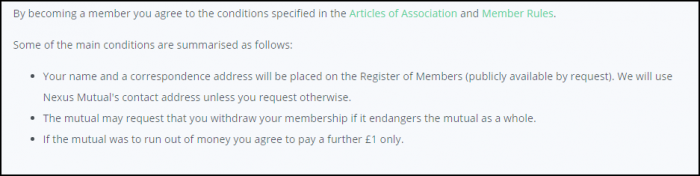

The third segment contains the links to Articles of Association and Member Rules.

These are pretty standard legal documents. But you might ask a lawyer to look into them and help you make the right decisions.

Below you can see the main conditions set forth by those documents among which is the fact that your name will be specified among the members of the mutual.

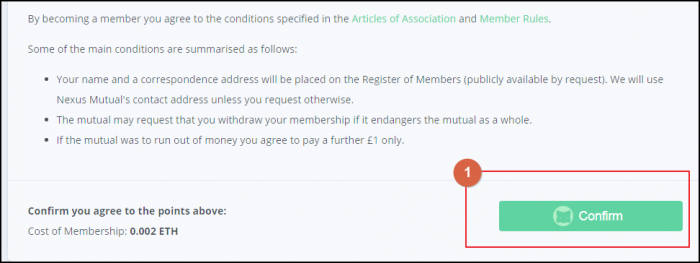

Step 3: Confirm the membership request

After you've familiarised with all the documents, click on the "Confirm" button.

Next, you'll need to go through the KYC process which we discussed before. Within it, you'll need to submit information about your name, address and some other pieces of information. In addition, you'll need to present your photo.

And this is where you actually “connect” your wallet to the system.

How to get insurance against the smart contract risk at Nexus Mutual?

After you've successfully registered at the platform, you can proceed with purchasing the insurance.

Step 1: Open "Cover" Tab

To start with the process, click on the "Cover" button in the left menu.

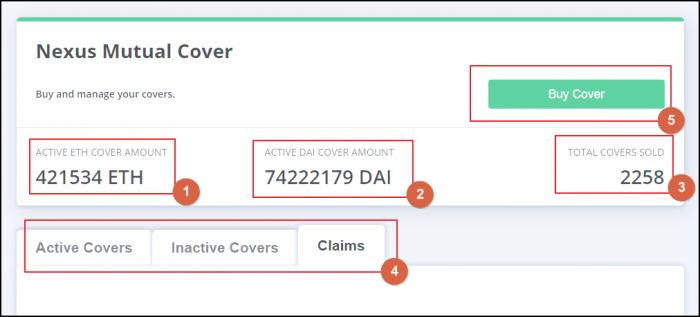

Step 2: Review data

Here, you'll be able to see the information about the totals. Such as total ETH stakes, total DAI staked and number of cover policies taken from the service, as shown in Fields 1, 2 and 3 in the screenshot below.

You can browse through your active and inactive covers. And you can review the claims you've placed with the service in Field 4.

Click the "Buy Cover" button (Field 5) if you wish to proceed.

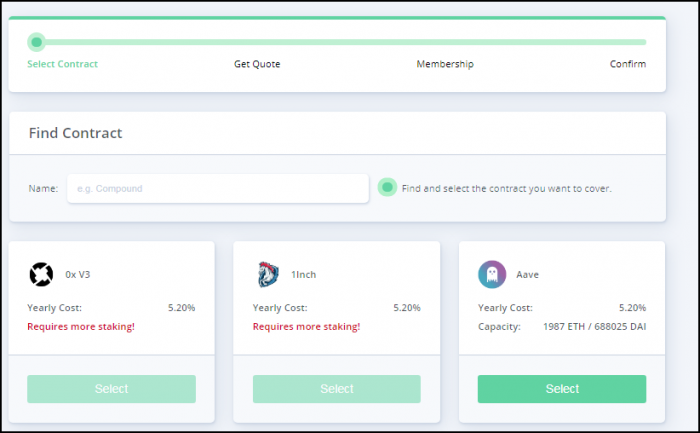

Step 3: Select the projects you want to buy cover for

At the next page, you'll be shown the list of the supported DeFi projects you can insure for. At the time of writing (October 2020), there are 45 projects here.

You can either look for the project manually or type its name in the search bar.

What projects should I buy cover for?

As we've said above, composability is a big thing in DeFi. This means that you would probably engage in multiple projects when implementing your DeFi strategies.

And thus your risks will be "stacked".

The most conservative approach would be to insure against the smart contract risk at each of the protocols you interact with. However, this might be too expensive.

And thus it might make sense to first analyze the quality of the projects you deal with and identify those that might pose the highest risk in terms of the smart contract vulnerabilities. If you obtain insurance for those first, you will have cut down on the overall riskiness for your DeFi operations.

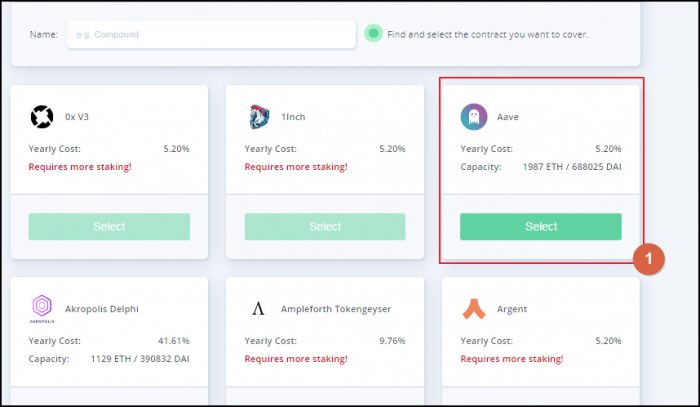

Let's say that we want to insure for only one project. And let's say it's Aave.

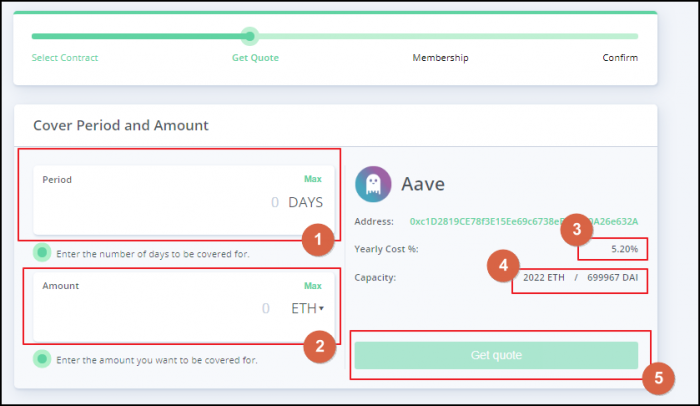

Step 4: Fill in the data for the quote

Click on the "Select" button for the Aave project.

You'll be taken to the page where you'll need to specify the details which the system needs to calculate the quote.

In Field 1, you need to specify the number of days, for which you wish to take out the insurance. The number of days must be no less than 30 days and no more than 365 days. Thus, you will need to re-issue the insurance for each next year.

It's great to see that Nexus Mutual enables users much more flexibility when selecting the duration of the insurance policy as compared to the legacy providers who usually offer only yearly options.

Field 2 asks you to specify the amount which you want to insure against.

What amount should I insure at Nexus Mutual?

Though it's up to you to decide on the exact amount you want to insure for the platform, it probably makes sense to specify the exact value that you might stand to lose should any problems arise with the DeFi projects you use. Thus, you need to understand how many wallets use a protocol (e.g. Aave) and what amounts you've invested. Sum them up and insure for that specific value.

We'll review the other options to fund at Nexual Mutual below in this tutorial.

Field 3 shows the yearly cost you'll need to pay. Thus, it's easy for you to calculate the net total of the APY you'll receive at a DeFi platform and the APR you'll need to pay at Nexus Mutual.

Of course, it might be hard to do whenever you are dealing with highly volatile yield rates like the ones offered by Aave if you pick their variable rates.

Field 4 specifies the maximum amount of ETH/DAI you can insure at the protocol. You have two options to insure with - either in ETH or DAI. And if you don't want to deal with high volatility of the asset you insure with, the stablecoin DAI is a better option.

After you've adjusted all the values at this page, click the "Confirm" button.

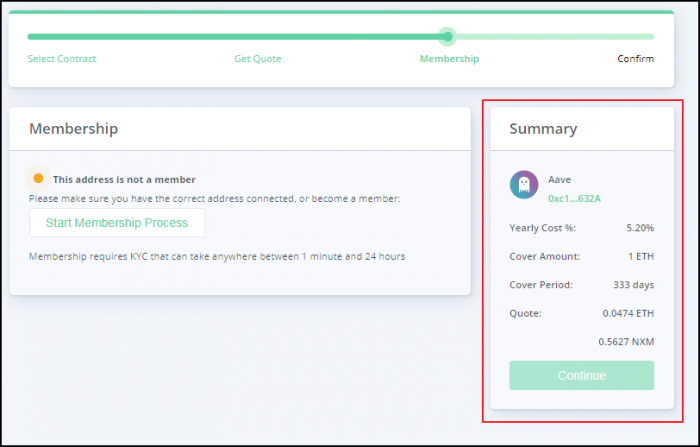

Step 5: Review the offered quote data

In the next window, you'll be shown the summary data for the cover insurance you've adjusted.

Review the values and make sure that this is what you want to insure. The quote amount is specified in both ETH and NXM.

Click the "Continue" button to proceed.

How to buy and sell NXM at Nexus Mutual?

NXM is the utility token used by Nexus Mutual. In stark contrast to many other projects, NXM can be bought and sold only within the protocol itself. And to do this, you need to first register as the member of Nexus Mutual. We've described the registration procedure above.

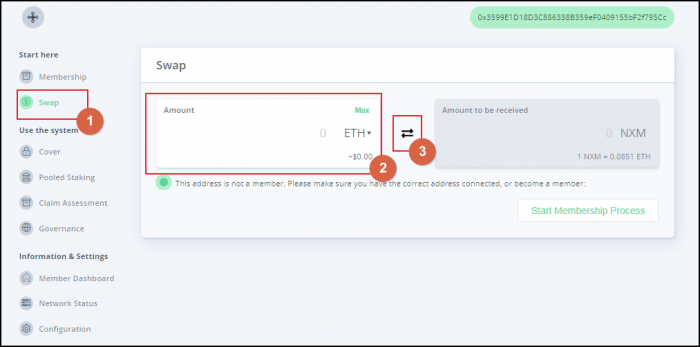

To exchange ETH for NXM, go to the "Swap" tab.

In Field 2, you should specify the amount of ETH you want to exchange for NXM.

Use the button in Field 3 to reverse the transaction and sell NXM for ETH.

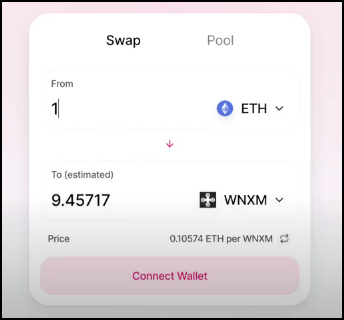

How to buy NXM if you aren't a member of Nexus Mutual?

Even though you gotta have the membership in order to buy NXM itself, you can purchase the wrapped version called wNXM at exchanges like Uniswap.

Albeit you won't be able to use NXM as the internal utility token, you'll still be able to win from the upside movements of the token if you believe that it has a great destiny in front of it.

How to become an insurer at Nexus Mutual?

At the protocol, it's the individual users who provide insurance as opposed to legacy financial institutions. Thus, anybody is free to register as a member and become the insurer with ease.

Here's how you can do that.

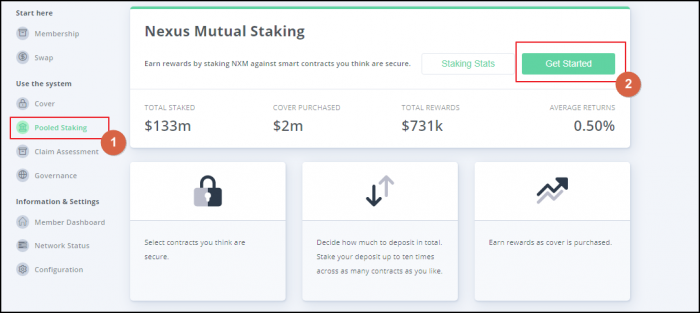

Step 1: Enter the insurer module

Click on the "Pooled Staking" button in the side menu in order to go into the insurer tab.

Review the information on how the system works at this page. And then click the "Get Started" button.

Step 2: Choose the protocol to insure for

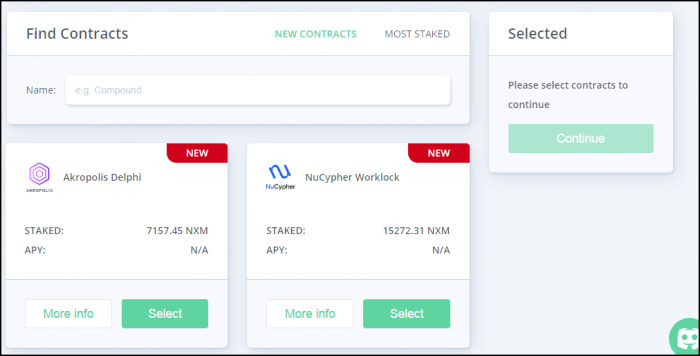

At the next page, you'll see the list of the protocols you can provide insurance for.

You need to choose the projects very carefully, taking into account all the details about the quality of code, performed audits and expected vulnerabilities.

The point is that in the event of the hack, the insurers will lose some or all of their funds which will be transferred to the insureds who have taken out the insurance policy. Thus, it makes sense to steer clear of any new and barely tested projects.

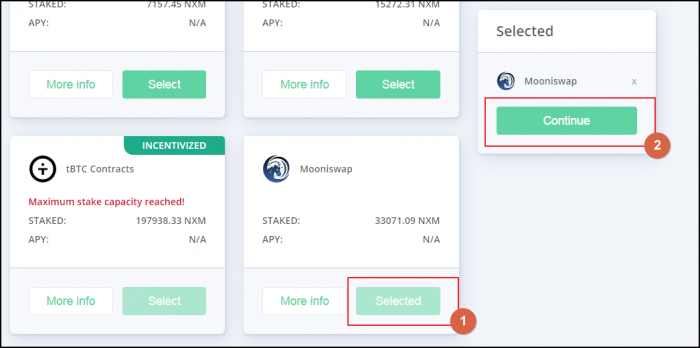

Let's say that we want to choose Mooniswap.

To do that, first click the "Select" button shown in Field 1. And then click the "Continue" button in Field 2.

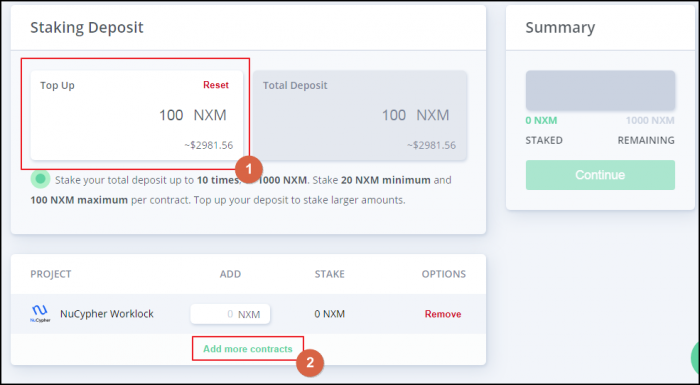

Step 3: Specify the stake amount

Next you'll need to identify the value of the stake you want to create at the system (Field 1 below).

You can always top up the stake in order to increase it in the future.

And you can choose any other additional projects to offer insurance for several of them at the same time. Use the button in Field 2 above to add more projects for insurance.

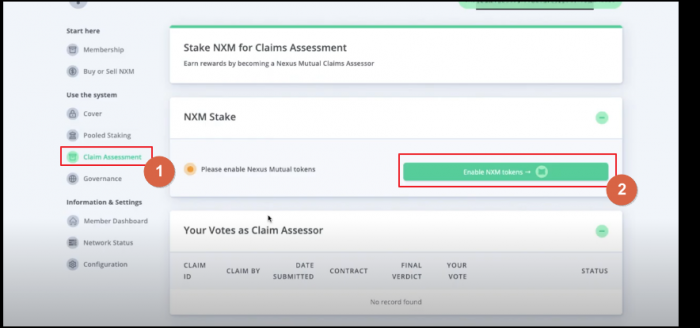

What is claim assessment at Nexus Mutual?

Anybody can register as a member, purchase some NXM tokens and stake those coins either in favor of the claim or against it.

To enter the assessment module, click the "Claim Assessment" button in the left menu and go into the tab (Field 1). Then, you'll need to enable NXM for the use in this section of the protocol.

The system incentivizes users who stake their coins in line with the prevailing majority of other stakers. Thus, you can use mechanisms in order to generate a certain fee, without being exposed to any risk.

And those who decide to vote against the majority of votes will see their NXM coins frozen for a certain period of time. Thus, the system still does allow users to dissent from the predominant majority of users, but it creates a strong disincentive from doing this "just for fun".

The users who are believed to have voted in the fraudulent or malicious manner might see their tokens burned and their account terminated at the mutual. This is where the Advisory Board kicks in, acting as the arbiter of last resource and preventing any attacks of this sort against the system.

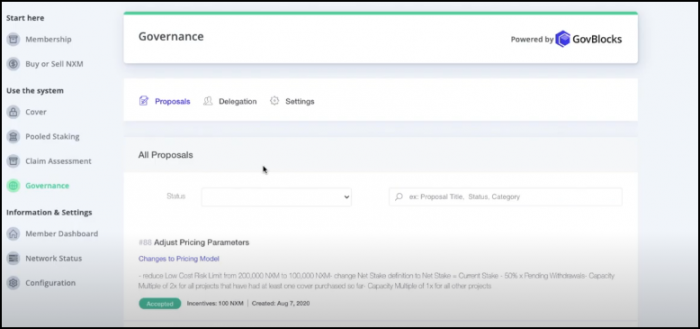

How does governance work at Nexus Mutual?

Any NXM holder can participate in the next governance process.

To do that, click the "Governance" button in the side menu and review the proposals currently tabled for the vote by the community.

In this way, decentralization is enabled at the platform, and the community is incentivized to take an active part in the decision-making on the internal matters.

Conclusion

Nexus Mutual is among the first insurance protocols in DeFi. The system is decentralized to a high degree, while the Advisory Board is the central body that activates whenever there are some extraordinary circumstances or attacks on the system to be dealt with. To use the platform, you need to register and identify your name. In this regard, Nexus Mutual reviewed here is very different from almost all other DeFi projects where there’s no need to go through the KYC process at all.

The team says that the no-KYC mode is coming in the near future, but as of right now the only way into the ecosystem is by registering up.

At the same time, if you are fascinated with the concept of Nexus Mutual and want to win from the rapid growth it might see, you can purchase the wrapped version of its token - wNXM at exchanges like Uniswap.

And if you wish to learn more about the project, make sure that you look through their Resources Base and the Whitepaper.